My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

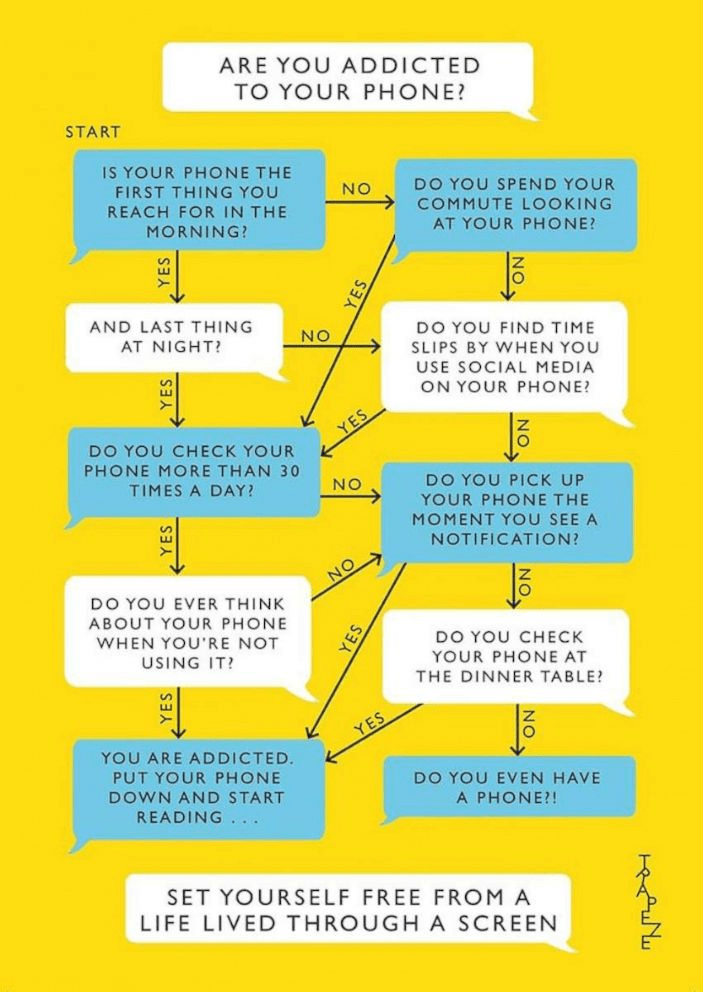

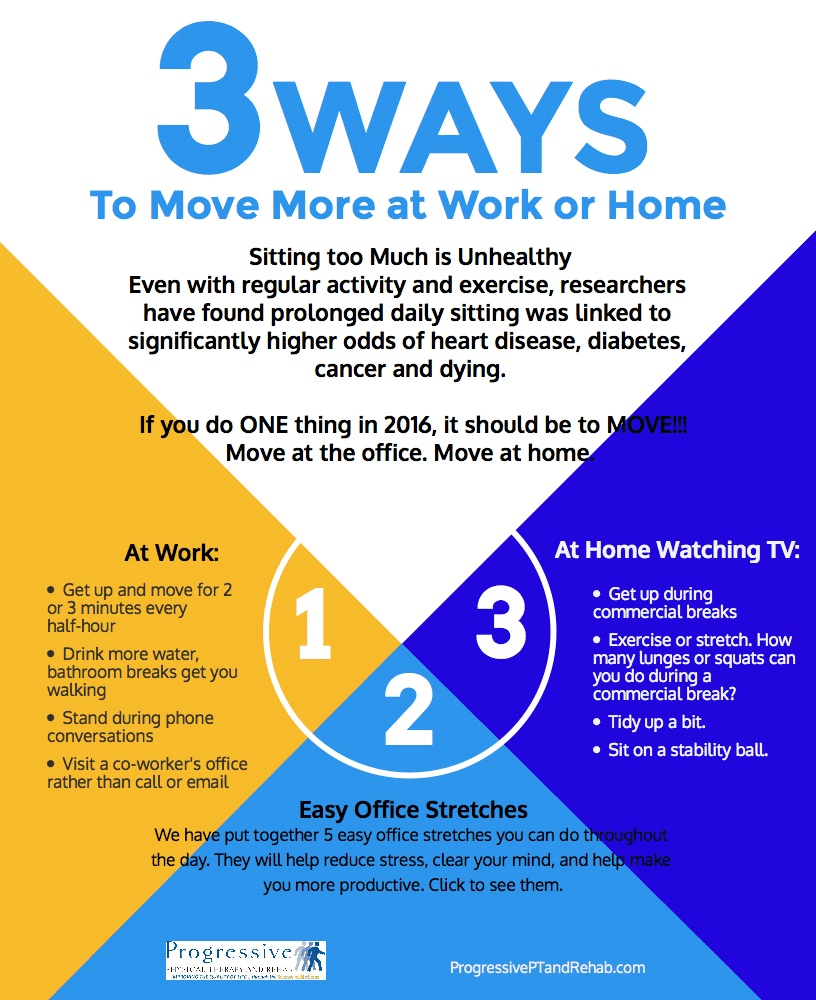

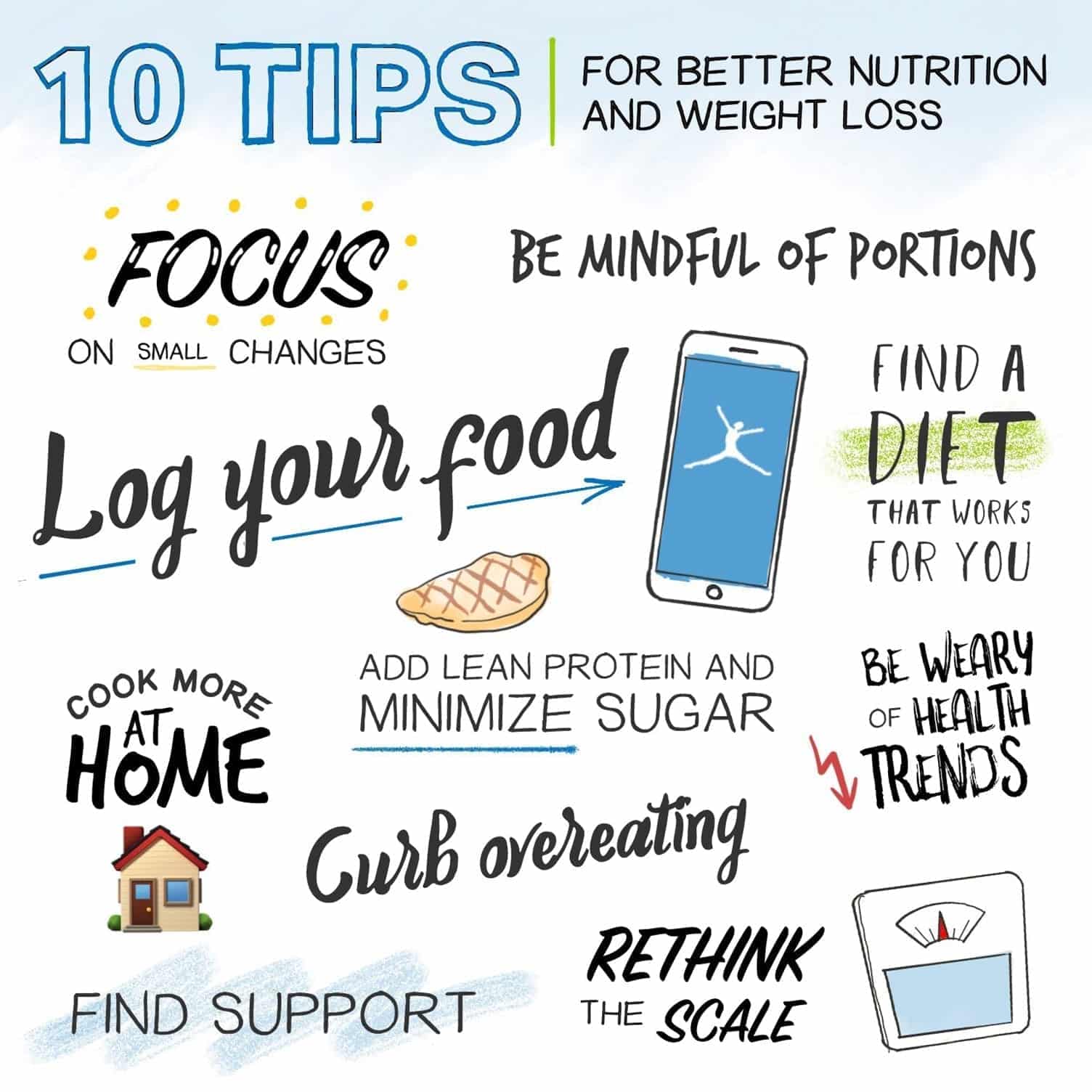

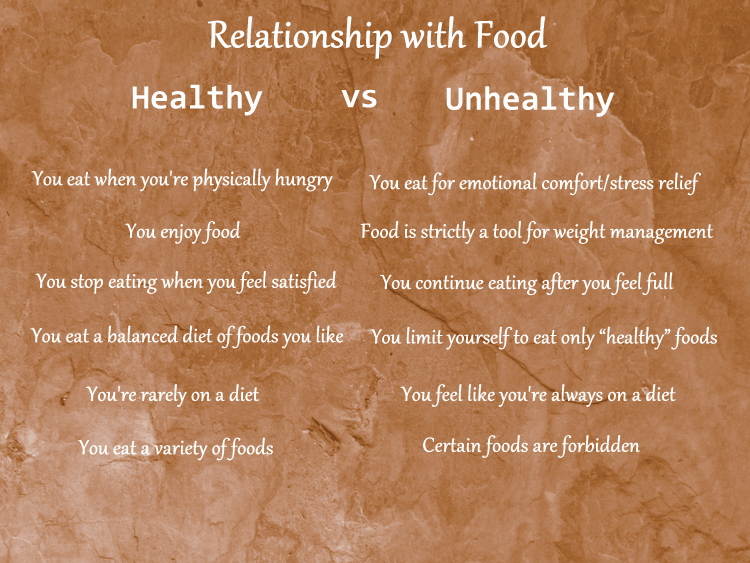

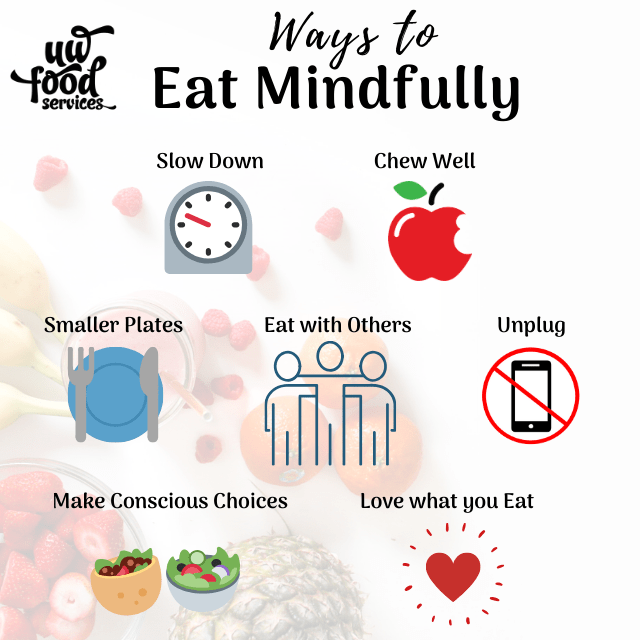

We live in a society where many people eat while on the go, while scrolling on their phones, or while watching tv. When you are eating while scrolling on your phone or watching tv, you aren’t engaging your senses and aren’t conscious of the amount you are eating.

- Mindful eating asks us to slow down and notice our food. Allocate time to eat and ONLY eat.

- Most nutritionists urge us to take 20 minutes to eat a meal. It takes that amount of time for your brain to signal to your body that you are full. Otherwise, you get that signal too late and feel terrible.

- Engage your senses as you eat. Notice the smells, colors, tastes, textures, and emotions that you’re feeling.

- Honor the food. Acknowledge the work that went into that meal.

- Take the time to taste the food. Try to eat one chip at a time. Put your food in a smaller dish beforehand to limit your intake. Allocate time to eat and ONLY eat.

- Savor and chew your food thoroughly to engage your senses and help with digestion.

