My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

Self-Growth Nerds – 5 Most Powerful Questions to Ask Yourself

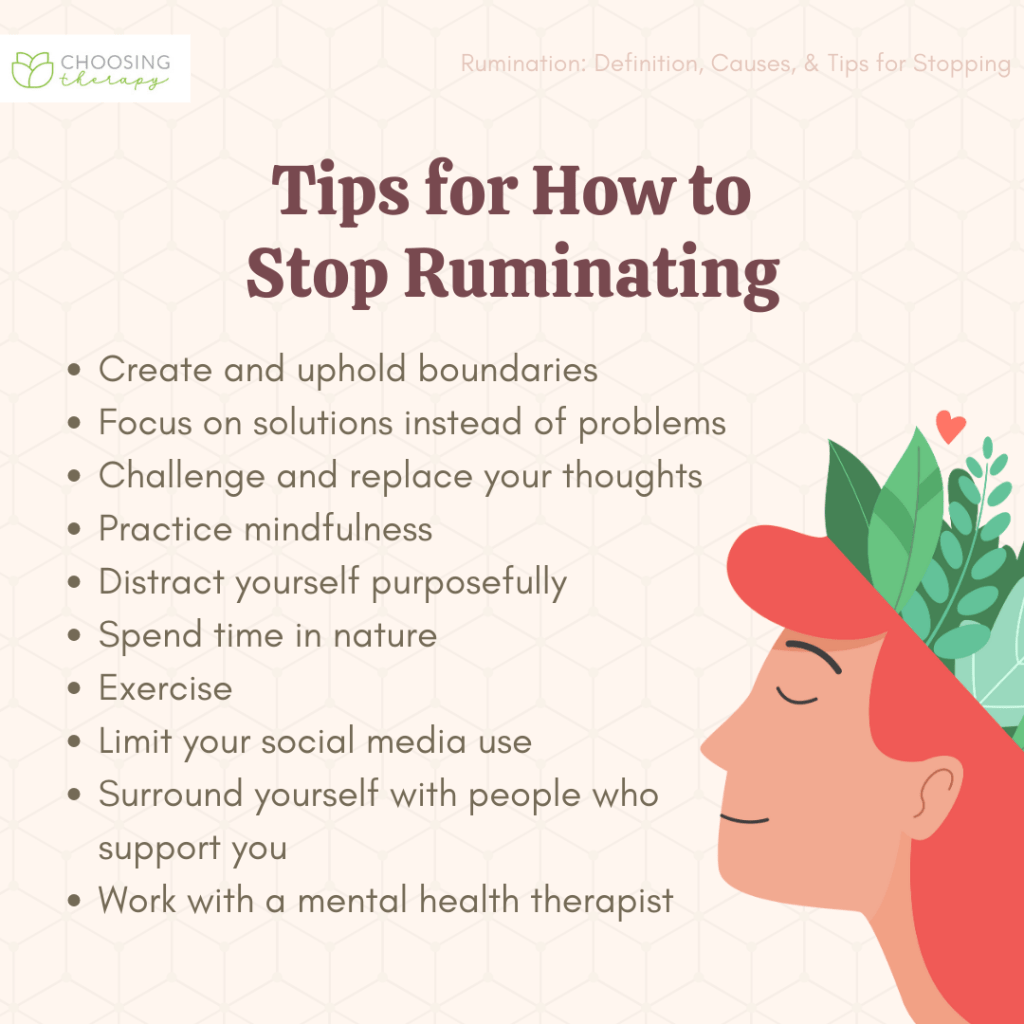

- What do I make ___ mean about myself? Ex: rejection – “I make it mean that I will never find someone because I am deeply flawed.” I make it mean . . . creates distance between you and your thoughts. You get to be the observer of your thoughts.

- What else could it mean/what else could be true? This opens your mind to other possibilities that you might not have considered because you are so focused on the one that is making you suffer.

- What would ___ say? What would someone I look up to say? What would my most loving and confident friend say?

- So what? Dedramatize the situation you’re in.

