My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

- These features won’t add much value to your home according to real estate agents:

- Swimming pools – come with a lot of upkeep – can put off potential buyers who aren’t keen on the additional responsibility – also increases price of homeowners insurance

- Extensive landscaping with exotic plants – can turn off future buyers – need a lot of care

- Garage conversions – converting a garage into a living space can reduce overall functionality. Instead, find a way to make a room more versatile.

- Motorized blinds – wildly expensive and don’t give any added design ambiance compared to regular blinds and shades

- Sink moved to center island – mistake to move the kitchen sink to the island – people want an island free from the clutter of dishes and drying racks

- Smart home technology systems – convenient, but will likely become obsolete quickly and will need to be updated or replaced

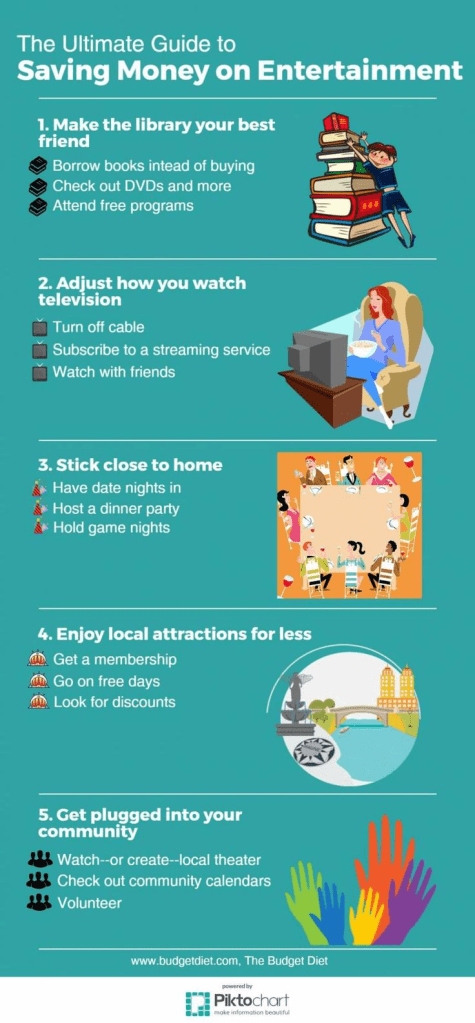

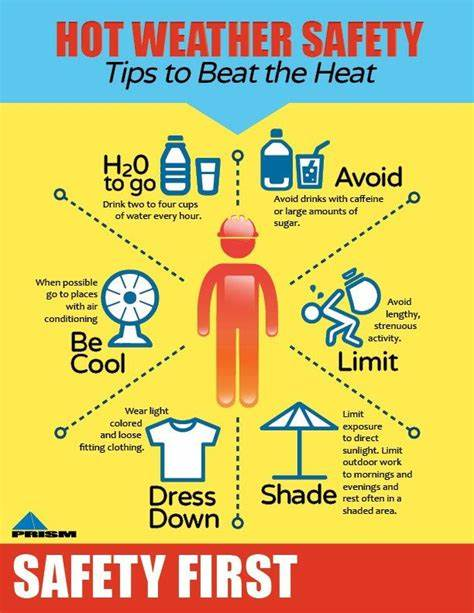

- Millions of people are experiencing what the National Weather Service is calling the first major heat wave of the summer. The local heat index could reach 105 degrees in some places.

- When we are exposed to heat, our body has ways to dissipate it and keep us cool, but when we are exposed to certain environments and certain temperatures, sometimes our body just can’t keep up.

- Keep your body as cool as possible. Stay hydrated with water, avoid alcohol during extreme temperatures, and wear loose-fitting clothing to help lower your body temperature.

- When dealing with extreme heat, it’s important to find the coolest place possible to be in if you need to be outside. If you are inside, use the air conditioning or go to the coolest place in your house.