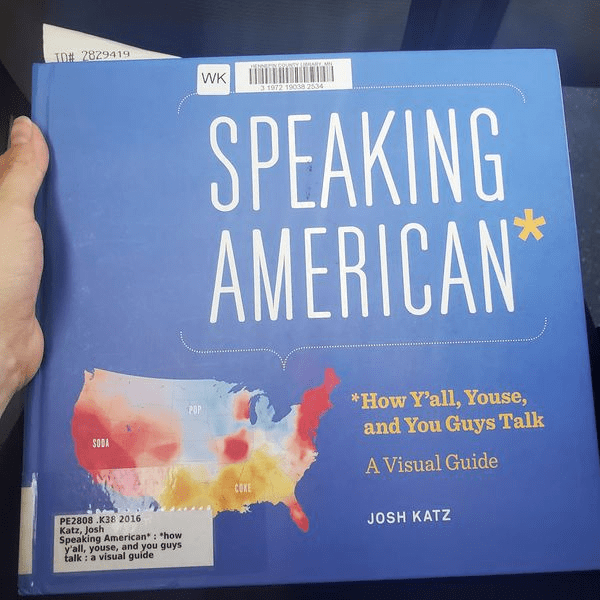

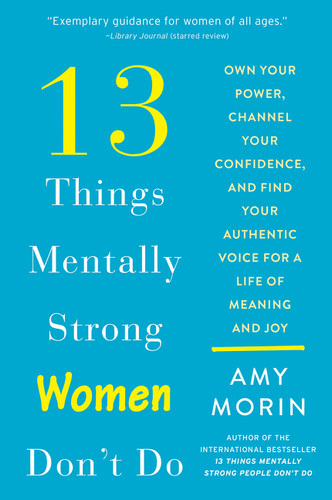

I’ve finished reading two books in the past week.

“I am more than my body: the body neutral journey” was written by Bethany C. Meyers, CEO of the be.come project. Bethany has over 15 years of experience in the fitness industry as an instructor, teacher, and workout creator. I struggle with my body image, and this book was much needed and thought-provoking. In fact, while I was reading this book, I had to refrain from exercising due to a foot injury, and my primary emotion was guilt. I felt guilty for not being able to be consistent with my habits. This book came at the right time. I will discuss this book in much more detail on my blog sometime, as I got SO much out of this book that may be helpful to others.

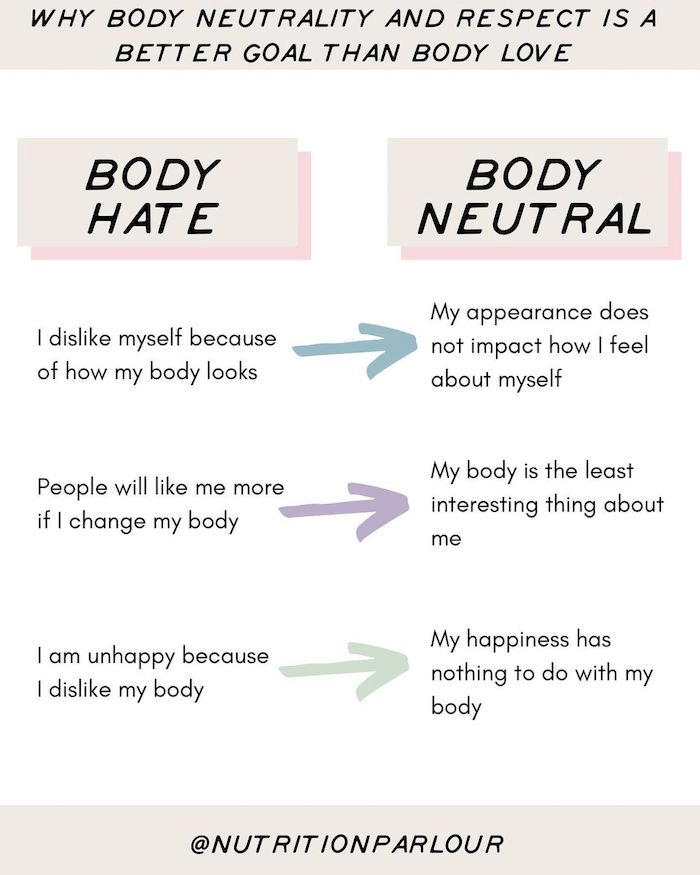

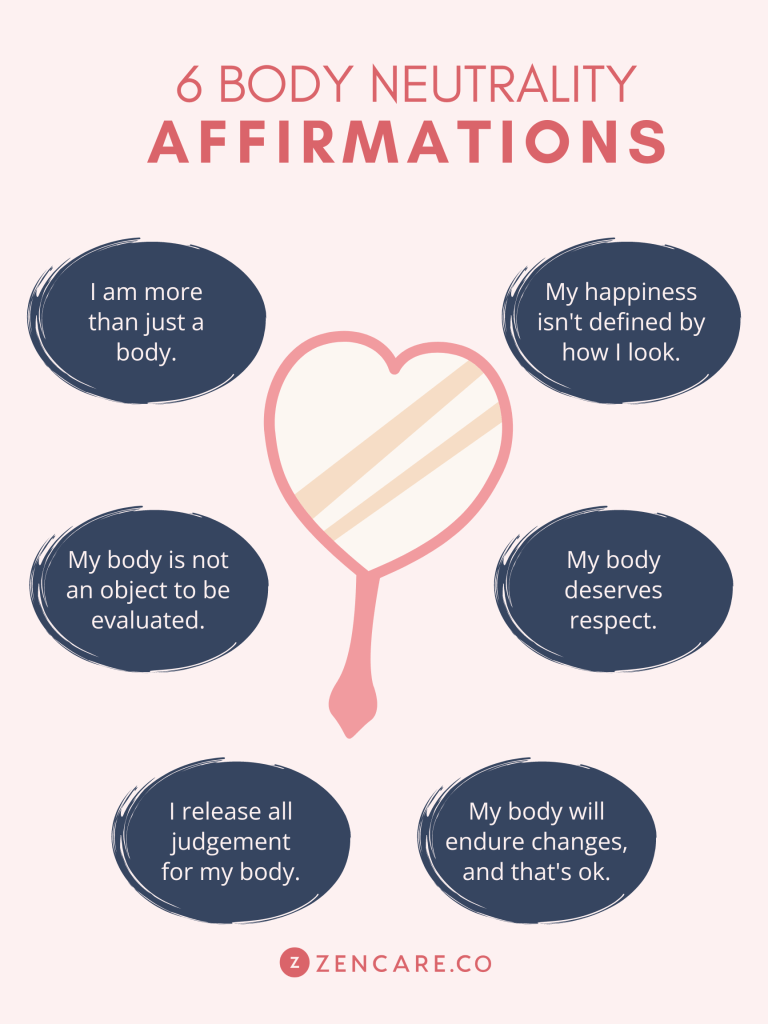

In short, body neutrality is the idea that each of us is more than our body, and our worth is not limited to our physical self. It is respecting our body even though we may feel differently about it on any given day. ![]()

The body neutral journey is to acknowledge the feelings we have, explore why those feelings came about, and reconnect with our self-worth.

