My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

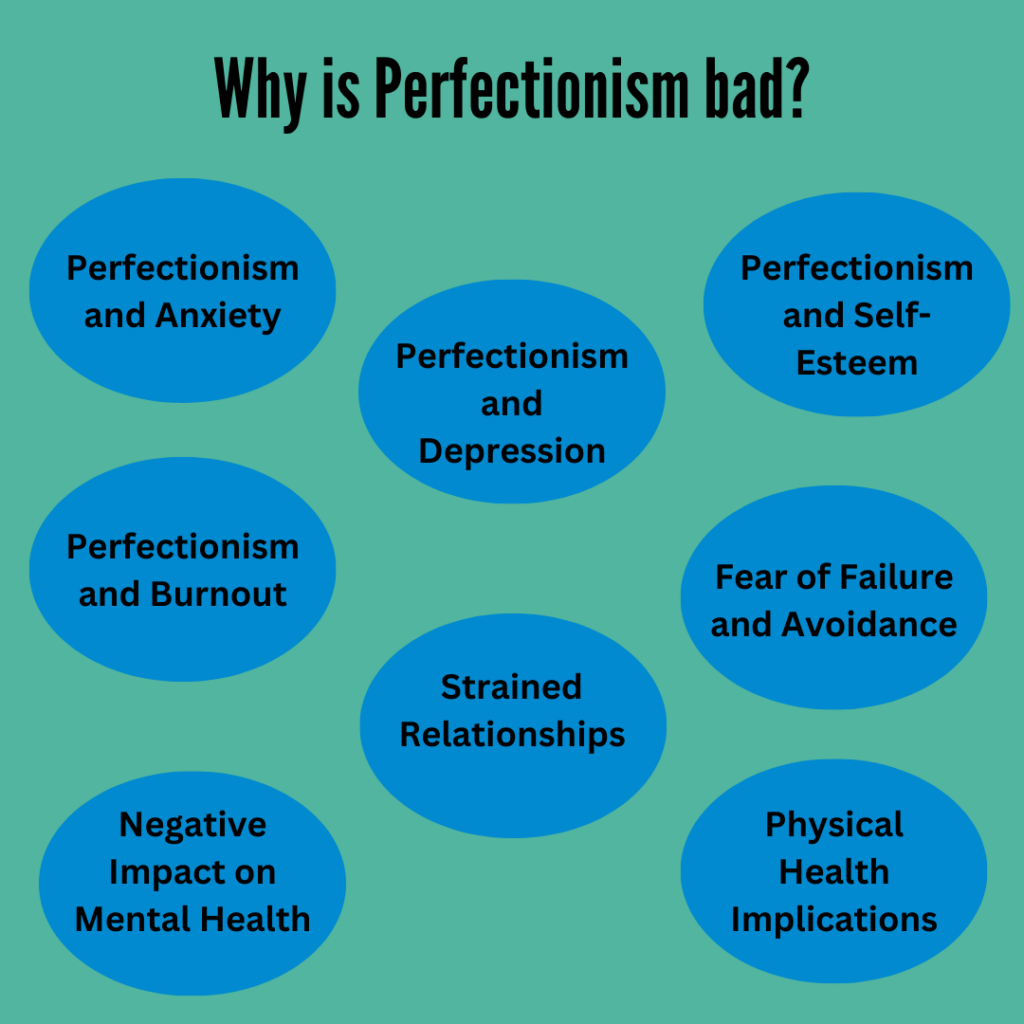

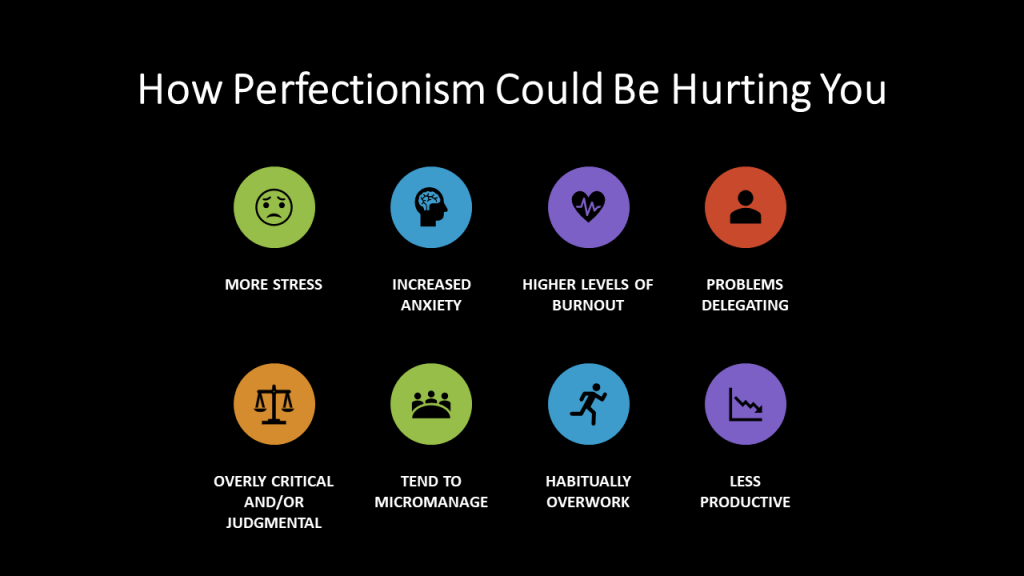

- You have the all or nothing mindset. The outcome has to either be perfect or there will be no outcome at all. You are either a success or a failure.

- You fear failure. You have a fear of putting yourself out there and going out of your comfort because you might not be seen as “perfect.”

- You might have trust issues. This has to do with the fear of letting go of control. You have the idea that if something needs to be done perfectly, you need to do it yourself. Letting go of this need for control and learning to trust other people is crucial for overcoming perfectionism.