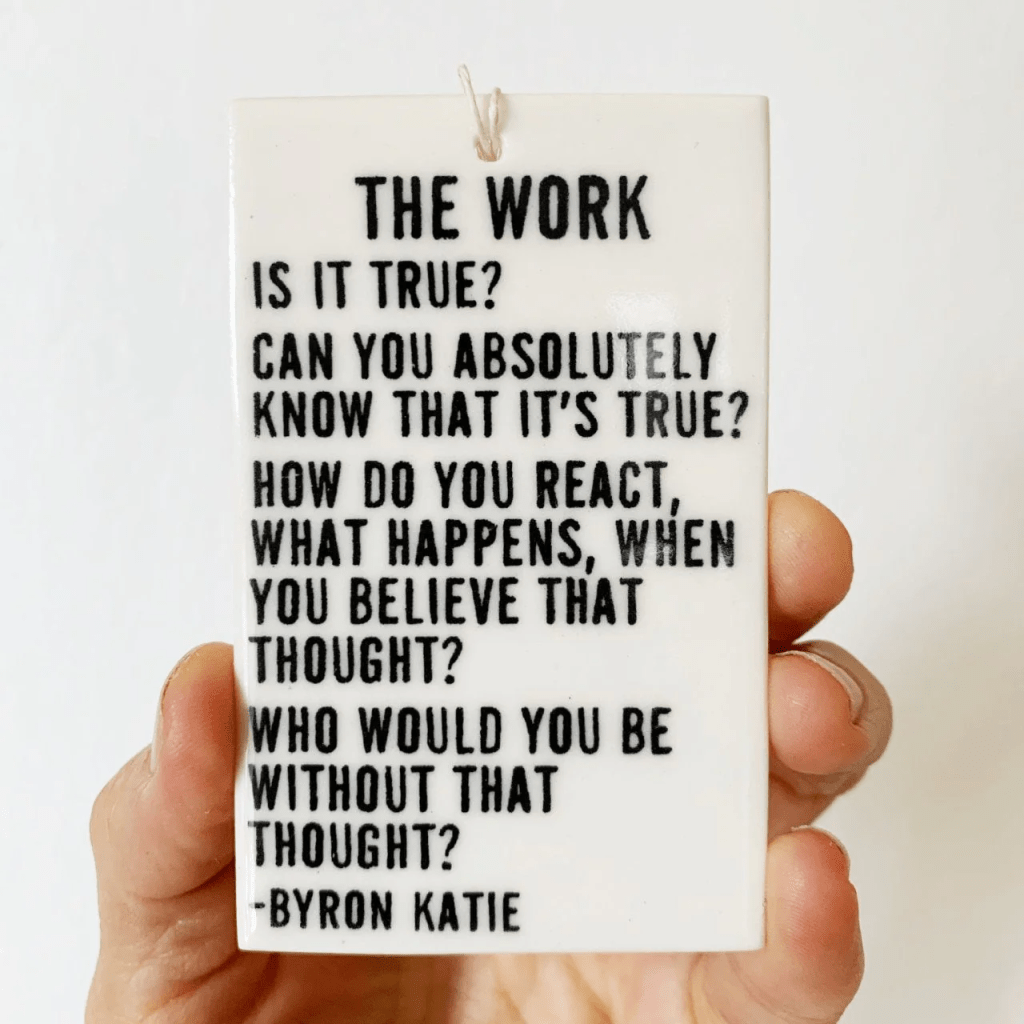

- Who would you be without that thought? The thought you are so attached to is a choice. Someone else with a different background might not have that thought.

