My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

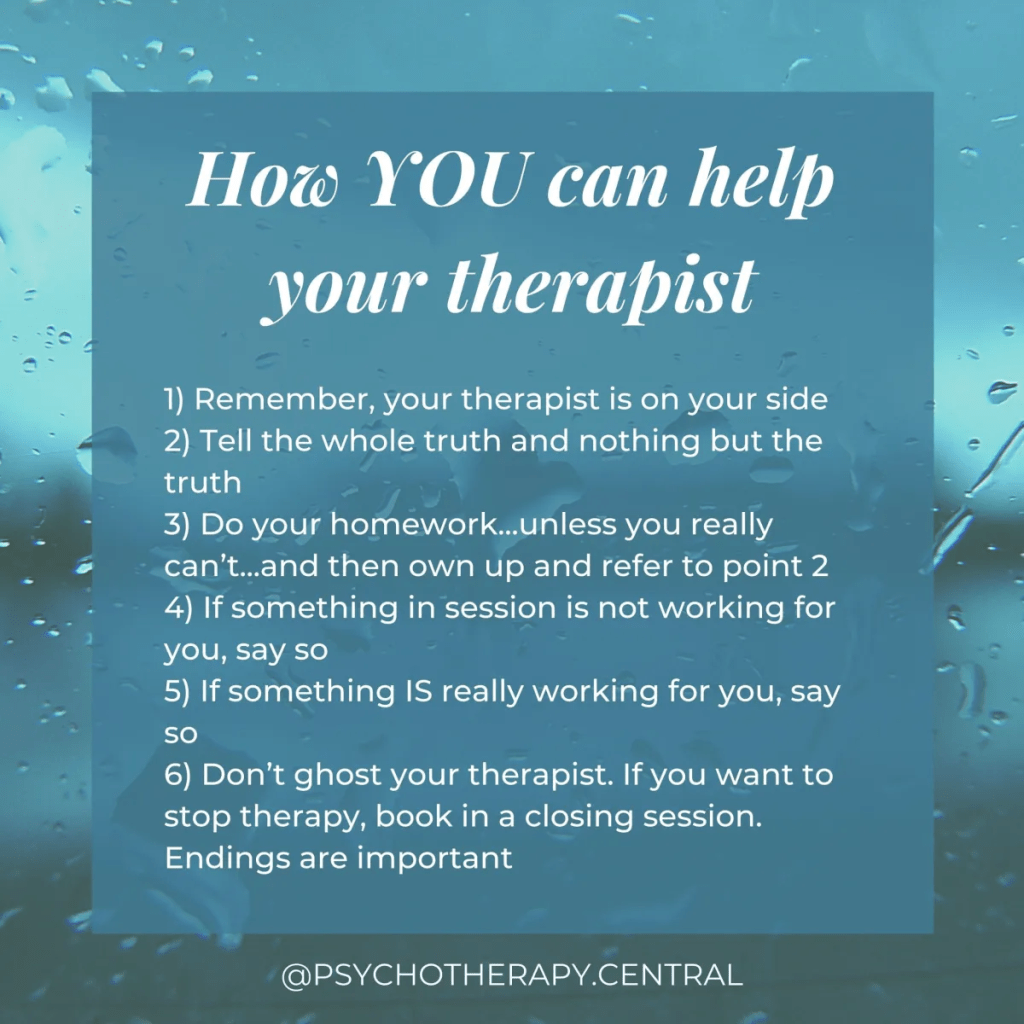

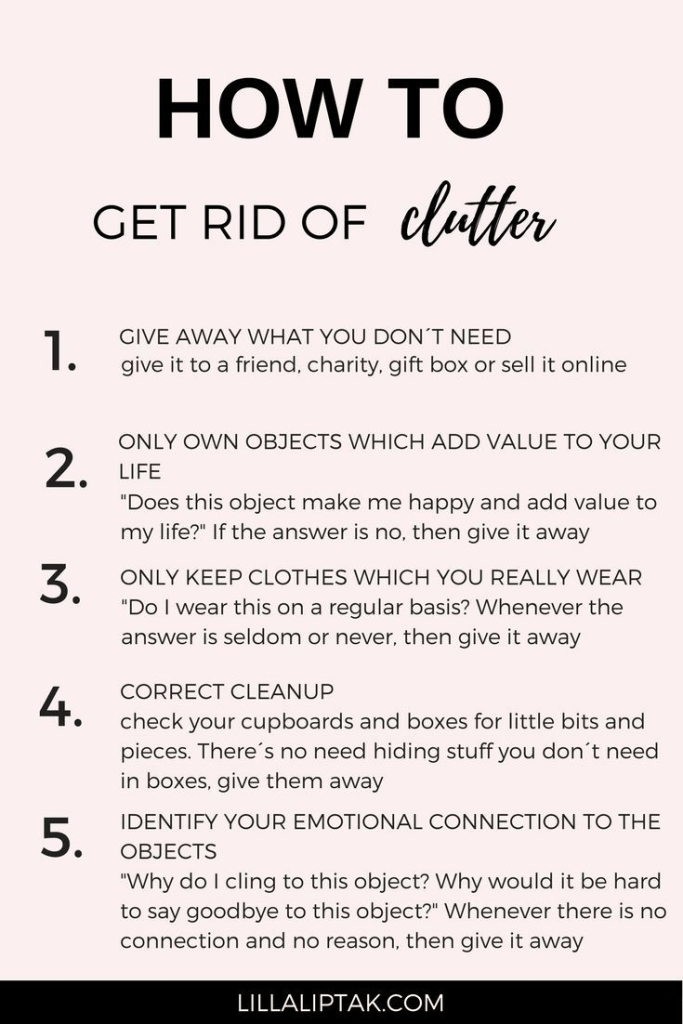

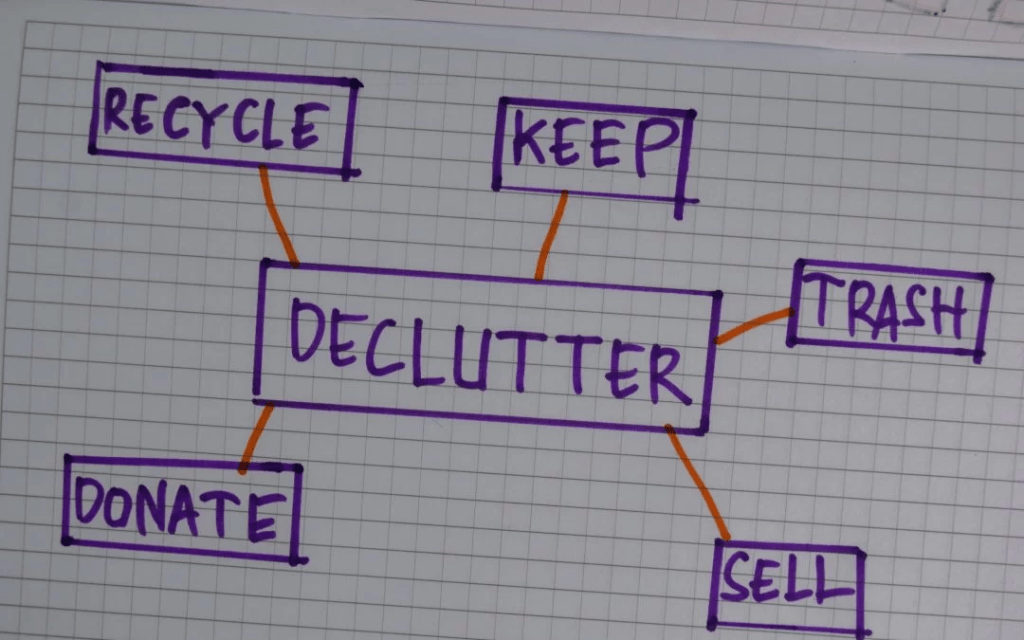

- Grab a box, walk around your home room by room, and put anything you don’t need in the box. Start with the easy stuff. Do this several times.

- Find motivation with built-in deadlines. Set a timer for 15 minutes and do the first wave in 15 minutes.

- Donate more. Use your local Buy Nothing group or Facebook marketplace. You can try selling what you would like to. If it’s not sold within a week, donate it.

- Have people in your household help you declutter. Have them find things they would like to give away or donate.

- Don’t rent a storage unit long-term. If you want to rent a storage unit short-term, pack up boxes and label them with a date. If, after 6 months to 1 year, you don’t go to your storage unit looking for that item, get rid of everything in the boxes, and get rid of the storage unit.

- Plan to have people over to give you a sense of urgency to get rid of the clutter. Use that as a deadline for you to declutter.

- Don’t confuse the desire to change with actual change. Thinking about change is not the same as implementing change.

- Spending money on something does not result in that hobby or activity getting done.

- Challenges

- 10 minutes, 10 spaces – 100 items. Get rid of 10 items from each of 10 different spaces, for a total of 100 items.