- You “should” all over yourself. You spend a lot of time in the “shoulda, woulda, coulda” land.

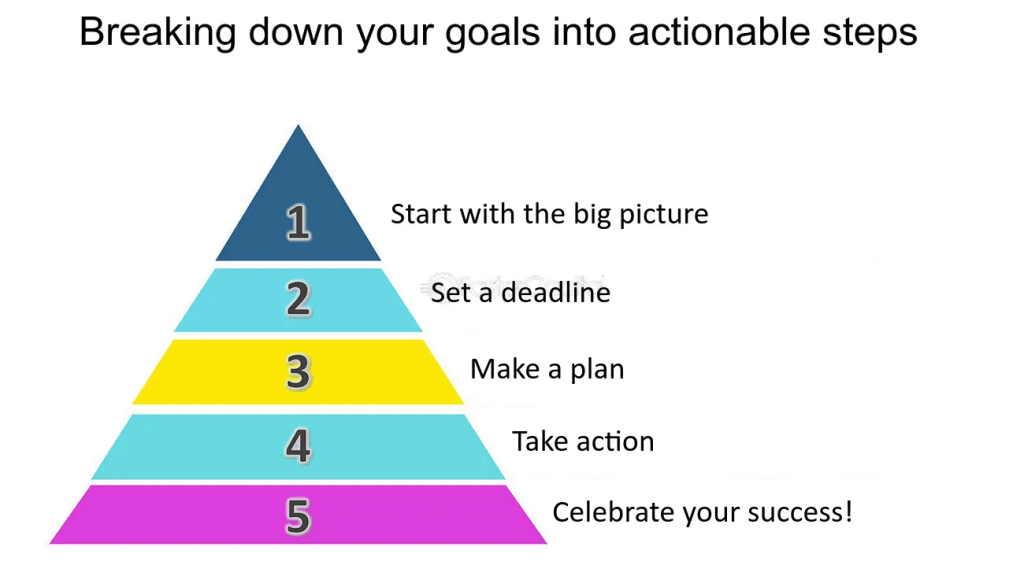

- You procrastinate without end to find the right time to work on your goals.

- You would rather give up than not do something perfectly. Putting decent work out there is a must to drive you all the way to your dream destination.

- You spot mistakes everywhere. You see mistakes where other people don’t and you make it your mission in life to uncover them in all situations.

- You fear judgment. The truth is that people don’t really think about you as much as you think they do. You don’t need other people’s approval to live your life; you just need your own.