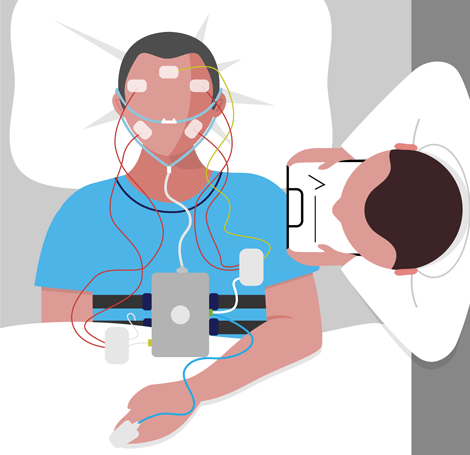

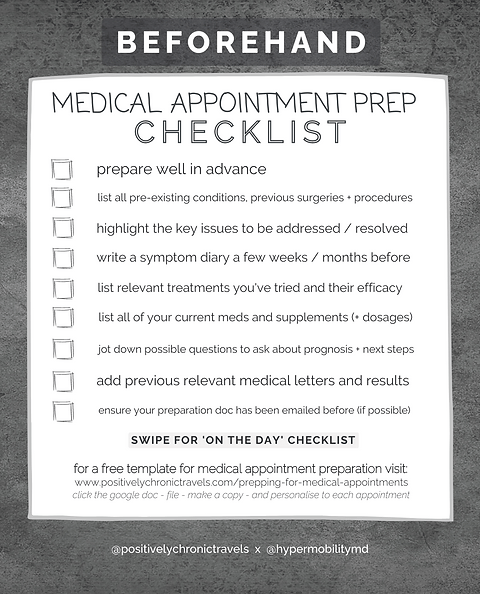

TED Health – A Healthier You: A 5-step guide to better doctor visits

- Prepare for the appointments. Write down questions or concerns to ask your doctor about.

- Be real with your doctor, even if it feels awkward. Tell them the whole story. Tell them exactly how pain or illnesses or medical procedures affect your day-to-day life.

- Don’t be afraid to ask questions or even get a second or third opinion. Clarifying things is necessary.

- Bring a trusted person to your appointments if you can. Take detailed notes that you can review later.

- Don’t be afraid to follow up. Be persistent. Push for answers or referrals to specialists. You’re never a burden for asking questions or pushing for better care. Follow up until you get the care that you deserve.

- What’s one step that you can take today to be a better advocate for your own health? Maybe it’s scheduling an appointment you’ve been putting off, writing down questions for your next appointment, or following up and requesting a referral to a specialist.

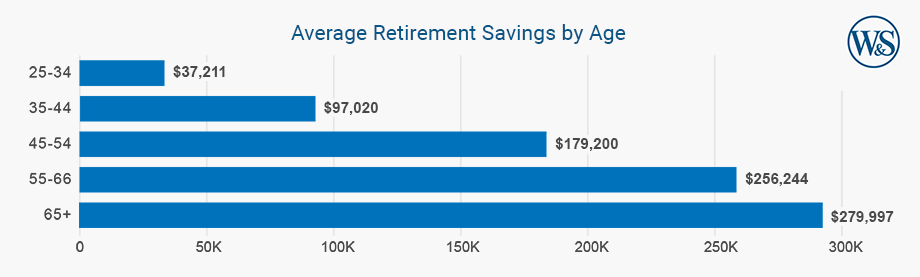

NerdWallet’s Smart Money Podcast – Are You Spending Like Your Generational Peers?

- BLS data – Baby Boomers spend 95% of annual income after taxes, Gen Z spends 93% of annual income after taxes, Millennials spend 83%, and Gen X spends 84%.

- Millennials and Gen X are spending close to 15% of total expenses on retirement. Gen Z are spending close to 12% on retirement. These are averages!