Some of the many points to consider: If you have been speaking poorly to yourself and judging yourself harshly, how much of that is seeping out into your relationships with others? How do your own comments about your body impact the people around you who hear them (especially children)? Are you appreciating the functions of your body without criticism? Are you focused on your body’s failings? Are you comparing yourself to others? When choosing to exercise, are you solely focused on changing your physical form? What influences or media do you consume that frames exercise as a punishment, a requirement, or a means only to change your physical shape? ![]()

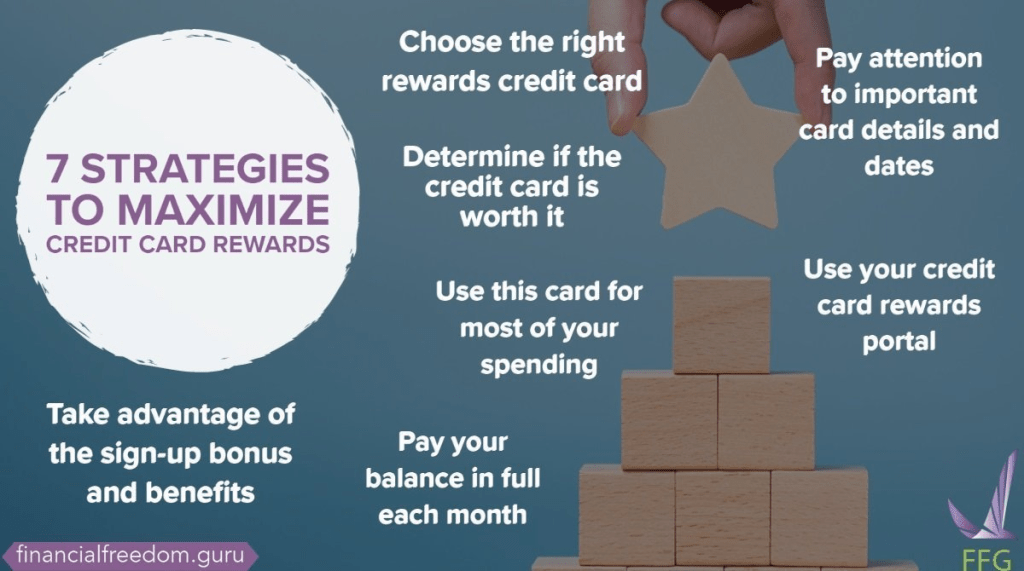

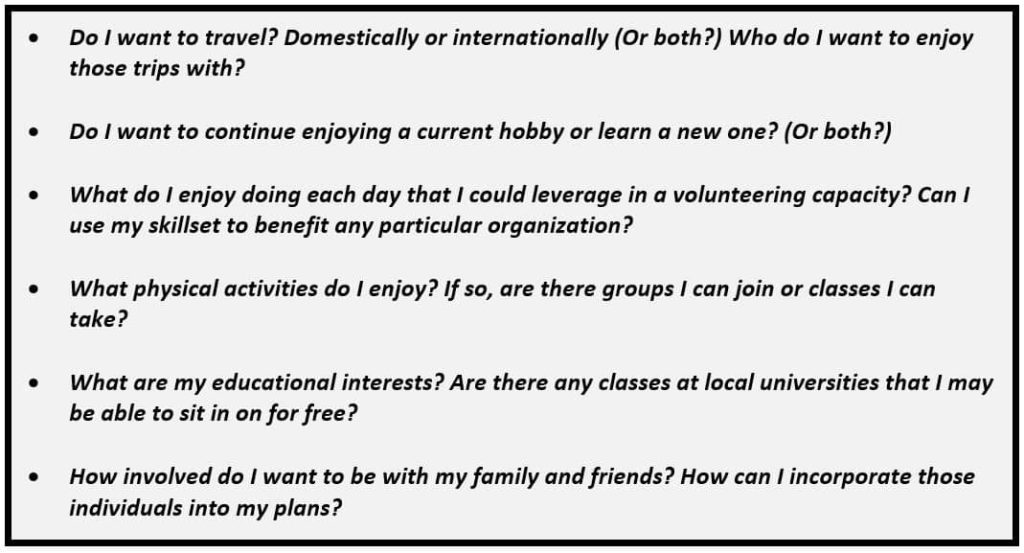

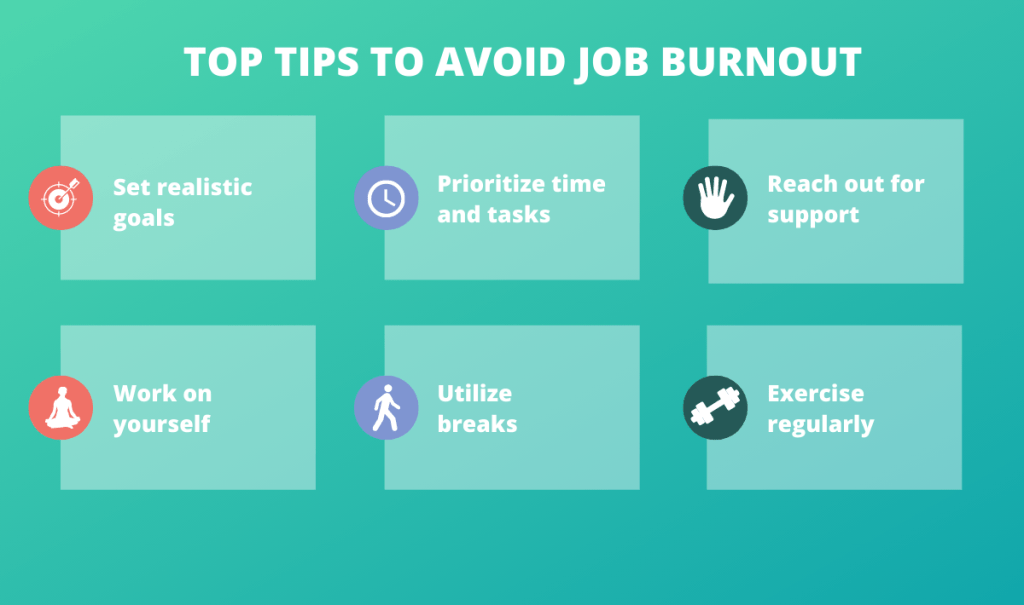

- Look at your entire journey. What are your goals? What are you looking to achieve? Where do you want to be by the end of the year? Have you progressed? Have you regressed? Address that and understand why, and implement the changes necessary to make sure you are progressing. It is easy to make excuses, but you need to be honest with yourself about how you can improve and implement the necessary changes. Set a goal and be intentional in making progress to achieve it.