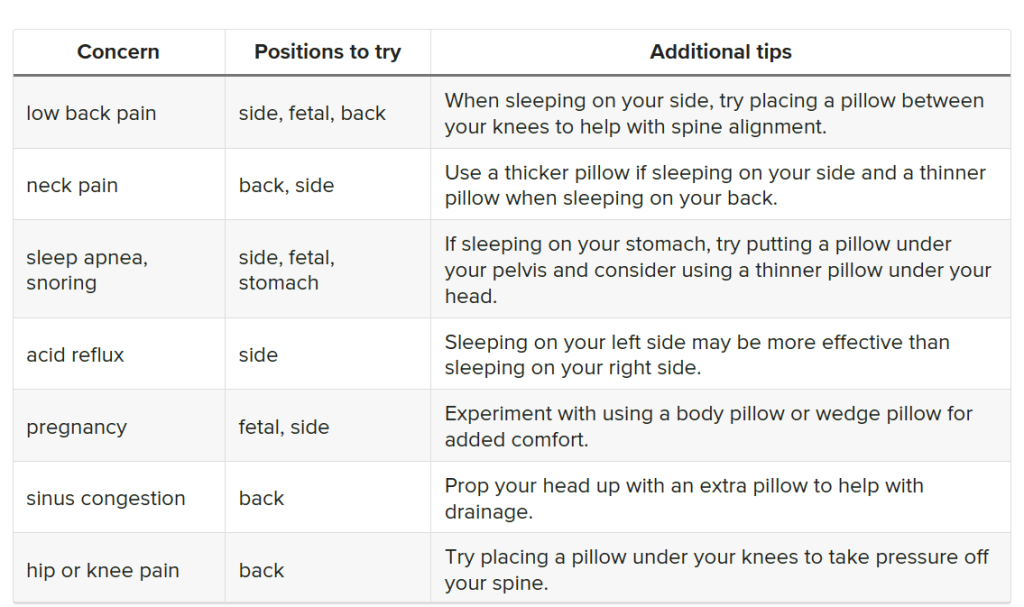

- Make a plan for the week. Know that some weeks will be busier with events and obligations and you might not be able to work out as much as you want to. That is fine. Overall consistency is key, but not every week will be perfect.

- Know that your body will change. You will need to alter your workouts. Don’t compare your body to how it was years ago. Your body may be looking for a different kind of workout.

- Mindful mile – run a mile without music – focus on mindfulness – your breath and your thoughts

- Yet, at the same time, you show up every day for work and for others. Show up every day for yourself. Don’t rely on motivation. Rely on self-respect, commitment, and dedication.

- Give a new fitness program 90 days before deciding if it’s for you long-term.

- Don’t wait until you “have the time.” Find the time. Prioritize yourself and your health.

- If you can stream shows for an hour or hours, you have time to work out. You can even walk on the treadmill or lift weights while you watch.

- Determine your why. Is it longevity? Physique? An event? You want to feel better? You’re only doing it because someone told you to do it?