- Minimalist challenge – get rid of 1 item on the 1st of the month, 2 items on the 2nd day, and so on, so on the 31st day of the month, you will get rid of 31 items. This challenge is often unfinished. You can do this challenge backwards – start with getting rid of 31 items, then 30, etc.

- Ask yourself: How do I actually foresee myself using this in the future? How much would it cost if I got rid of this and then suddenly needed to get it again? Where am I going to keep this item?

- If you haven’t used it in the last year and it costs less than $20 to replace it, get rid of it.

Last January, I got rid of one thing each day in our local Buy Nothing group. This year, so far, we have started decluttering one spare room that has been filled with boxes we haven’t really touched since we combined our belongings over a year ago. We have organized what we are keeping, we have thrown a lot of junk away, and we have made piles to give away. It is crazy to think about how much stuff we don’t actually need/want! We have several more spaces/rooms to declutter yet, but it is exciting that we started.

- Start in the easiest place first – not paperwork or sentimental things. Decide what should stay or go. If you decide to get rid of things, get it out of the room/space right then to eliminate clutter.

- After you decide to keep things, find a space for them.

- The smaller the space, the more intentional you need to be. Ask yourself: What are the 3-5 activities you want to do in this space? How do you want it to look? How do you want to feel?

- You will never be at an “end point.” You will crush goals and create new goals. Learn to love the process and appreciate how far you’ve come.

- Training to failure is overrated. Do a specified number of reps and don’t overtrain.

- Nothing beats consistency. Set realistic goals.

- Lifestyle adaptation – fight laziness and enjoy the process.

- You’re not giving 100%. You’re typically capable of a lot more than you think.

- Supplements are way less important than you think. Supplements are supplemental to a great diet, great training, and a great mindset.

- If you find something especially hard, do more of it. Ex: cooking, hard exercises, fixing sleep schedule. Fix your weakness.

- Keep learning and reading. Question everything and try to have a deeper understanding of it.

- You should be doing this to be healthy, not just look sexy.

- Form will always be one of the most important things. Without the right form, you’re either getting injured or you aren’t getting the most out of the movement.

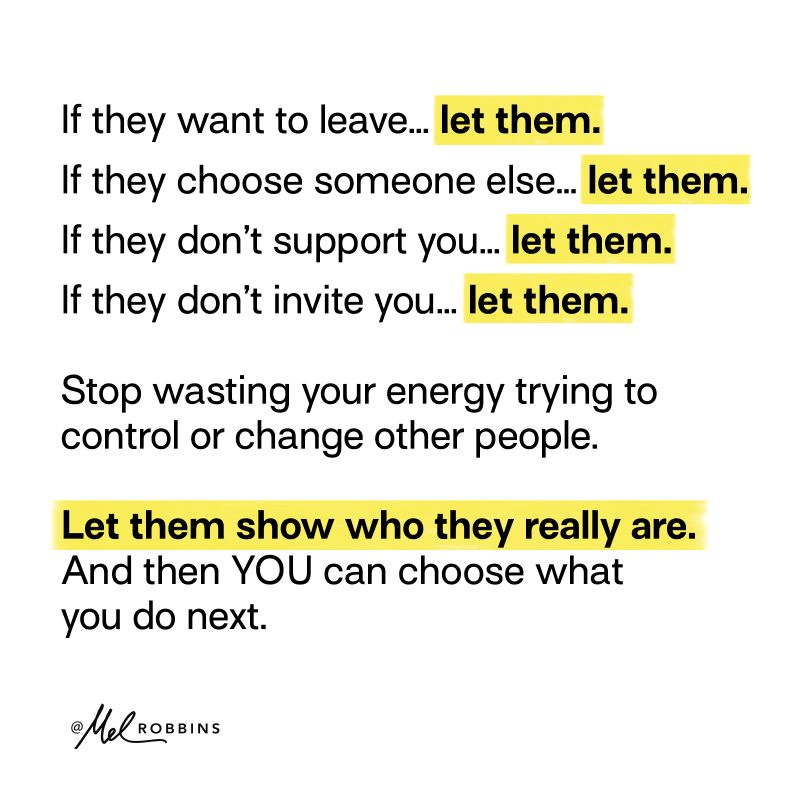

- Whenever someone is doing something you don’t like, let them.