- Establish a workout routine and keep track of it. Keeping track allows you to be more aware of what are doing and also allows you to more easily measure your progress.

- Follow a nutrition protocol. Make sure you’re eating enough protein to maintain and build muscle. Eat mostly clean foods.

- Prepare by planning your workouts and food and developing new goals and challenges.

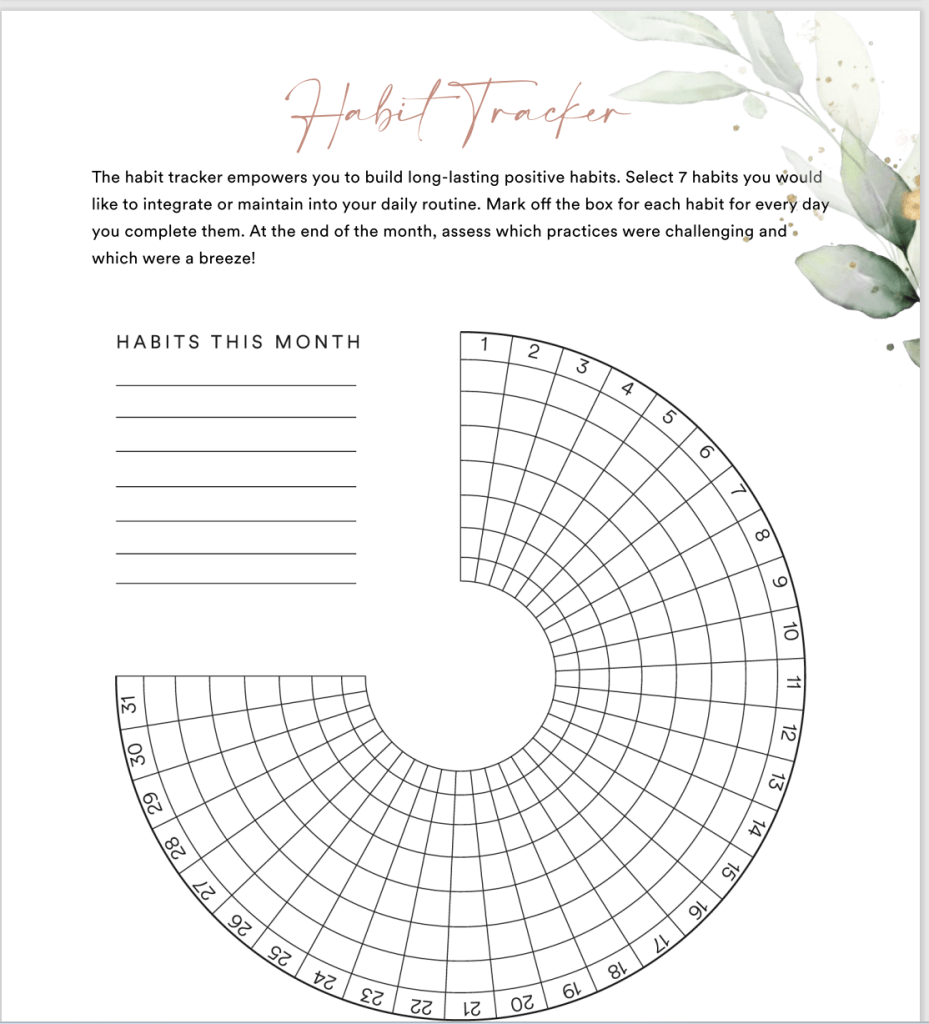

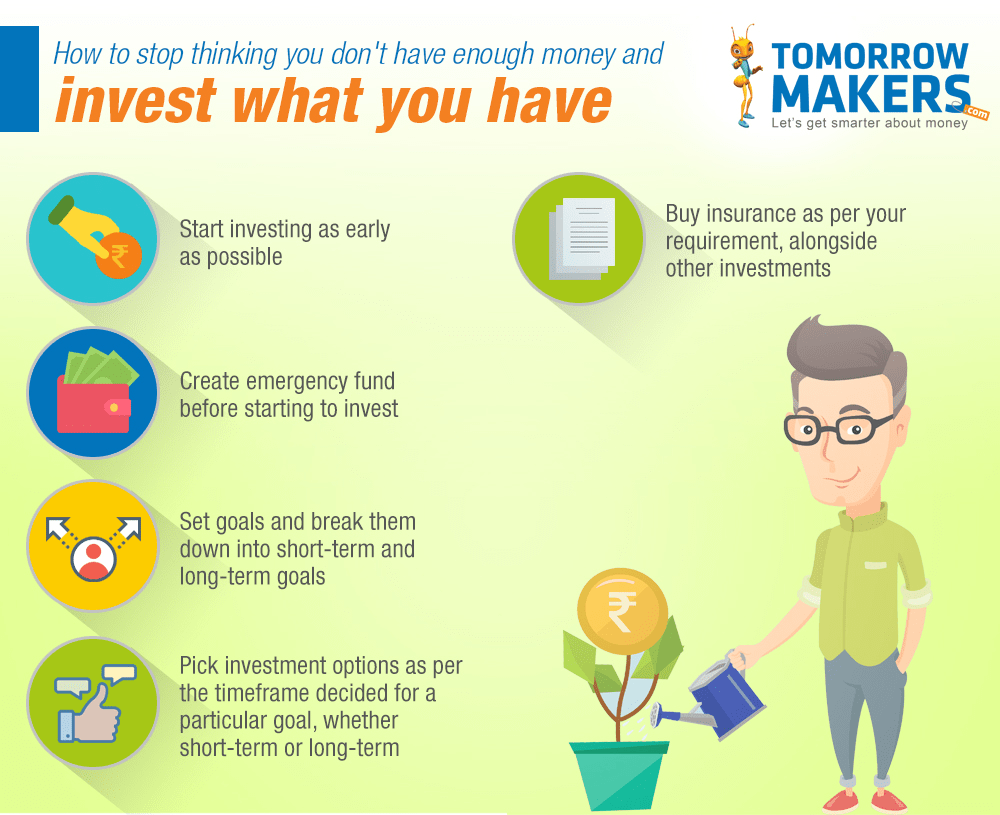

- Have accountability. Methods include using a habit tracker or checking in with friends or a fitness coach.

- Continual learning. Listen to podcasts and do research. You don’t need sketchy supplements.

- Develop habits that make it easier for you to achieve your goals.

- Don’t be all or nothing. There will be ups and downs in your journey. Keep showing up.

I don’t drink, but I wanted to learn more about alcohol and addiction recovery. This podcast was very insightful!