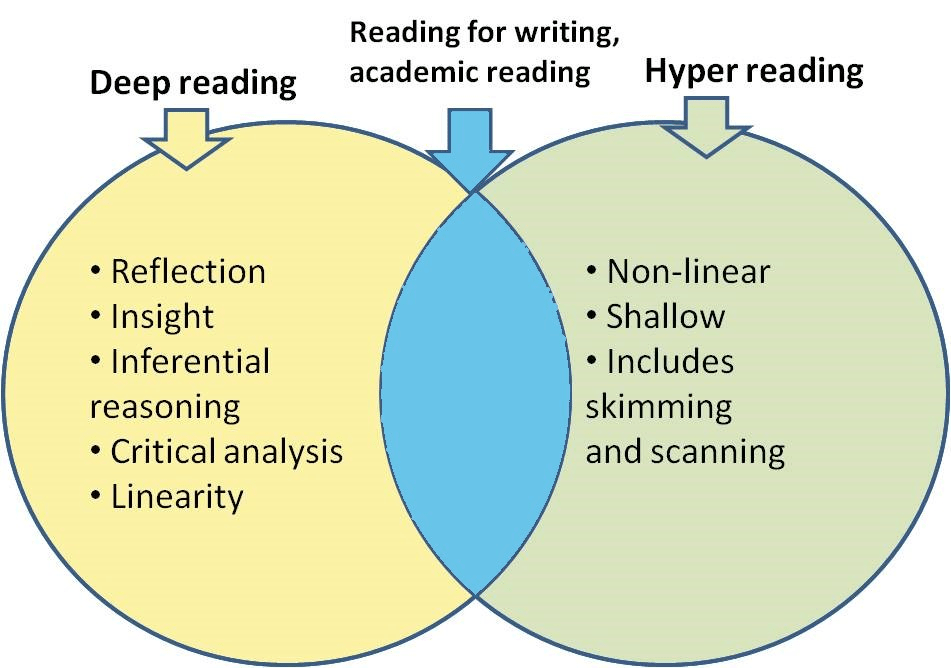

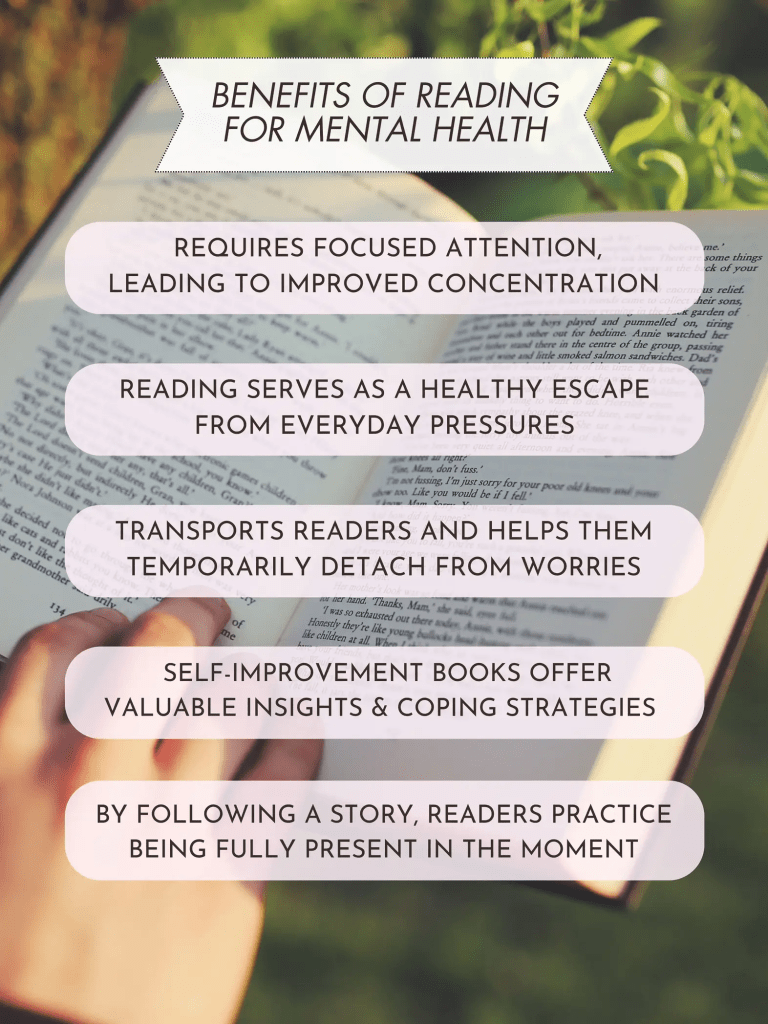

- Reading can be extremely difficult because things are competing for your attention. Our brains aren’t meant to deep read; it is supposed to be hard.

- Reduce distractions.

- Deep reading takes place when we become so immersed in deep thought and concentration and don’t give in to distractions.

- We tend to skim instead of deep read. Skimming is one of the greatest disruptions of deep reading. It’s a defense mechanism.

- Screens are fine if you are skimming. If you want to deep read, you have a better chance of minimizing distractions if you read on paper, where you can go at your own pace.

- Start by forcing yourself to read at least 20 minutes per day in print – not on screens.

- Deep reading takes practice, discipline, and finding time devoted to it each day.

- Do not be concerned about how many books you are reading. People read at different speeds and different books require different paces. Let the book determine your pace and enjoy your own pace.

- There is more memory that consolidates than we have immediate perceptible access to. On the other hand, when we skim, we consolidate less. Taking notes adds to your ability to remember and reading the notes about what you read activates what you actually did remember and have stored.

- Deep reading is a place of discovery of others, discovery of beauty, and discovery of appreciation for our ability to think outside the bounds of our everyday lives.