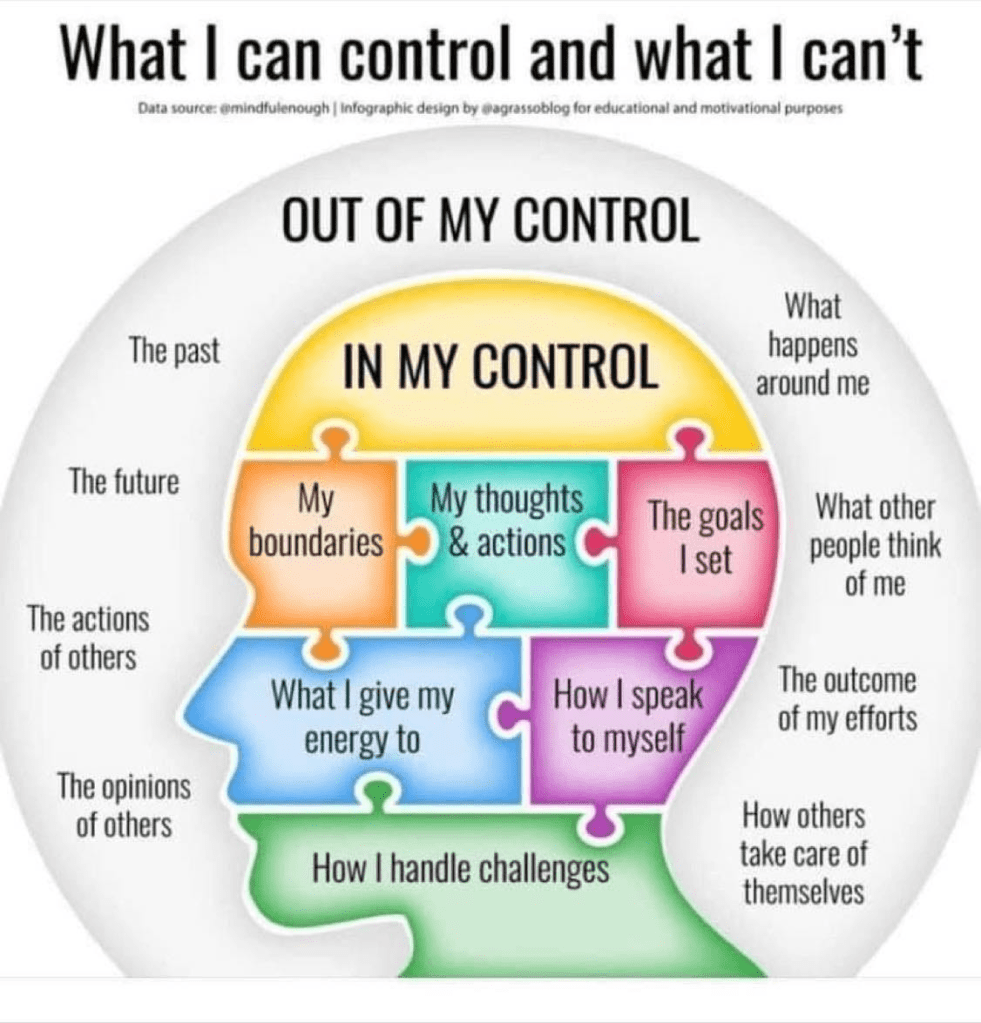

- You will be more in control when you use the “let them” theory. You stop giving your time and energy to other people and situations you can’t control. You take your time and energy back and figure out what is best for you.

- The more you try to control something, the more out of control you feel. The only way to feel in control in life is to focus on where your time and energy is going.

- Everyone has an opinion of you. Unhook yourself from that concern. Their opinion of you is irrelevant to you.

- It’s not your job to manage other people’s reactions. When you think about how often you are managing other people’s reactions, managing other people’s happiness, tiptoeing around the topics, shrinking yourself, staying silent, not asking for what you need, trying to fix problems, showing up when you don’t feel like it, doing things out of guilt, you are resisting the reality of the situation. When you think about it, you will realize how much time and energy you have and how much time and energy you can spend on yourself.

- You aren’t responsible for other people’s happiness, other people’s boundaries, or managing other people’s tantrums. You’re responsible for your truth, your needs, expressing yourself, and telling people how you feel. You’re responsible for creating what you want.

- When we step in and feel the responsibility for bailing people out, we rob them of the opportunity to face the things they didn’t face.

- You can’t force anyone else to change or to do something. You can try, but someone only does something because they want to do something.

- Savings – emergency fund + retirement – even if you don’t have much money to save now, starting will help ensure that you’ll be better off financially down the line. At a minimum, contribute enough money to get an employer match.