- 1 out of 5 deaths for people between the ages of 20-49 is attributed to alcohol.

- Many people go to great lengths to hide their drinking problems.

- Daniel said that, in any situation, alcohol was the top priority: strategizing, sneaking around, mental equity spent wondering will I have enough, do I have enough, where can I get enough, should I drink beforehand, and not being present at outings.

- Daniel got really defensive when his wife would call him out on his problem and would say things like “I can stop, I can take a break” and make empty promises like “I’m only going to drink on the weekends” and would last for a weekend. Pretty soon he was drinking every day again. Eventually he would use his trauma as his defense.

- “You can quit for other people, but you can only stay sober for yourself.”

- “My wife went to therapy to deal with how to understand me without enabling me. I would lie to my doctor about my alcohol use.”

“I was using my previous trauma as a hall pass to drink.”

- “To quit, you have to be willing but you don’t need to be ready.” Many alcoholics will set a quit date and then make excuses like “we’re going to the lake and I like to drink at the lake, it’s the 4th of July and I’ll want to drink,” etc. There is always going to be a reason to drink, but there is always going to be a reason to not drink too.

- After quitting, Daniel reports that his mental health became more manageable, he was sleeping better, and through therapy, his trauma became processed, so he had eliminated a lot of my talking points he would use to defend his drinking.

Many alcoholics will say “I don’t need medication. I don’t take medication” when referring to their mental health needs, which is interesting because they are using alcohol as self-medication.

- To begin quitting, Daniel removed all alcohol from his house and would mark days off the calendar with an X, take two walks each day “sober walks”, watched tv, read books, listened to podcasts, etc. He tried to be sober for one month, and he felt better, so he stopped drinking altogether. He reports his energy and sleep were better, and he was so proud of himself.

- “It’s never been easy, but it’s gotten easier.”

- Access to resources is a huge barrier for many people. It requires good insurance and time freedom and financial freedom to go to treatment and take time off work.

“People say life is boring without alcohol, but life without alcohol is peaceful. I think they’re mistaking peace for boredom. It is a transition at first; you have been giving your brain an instant hit for years, so your brain is trained for instant gratification, and you take it away and have to sit with it. It can be lonely without drinking because the changes that have to be made for sustained recovery often require not doing the things you used to do with the people you used to do them with. You have to rest in your emotions and you can’t drink every time you’re anxious, nervous, sad, or celebrating. Alcohol has Velcroed itself to every situation, rite of passage, and emotion in our society that it is odd if you don’t drink and not odd if you do drink.”

“People are treatment-averse and label-averse. They are afraid of being labeled an alcoholic. I encourage people to ask the question: Does drinking benefit my mental health, my physical health, my finances, and my relationships?”

- People who want to change their behavior but are unsure where to start or what to do can start listening to podcasts of others’ stories and experiences.

- Advice for loved ones of alcoholics: treat alcoholism as a medical condition and not a moral failure. Encourage medical treatment for the addiction. This can help take the morality and shame out of it. Substance use disorders have a significant biological component to them. It’s not a moral failure, a sign of weakness, or a shortcoming. Getting health professionals involved is key for so many people who want to get into recovery. Al-anon is a good resource.

- Advice for those struggling with addiction: Try cutting back or quitting as an experiment. Some people find it easier to think about it as “one day at a time.”

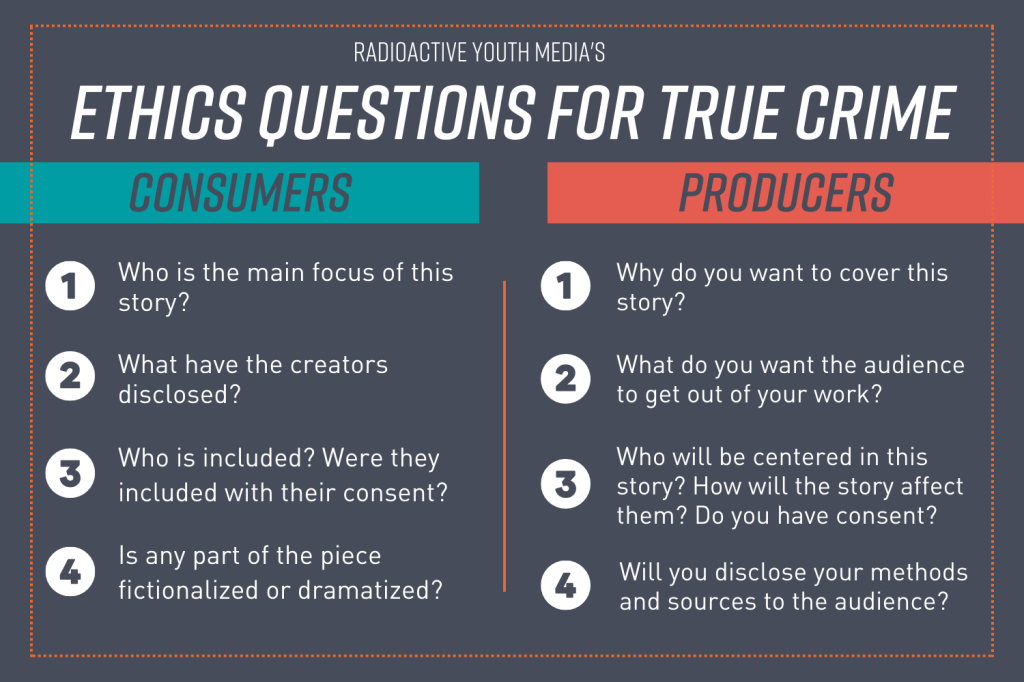

This week I listened to this podcast AND read the book “In Two Minds: Stories of Murder, Justice, and Recovery from a Forensic Psychiatrist” written by Dr. Sohom Das.

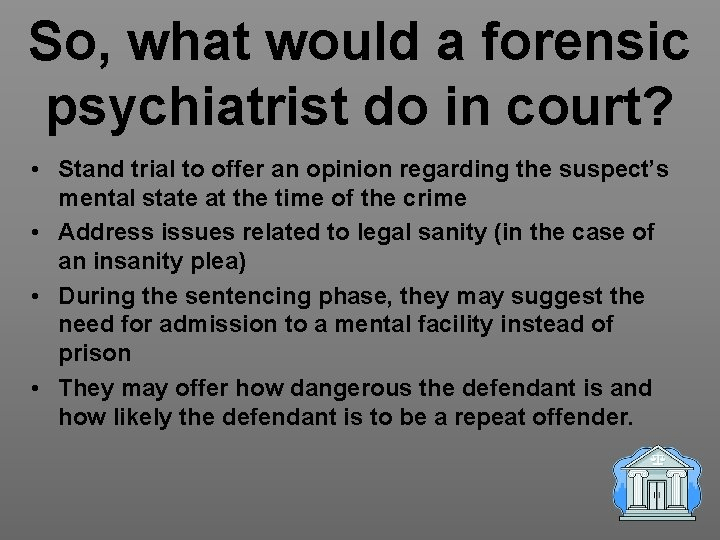

- When a violent crime is committed, the justice system needs to determine if the perpetrator of that crime is a permanent danger to society who should be locked away for life, or if they’re mentally ill to a degree that proper treatment would allow them to re-enter that society. In other words, are they bad, or are they mad?