- Store-bought pesto – hard no for many. It is so easy to make at home with whatever greens you like and need to use up, and you can make it dairy-free if needed.

- Jarred tomato sauce – full of sugars and preservatives. Instead, buy canned, whole, organic tomatoes, blend them up, and cook them down with your favorite aromatics in twenty minutes.

- Premade salad dressings – make your own with olive oils, lemon juice, garlic, and herbs.

- Boxed broth – save your veggie scraps (carrot peels, herb stems, garlic skins, etc.) and make broth when you have enough scraps. Use your veggie scraps with water, salt, and herbs and refrigerate or freeze batches.

- Pre-grated parmesan – seek out parmesan and grate it fresh when you need it.

This list surprised me. I love cooking, although I am not a professional chef. Still, to save time, I buy jarred tomato sauce, premade salad dressings, and boxed broth!

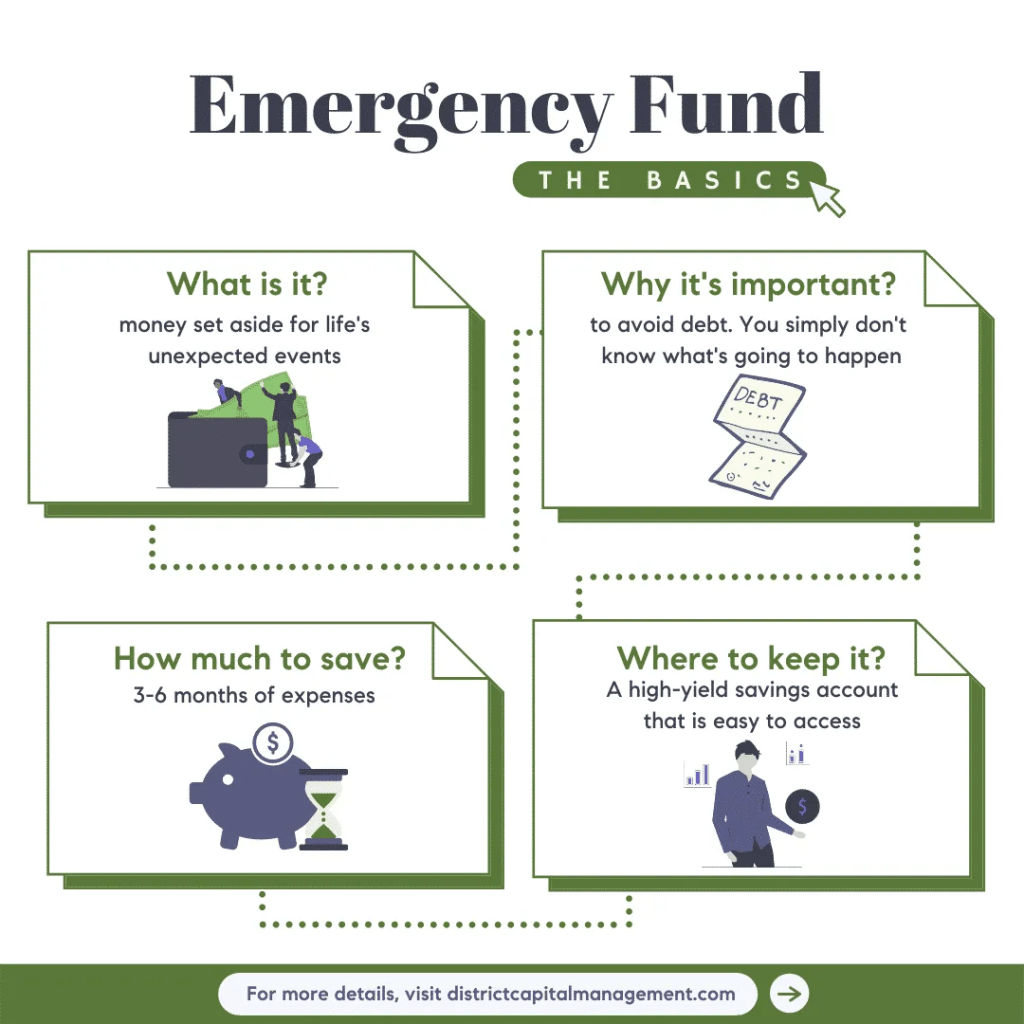

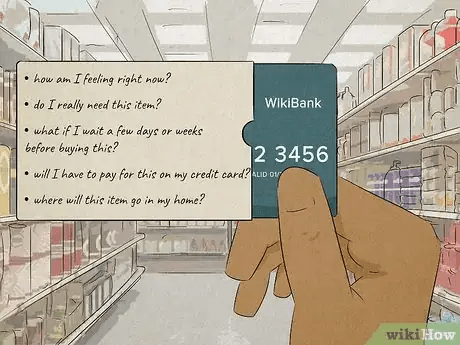

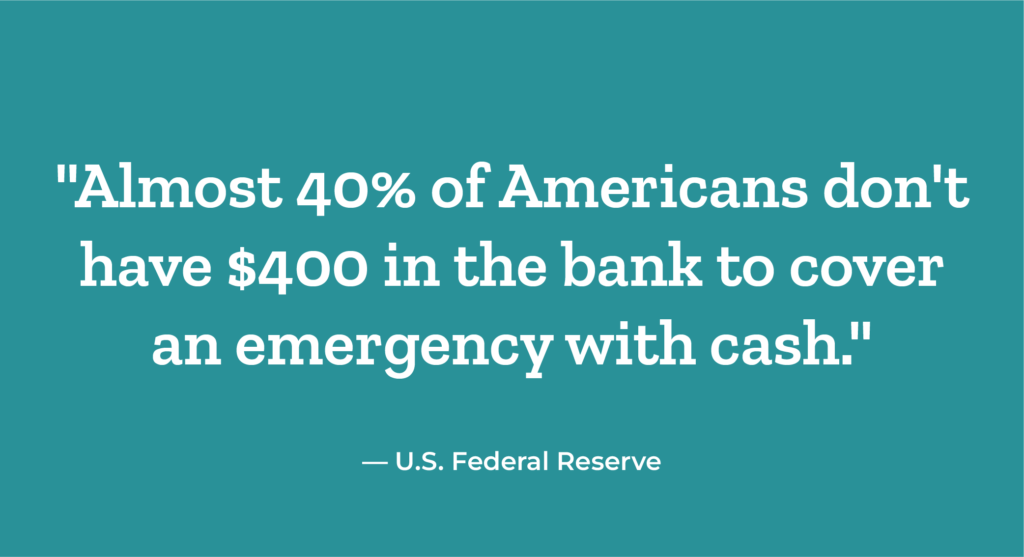

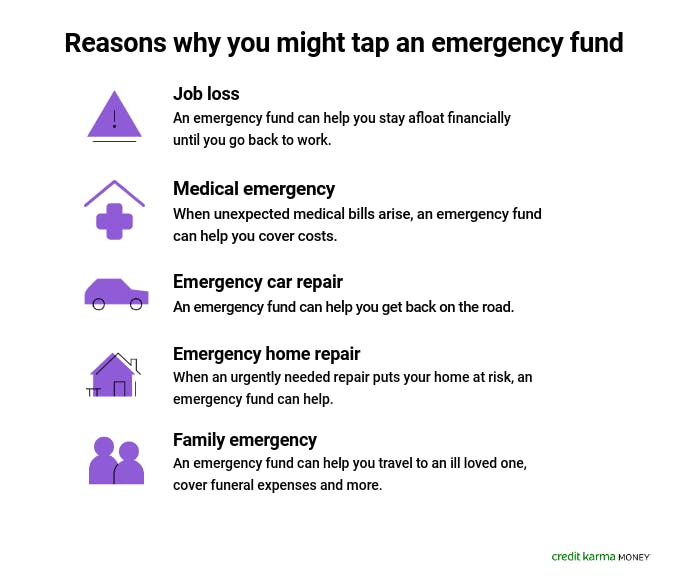

- Credit card dependence – don’t use credit cards as an emergency expense vehicle. Have an emergency fund in place and take the time to build it up. Nearly half of Americans use credit cards to cover essential living expenses. Nearly half of Americans have reached their credit card limits at some point.

- If you aren’t making enough money to make ends meet, reduce expenses or increase your income. When you fall into credit card debt, you are paying an extremely high interest rate (often over 20%). Compound interest can cost you thousands of dollars. If you struggle with credit card debt, get rid of your credit cards and force yourself to make it work. Your credit card debt is robbing you of your financial freedom.