- Health insurance – make sure you have insurance in case you experience a major illness.

- Debt repayment – have a plan to pay down student loans, credit cards, and other high-interest debts as quickly as possible. Consider getting a side hustle or working overtime to increase your income and pay off debts.

- Life insurance – make sure your dependents are covered if something were to happen to you tomorrow. Adjust your life insurance policy as needed; you may need to take out more money as major expenses occur or as you have more children.

- Spending money – put aside some money to spend – don’t spend it all at once. Sometimes having something now isn’t worth incurring interest charges down the road.

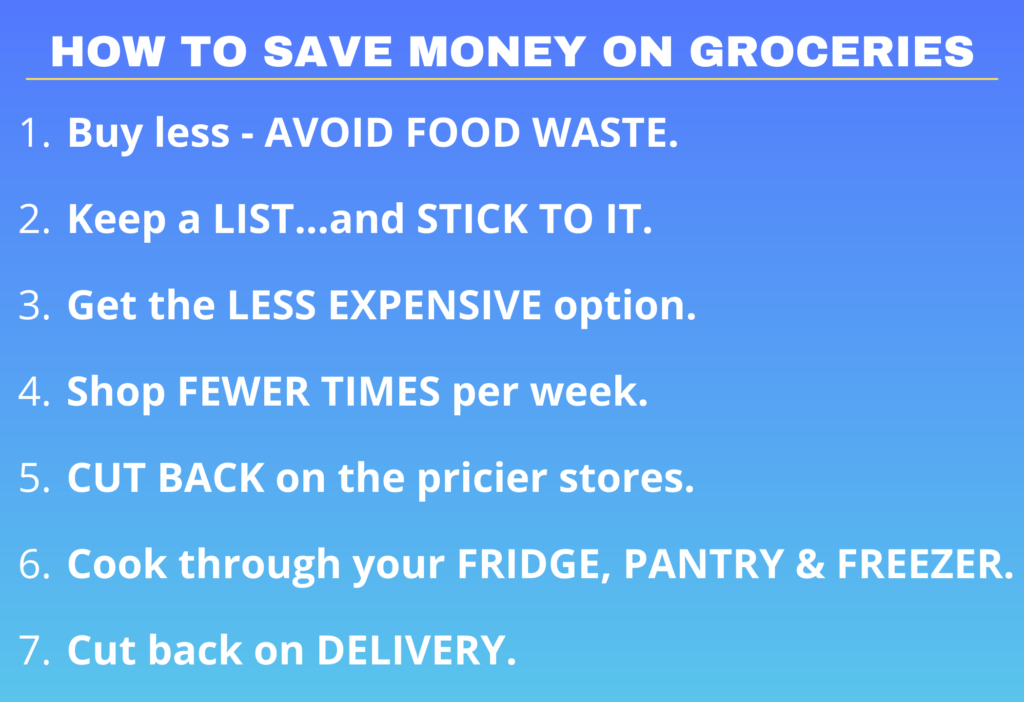

- Groceries – know what you can afford on a weekly basis. Look into ways to cut back without dramatically impacting meals, such as shopping at discount stores or taking advantage of coupons and sales. Remember that eating out often will quickly eat away any extra money you may have had available in your budget.

To save money, we shop at a discount food store, keep some staples on hand, and we frequently plan meals around what we can find at a discount rather than planning around recipes or a list.

- The first step to saving more money is to figure out why you are unable to save money.

- “I’ll hate my life if I start saving money” ➡️You can still live a great life AND save money. You need to learn how to manage your money better so that you can live the life you want to live, but on a more realistic budget.

- “I’ll figure out how to save money later.” ➡️Many people put off saving because they’d rather spend their money now and believe they’ll have plenty of money to save money later. There is no need to spend all of your money now just because you can.

- “I deserve and/or need the things I buy.” ➡️Many people believe they need to upgrade to the latest and best technology, clothing, etc. and need expensive vacations. Watch your spending, figure out ways to lower your expenses, and cut out anything unnecessary.

- “I enjoy my job and can always make money.” ➡️You should still be saving money. What happens when you can no longer work? You don’t know what the future will bring – a medical problem, a serious life event, or you may hate your job later. You can enjoy your job and save money at the same time.

- “The city I live in is too expensive to save money.” ➡️It may take time, but you need to either increase your income or cut your expenses or do both.

- “It’s too late for me to start saving money.” ➡️It’s never too late to start saving money. Every little bit helps and can drastically change your future. Saving something is better than nothing.

I look forward to reading, learning, and sharing more with you soon!