- Dr. Sohom Das is a consultant forensic psychiatrist who works in prisons and criminal courts to assess and rehabilitate mentally ill offenders. He is also the author of “In Two Minds: Stories of Murder, Justice, and Recovery From a Forensic Psychiatrist.”

- Forensic psychiatrists work in a few different environments. Dr. Sohom Das does most of his work in courts as an expert witness. His job is to decipher whether a defendant has a mental illness and whether they had symptoms at the time of the violent offense. If they did, he needs to determine whether their symptoms affect their criminal culpability. If they do, he makes a recommendation as to whether they should go to prison or to a psychiatric hospital.

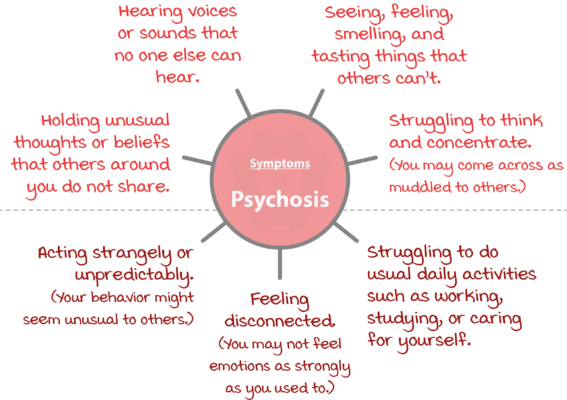

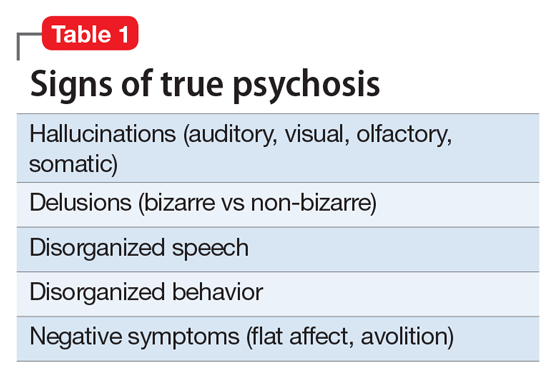

- Determining mad vs. bad (a spectrum): mad (a psychotic illness – people hearing voices, telling them to hurt people, or people that have paranoid delusions). They might attack somebody because they have a delusional belief that that person’s a pedophile or that person wants to attack, hurt them, or kill them. So that’s one end of the spectrum.

- The other end of the spectrum, which would be bad, would be a personality disorder. Psychopathy would be a really well-known one. Antisocial personality disorder causes people to be impulsive and aggressive. They don’t care about the rights and wrongs of other people. They are career criminals that just have a complete lack of empathy and remorse.

- Dr. Sohom Das reports that 99 percent of the defendants that he has assessed have had some kind of trauma or abuse in their childhood: physical abuse, sexual abuse, neglectful parents, drug abuse, homelessness, witnessing violence, gang violence. These factors often cause criminality, but they also cause mental illness. So that’s why they’re so common. Dr. Sohom Das emphasized that he rarely sees someone who purely has a psychotic illness and has had no problems in their background or upbringing.

- If you have a severe mental illness and you’re lucky enough to have a good family support structure that cares about you and will take you to a doctor and will make sure you take your prescribed medications, then your outcome generally is going to be a bit more positive.

- A lot of his patients come from broken homes. They are adopted or brought up in the care system or have families that don’t look out for them. They drift into homelessness, and the mental illness itself can massively damage their physical health.

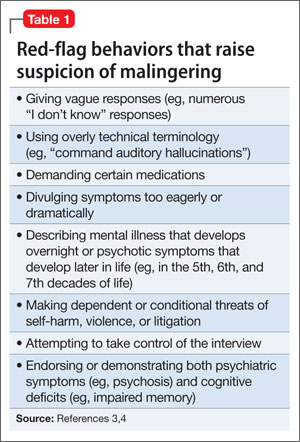

- Regarding faking it: “If somebody tells me that they’re hearing voices, but they’ve been going to work every single day, they’re going down to the pub with their friends, they’re managing a normal home and family life, and they’re socializing, then I’m going to be suspicious. I’m looking at all of the evidence. I also see what their mental state is like from objective evidence from other people. If they’re remanded in prison, I will speak to the prison officers. If that person says they’re paranoid or is acting paranoid in front of me, but the prison officers say that they’re laughing and joking with others on the wings, then I’m suspicious.”

- “The other telltale sign is that if somebody’s really, really unwell, they don’t have an agenda. They’re not trying to convince. They’re not trying to say that they need to be in the hospital because in their minds, those delusions are real. So they don’t think they need to be in the hospital or need antipsychotic medication. Whereas those who are trying to exaggerate or fabricate have an agenda. They tell me straight away that they’re hearing voices or that they’re paranoid.”

- “So when somebody says, Voices inside my head,’ I’m already suspicious because an actual auditory hallucination feels as real as you hearing my voice now. It’s actually external outside to somebody’s head, even though people say ‘voices in my head’. The voices in psychosis tend to be quite blunt. If someone says they have a really detailed intellectual conversation with a voice, that’s really unlikely. It’s usually just one message and it’s negative, like ‘You’re a piece of sh*t‘ or ‘people think you’re a pedophile‘ or ‘these people want to rape you.’ They’re short, simple phrases that repeat over and over again.”

People can’t just fake it on the day of their psychiatric interview. If they claim to hear voices, it has to be bleed into their functioning and should affect their work, family members, and social functions. Witnesses would corroborate that a mentally ill person was acting bizarre and responding to themselves on the street, and police officers would also observe these behaviors. The police interview transcripts would indicate mental illness.