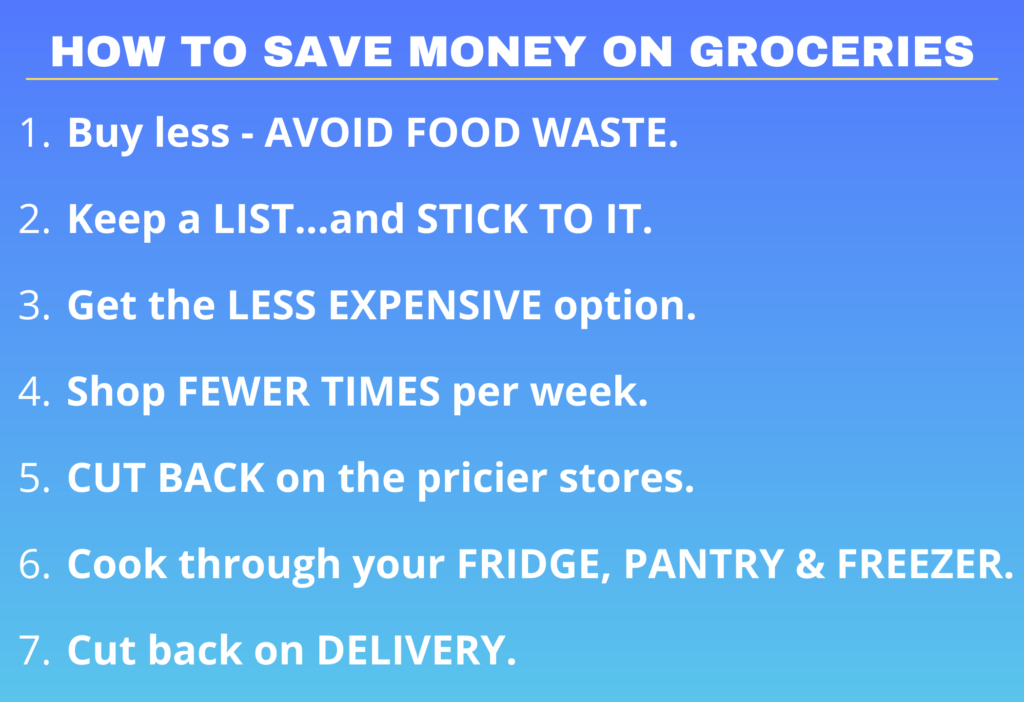

- Food accounts for 12-13% of expenditures among all generations.

- Groceries account for 7% of all spending and takeout takes up 6% of spending

- Gen Z spend on average 4% on healthcare expenses.

- The highest-earning generation spends the most money on transportation (car, flights, public transit). Gen X spent $17,000 on average in 2023 compared to $10,000 for Gen Z.

Are you spending and saving like your generational peers? Or are you doing better or worse?