- Stay informed with the heat index. Check weather updates and try to be proactive in protecting yourself against the heat.

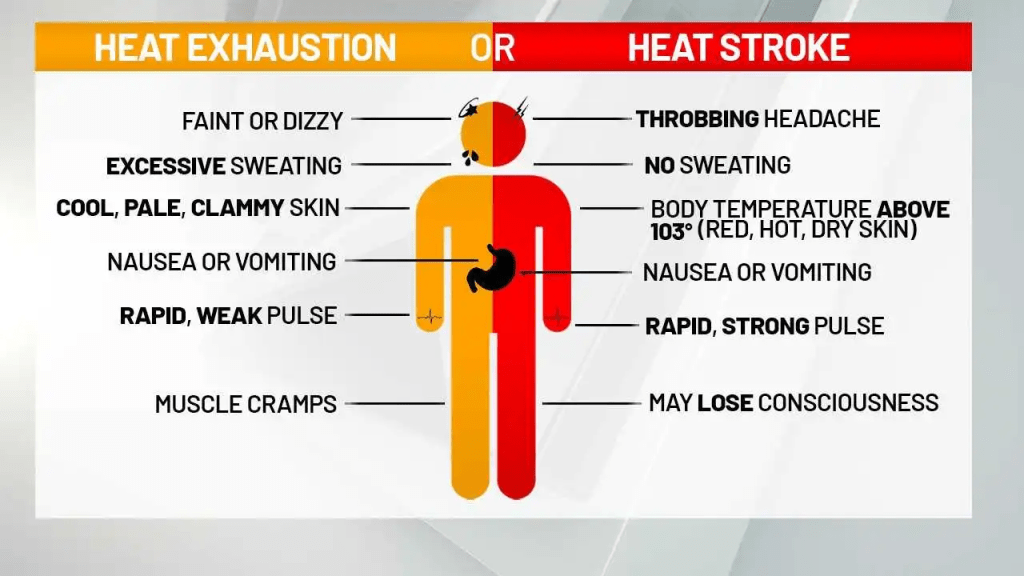

- Know when to seek medical help – heat exhaustion and heat stroke. Symptoms of heat exhaustion can be broad and different for everyone: feeling weak, dizzy, nauseous, vomiting, excessive sweating. With heat stroke, you’re red, hot, and dry and you aren’t able to sweat. Heat stroke is a medical emergency.

- The idea that the 20s are the time of your life is bull. It might be one of the hardest decades of your life, so give yourself more grace. You will figure it out.

- Stop spending your money on stupid stuff. You need to take control of your addiction to buying things. Spending money that you do not have on the things you do not need does not give you power; it makes you feel powerless. Keeping up with the ever-changing trends is not serving you and your happiness.

- You have so much time. You have plenty of time to figure out your life, your career, your love life, your friend group, etc. Social media is warping your perception about what it takes to be successful. Don’t be triggered by other people’s timelines. Trust the timeline of your life.

- Date the person, not their potential. Be in a relationship with the person they are right now, not the person you wish they were.

- It’s not fair. Don’t let yourself play the victim. You can’t change what’s happening around you, and the sooner you accept that, the freer you will feel.

- Define your career wins not but the quantity of your paycheck but by the quality of your circle. Focus your time and energy on making meaningful connections. People will get you further in your career than any single paying job on your resume ever will. Your connections matter.

- Be kind. Go above and beyond to make other people feel appreciated and seen.

- You don’t get to want something if you don’t ask for it.