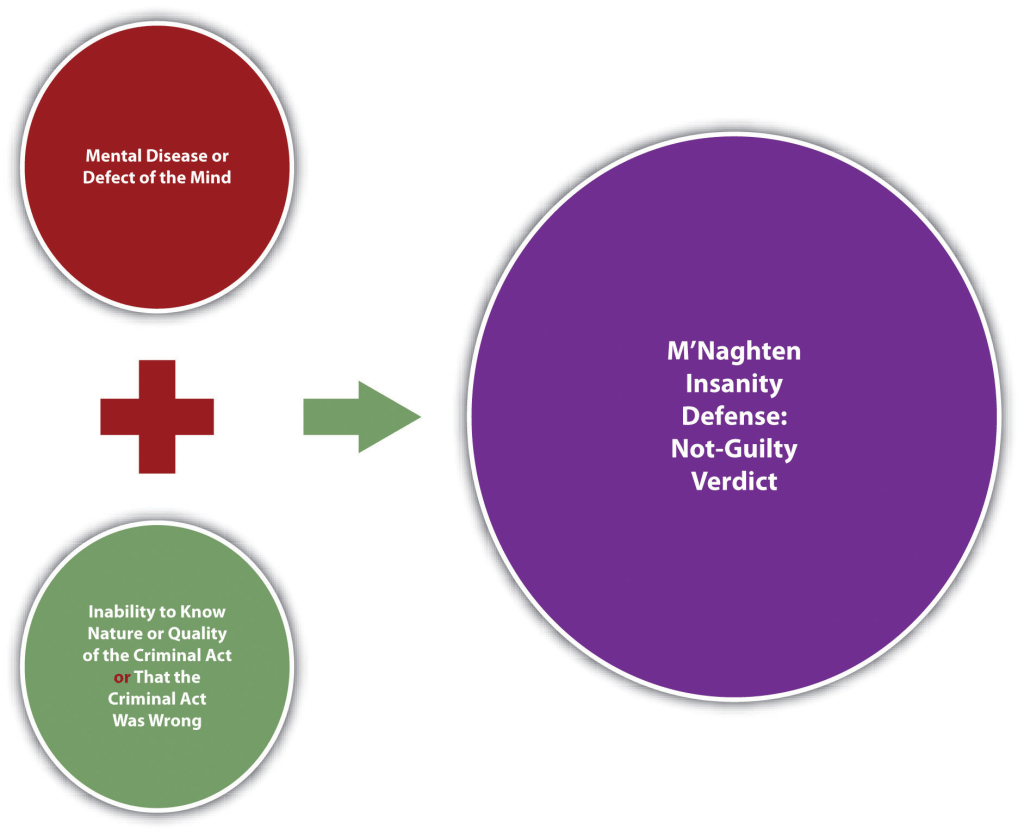

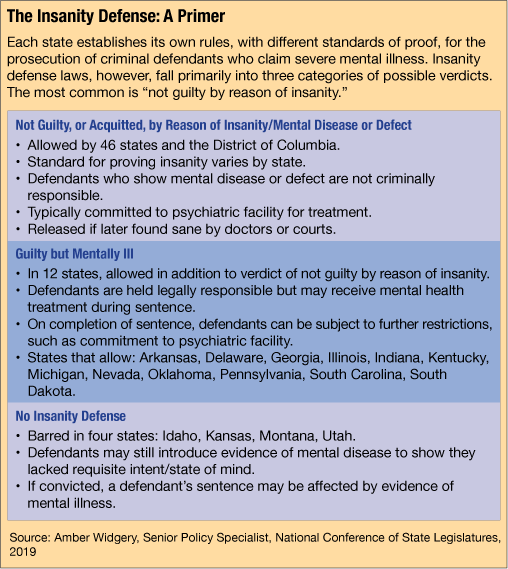

There’s a misconception that if you are found not guilty by reason of insanity, the case is dropped and you are released back onto the streets. That’s very rarely the case, especially if you’ve committed serious violence. The person would go to a secure psychiatric hospital for treatment, possibly for years.

- By far the most common diagnosis is antisocial personality disorder. It’s somebody that’s impulsive, aggressive, doesn’t care about the rights and wrongs of other people, and doesn’t learn from their mistakes. They’ll have repeated prison sentences and won’t change their lifestyles. They are career criminals who intend to offend.

- Psychopaths tend to have the symptoms of antisocial personality disorder, but also tend to be really charming, manipulative, and deceitful. It’s not obvious that they’re antisocial. They tend to be very charming and pleasant, but they will stab anyone in the back to get what they want.

- Sociopaths tend to not be quite as skilled as psychopaths in fitting into society. They tend to be outlaws and career criminals. They don’t have the emotional stability to plot for months or weeks about how to hurt someone. Instead, they tend to explode in anger.

- Borderline personality disorder came from being borderline between a personality disorder and a psychosis. People with borderline personality disorder don’t intend to offend and aren’t antisocial. They do have empathy and care about other people, but they have unstable relationships and tend to explode with anger because they can’t contain their emotions. They often lash out and regret it immediately, whereas psychopaths, sociopaths, and those with antisocial personality disorder don’t regret it.

- Dr. Sohom Das has done over 1,000 evaluations for criminal court alone! His main priority is determining bad (personality disorder) vs. mad (psychosis). Because of their backgrounds with trauma, physical sexual abuse, homelessness, abusive parents, drug abuse, etc., they tend to have elements of personality disorder and elements of criminality. Although there are people on different points of the spectrum, the law is very black and white. So you either have a psychiatric defense like not guilty by reason of insanity or diminished responsibility for murder, or you don’t. There are no gray areas. It’s a yes or no. His role is never to decide whether someone’s guilty or not guilty or to decide the length of punishment.

- If they end up going to prison, he can say that they should go to prison by saying that they shouldn’t go to hospital by process of elimination, but he can never say how long the prison sentence should be. He trusts and has to have trust in the court system.

- Traits of school shooters Dr. Sohom Das has pointed out: They are usually quite isolated, withdrawn, and marginalized. They’re romantically and sexually unsuccessful (involuntarily celibate). They tend to find their own little communities on the internet and kind of weaponize and encourage misogyny. Entitlement is another trait. They feel entitled to sex. They feel that society is geared against them because they aren’t attractive.

The easiest, simplest, and quickest predictor of future violence is previous violence, and it usually escalates. The majority of the time it’s young men who carry on offending, and their level of aggression and violence increases. They often don’t learn from their mistakes, so they serve prison sentences and carry on committing violence.

One of the cons of working as a forensic psychiatrist is the lack of customer satisfaction and success stories. They don’t hear about what happens to the clients after their assessment or treatment.

I look forward to reading, learning, and sharing more with you soon!