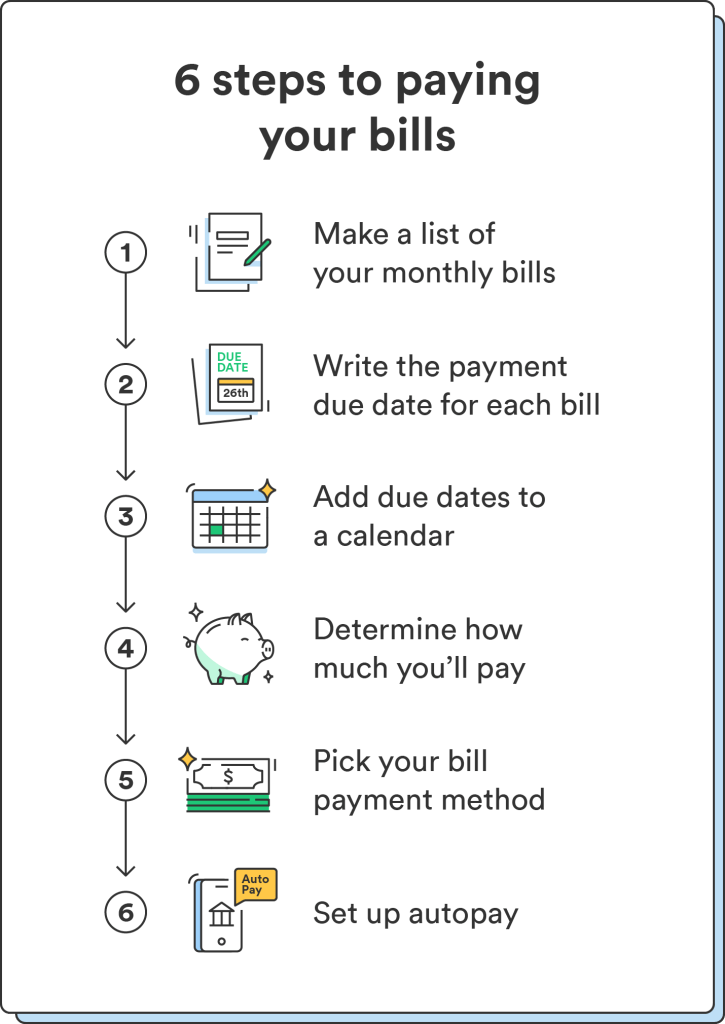

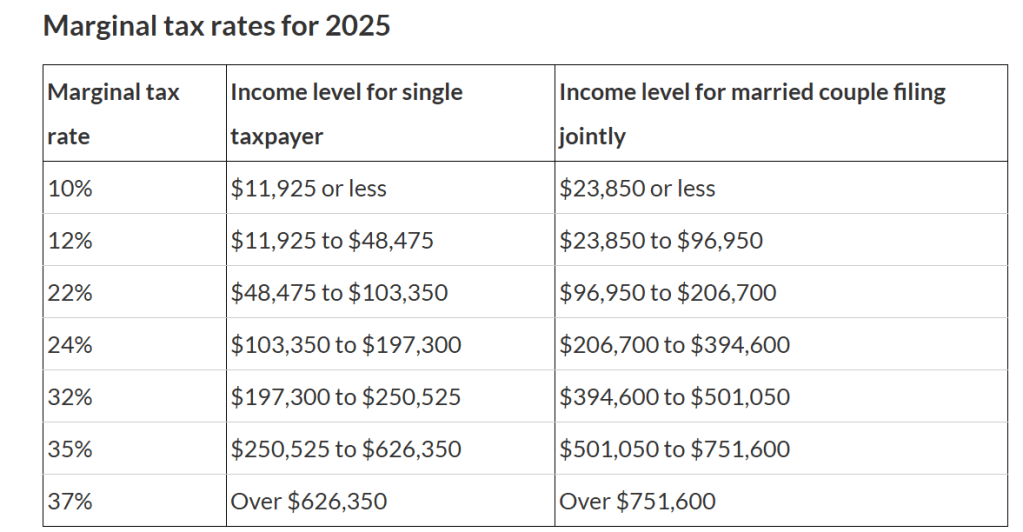

- New tax brackets for 2025 + new standard deductions

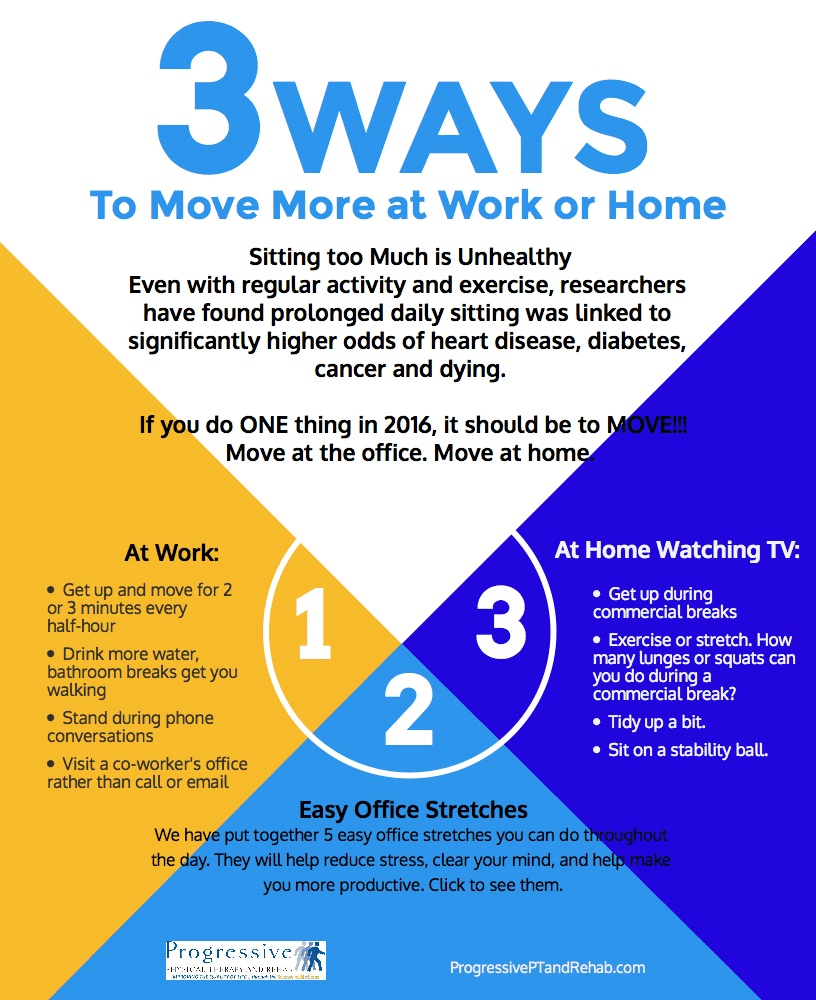

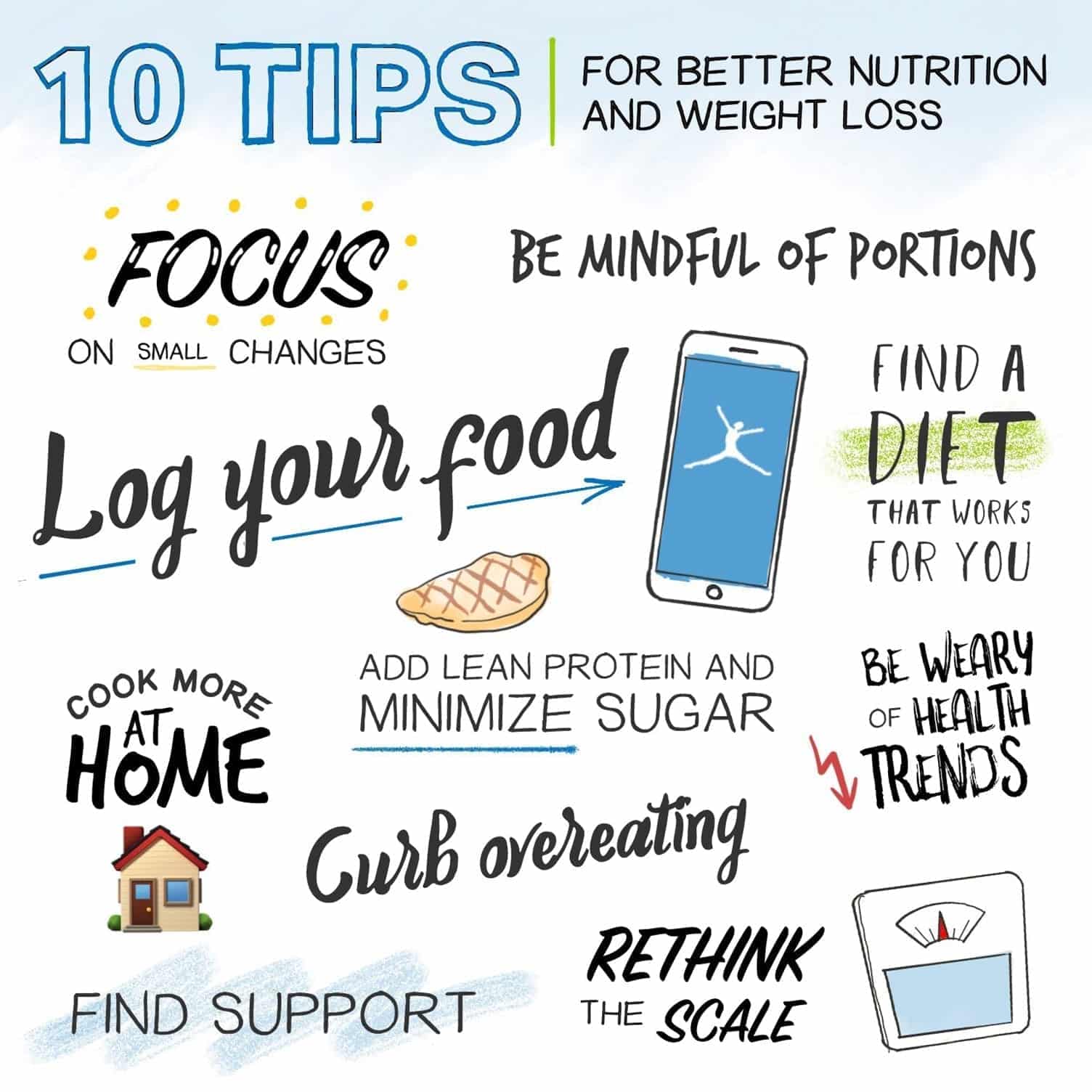

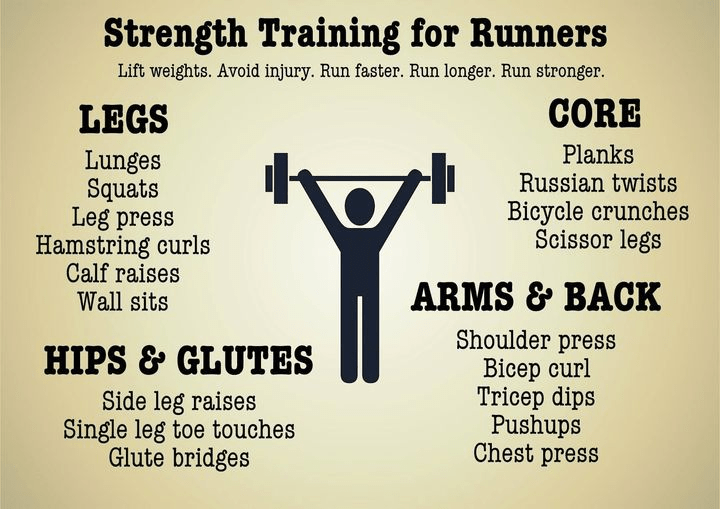

Fit, Healthy, & Happy Podcast – Fitness & Health Habits to Break

- Pre-workout – too much caffeine. Don’t drink more than 500 mg per day. You shouldn’t need pre-workout every day. Analyze your consumption and don’t rely on pre-workout. Are you getting enough sleep?

- Over-reliance on warms ups/needing certain machines/shoes/equipment – some people are so particular and don’t deviate from warmup routines, an Apple Watch, etc.

- All or nothing mentality (weekends especially) – it won’t always be a perfect day to work out and you won’t have as much time as you’d like to but move your body anyway.