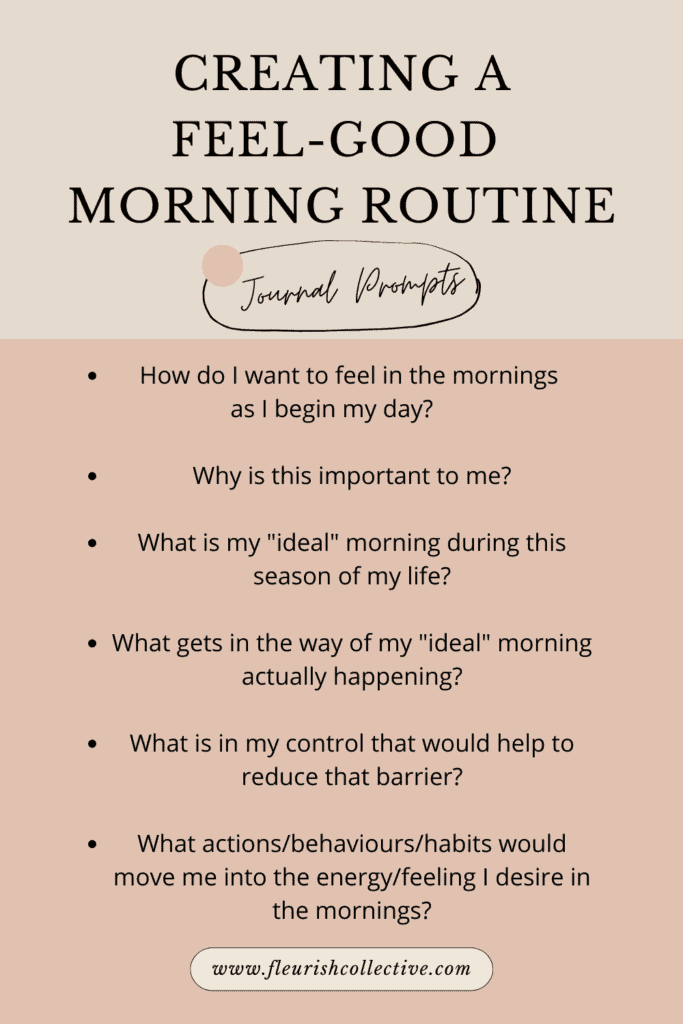

- A rock-solid morning routine is the fastest way to take control of your life. You need structure to your day, and how you set the day up is how it ends up. Core 5 practices from Mel: get up when the alarm rings, get outside and get five minutes of sunlight, take a walk without listening to music or a podcast, drink a glass of water, and have some kind of mindfulness practice such as journaling

- Get serious about who you are hanging out with. What are their habits? Are the five people you are spending the most time driven? Do they have goals? How do they treat you? How do they make you feel? Can you actually open up and be yourself with them? Surround yourself with people who bring out the best in you.

- Be your own person. Stop pretending to like things that you don’t. Live authentically. Learn to make your own choices. The fastest way to figure out what you like and who you are as a person is by doing things by yourself because then you don’t have the pressure of managing the person with you and whether or not they like the thing that you are doing. Explore your interests alone.

- You are not in competition with anyone. Success, happiness, and friendship are in a limitless supply.

- Take the biggest risks of your life right now. You have time.

I really enjoyed this post from Gabe the Bass Player this week:

https://www.gabethebassplayer.com/blog/charging-for-the-chapel

Charging For The Chapel

July 9, 2024

Would Michelangelo have painted the Sistine Chapel if he hadn’t been commissioned by the church, being paid along the way?

Probably not.

It’s ok for you to charge (lots of) money for the thing you’re good at too.

This post from Seth’s blog emphasized the power of learning:

“The paradox of lessons

The people most likely to sign up for coaching or additional learning are the folks who are already good at their craft.

“I’m terrible at this,” can lead to, “and I don’t want to be reminded of it.” Or perhaps, “I don’t want to waste their time,” or, “I’m never going to get better.”

When it’s possible to get better, embracing mediocrity isn’t a useful strategy.

I’d rather have a surgeon who regularly attends trainings, wouldn’t you?

Read a book, find a coach, organize a group. If you’re serious about getting better, you’ll improve.

Learning creates more competence but first, it amplifies our feelings of incompetence.”

I look forward to reading, learning, and sharing more with you soon!