Decreased financial preparedness – when you are trying to build up your emergency fund, it can seem like you will never get ahead due to emergencies. You are likely either spending too much money or not making enough money. Income is the propeller that allows you to build more wealth. Have an emergency fund to protect you from life – medical deductible, vet, car repairs, etc.

Focus on how to get extra cash on hand. Open a high-yield savings account and automate contributions. Put at least $5,000 in a high-yield savings account then start to work up to 6 months of your monthly expenses.

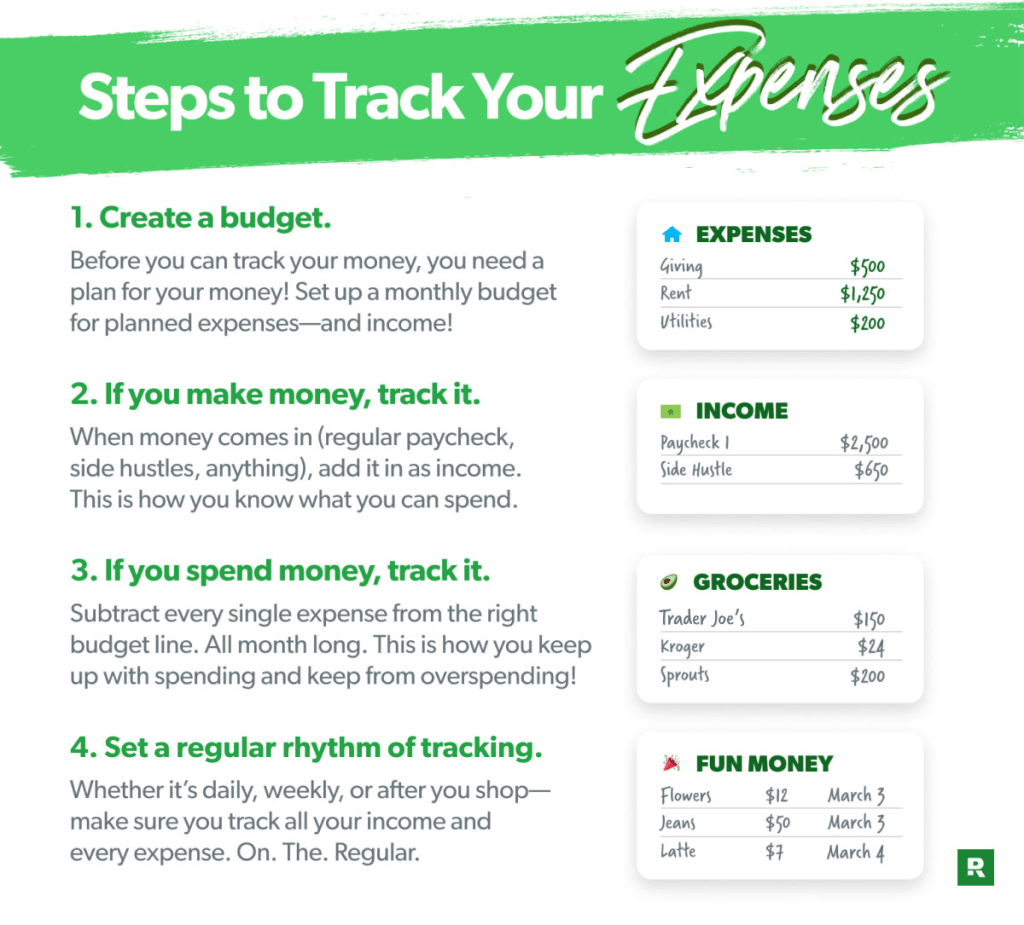

- People do not prioritize money flow. Figure out how much money you have coming in and where that money is going to go. Keep a list of all of your income and expenses in a spreadsheet.

- First, focus on housing, food, and transportation and get those expenses down. Car payments, groceries, and eating out are easy expenses to overspend on. Get them under control.

- People worry about $10 problems instead of bigger problems: investment fees, mortgage interest, asset allocation, negotiating your salary, transportation costs, and student loan interest. Some of these will cost you six figures over time!