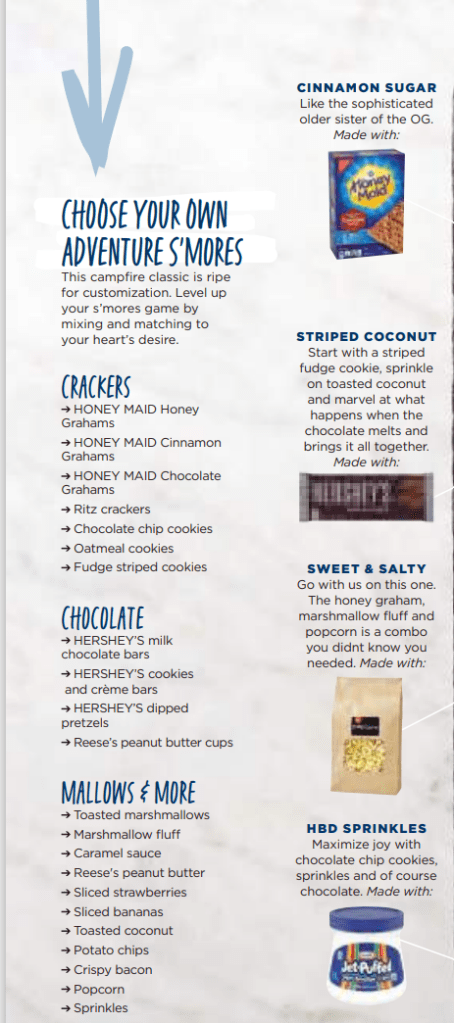

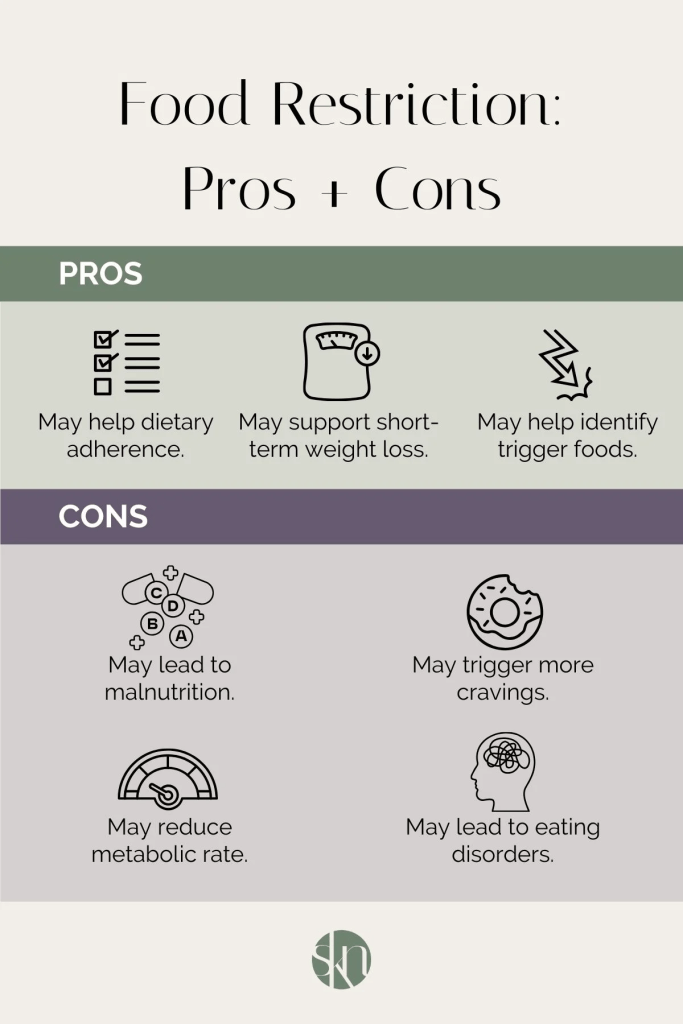

- Demonizing foods – restriction causes cravings. Don’t put labels on foods. Moderation is the key to success. 80/20 clean eating

- Neglecting sleep/recovery – cut off caffeine consumption by 12 p.m. Prioritize sleep and recovery.

- Crutching protein and protein supplements – focus on whole food sources for protein.

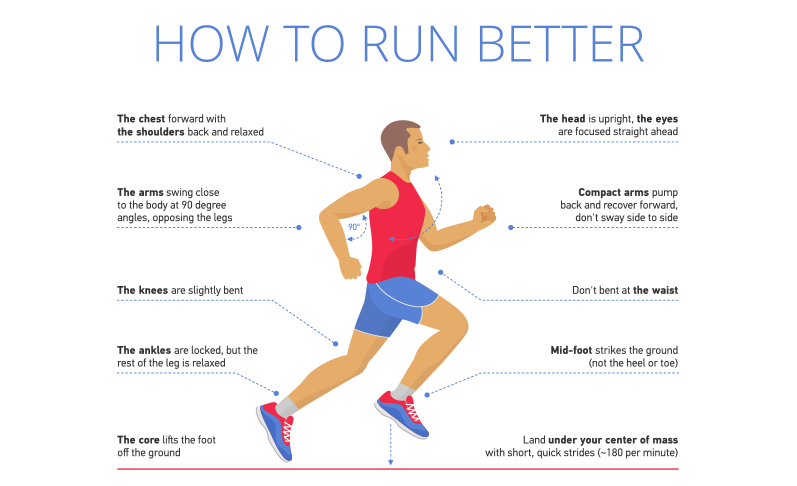

- Lifting with bad form – have a season where you really focus on perfecting your form.

- Treating it as a chore and not having much to look forward to – if you view working out as a chore, you won’t push yourself or make progress. Find something to look forward to and set goals you want to hit. When you see results or progress, working out is more exciting. Update your routine or goals or try a new challenge.

- Only allowing yourself to see results or having no social life – have a balance of working out and a social life. Fitness and health need to be integrated within your life. Have some flexibility with your fitness to have a social life.

- Refusing to change your mind/update your beliefs – you need to try new things, update your beliefs, and have the capacity to change your mind. Ex: you can have carbs and still be in shape.

I enjoyed this post from Seth’s blog this week:

“The problem with the movie version

There are lights, camera and action, but mostly there’s the unreality of making it fit.

Happily ever after, a climax at just the right moment, perfect heroes, tension, resolution and a swelling soundtrack. Every element is amplified and things happen right on schedule.

Consume enough media and we may come to believe that our life is carefully scripted, and that we’re stars of a movie someone else is directing.

This distracts us from the truth that real life is more muddled and less scripted. There is no soundtrack. We’re actually signed up for a journey and a slog. Nothing happens ever after. It’ll change, often in a way we don’t expect.

We have no choice but to condense a story when we want to film it. Our real story, on the other hand, cannot be condensed, it can only be lived. Day by day.”

I look forward to reading, learning, and sharing more with you soon!