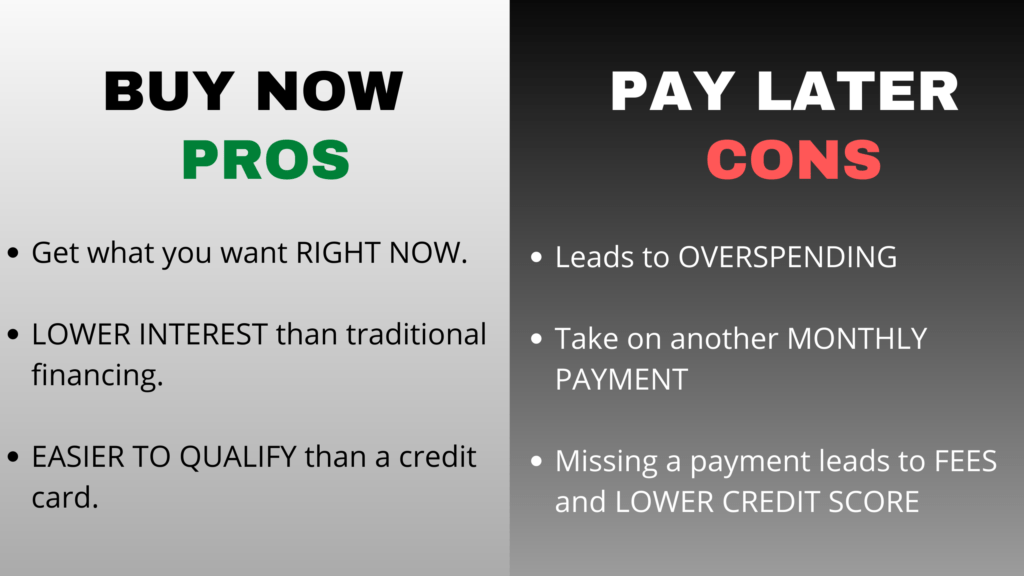

- Over-reliance on buy now, pay later services for basic necessities – many people do it to avoid credit card interest. 46% of people use buy now, pay later for electronics, 56% use it for clothing, and 31% use it for furniture and appliances. Instead, save up for these items. If you don’t have the money, don’t buy it. Focus on building up your emergency fund. Buy now, pay later increases your debt volume, reduces your net worth, and can result in late fees and financial penalties

- Lifestyle inflation and mismanagement of raises or bonuses – when you get married, it is easy to increase your lifestyle and want to do more. However, it’s still important to have a gap between your income and expenses.

- Every time you get a raise, put half of it toward investments and allow yourself to use half of it to increase your lifestyle.

- Lack of financial education and planning – can use a financial planner (can cost a couple thousand dollars), take a class, or read books and research yourself

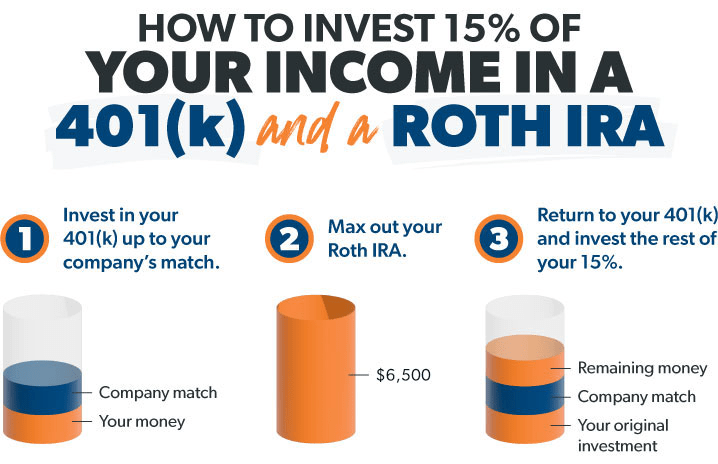

- Low national savings rate – the average American saves 3.6% of their income. You need to save and invest the savings to retire. Experts say to save at least 20% of your income (and invest it) so that you can be able to retire. Some people save 50% of their income to retire very early!

- People are trying to access their retirement funds early and doing it often – 10% penalty. Don’t do that. Don’t interrupt compound interest unnecessarily. This year, Americans will pay $6.1 billion in penalties for early 401k withdrawals!

- People don’t understand compound interest – they don’t realize how much it impacts your finances and retirement.

I look forward to reading, learning, and sharing more with you soon!