My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

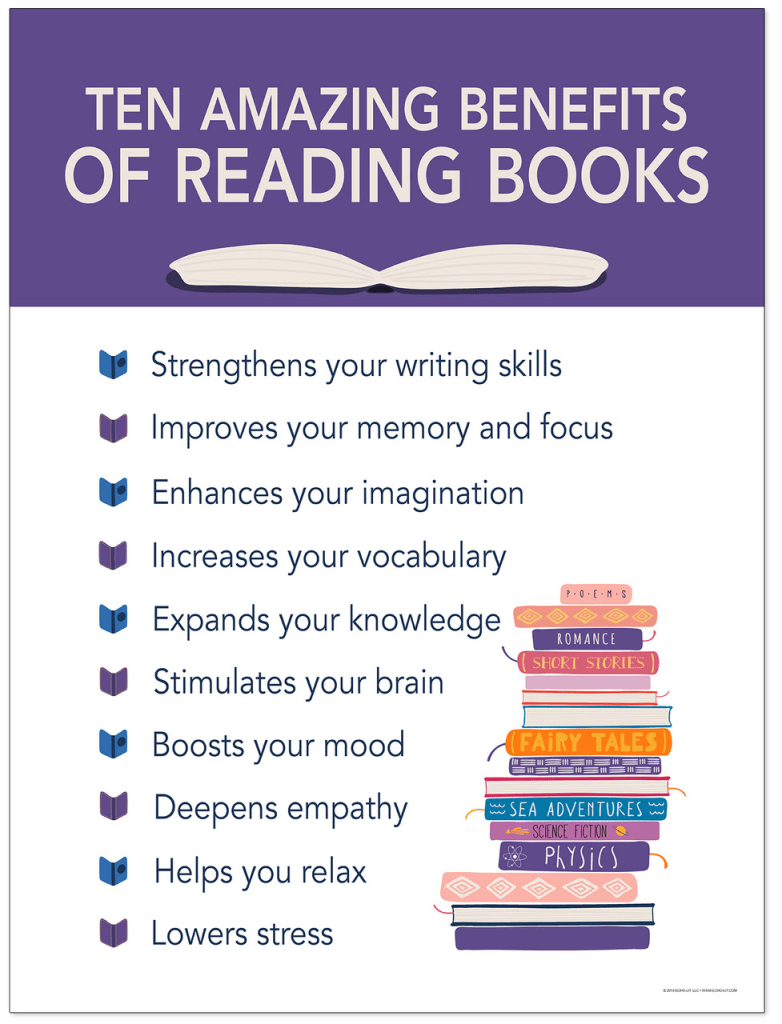

- If you are out of the habit of reading or feeling tired in general, read a short book. It can be just the thing to get you going.

- Look for a short book to distract your mind from social media, boredom, sadness, etc.

I have been so busy and stressed with schoolwork this month and took nearly all month to read two books for fun. I decided to read a short book of poems as my third book to give myself a mental break, and I have ended the month reading four books. I think reading the short book gave me a mental break and momentum to read more.

- Behave like the person you want to become.

- If you change your behavior first, the feelings will follow. Changing your behavior can also change your thoughts because you train your brain to see yourself differently.

- Want to feel happier? Ask if you are happy right now. Want to be more confident? Act as if you feel confident.

- If you are battling depression, ask yourself what you might be doing differently today if you felt a bit better. Depression causes us to do things that reinforces depression, such as staying in bed. Anxiety causes us to avoid things that will ultimately help us solve a problem.

- We do the things that reinforce how we are feeling. So when you feel angry, you’re more tempted to complain. When you feel anxious, you might pace back and forth and think about all of the things causing you to feel anxious.

- Act as if you feel confident to help you feel confident. Pursue classes/learning/education to feel more confident about a topic. Confidence comes from facing your fears.

- Act “as if.” When you feel low on energy, act as if you have energy. When you’re struggling with fear, act as if you feel brave. If you want to change your life, act like a mentally strong person. If you want more friends, act like a friendly person. Acting “as if” doesn’t mean you’re acting as a fake person; it just means you’re putting a certain aspect of your personality forward.

- What kind of person do I want to be? What are some steps I could take right now to start acting more like that kind of person? How would it change my life?

- How would I be acting right now if I felt better? Changing your behavior first shifts your emotions.

- Pick your bedtime. What time do you need to be asleep if you wanted to get eight hours of sleep every night? In order to pick a bedtime, you need to know what time you truly need to wake up. Know how long your morning routine takes! Have a plan. What time do you really need to wake up in order to truly start your day on the right foot and do all the things you want/need to do in the morning?

- The time you need to wake up is probably a half hour or hour earlier than you have been waking up. If you aren’t honest with yourself about what time you need to get up to give yourself the runway of time that you need, then before you have laid your head on the pillow tonight, you have already screwed up your morning routine.

- Start by picking the time you need to wake up – the time you need to give yourself the runway, the time that would really allow you to do everything that you would like to do, and plan for eight hours of sleep to establish your bedtime. You need to be asleep for eight hours, so figure out how long it takes you to fall asleep and decide what time you need to get into bed to get eight hours of sleep!

- If you don’t pick the right time to climb into bed, you will never actually be able to build a rock solid evening routine. Understanding what it takes to fall asleep and giving yourself that amount of time and building an evening routine that leads up to it is essential. Having a consistent bedtime and wakeup time will help you get better sleep and help you fall asleep faster. You will train your brain to be a better sleeper.

- Clean up the mess so your morning is fresh. Empty the dishwasher/do the dishes, take out the trash if needed, clean up the counters, turn off the lights, clean up the things from today, and charge your phone/computer.

- Once you’ve cleaned up the mess, take five minutes and set yourself up for the morning. If you’re going to exercise in the morning, lay out your clothes the night before. If you take supplements or vitamins in the morning, set them out the night before. If you’re bringing lunch to work, portion out your lunch. This eliminates decision fatigue and your morning routine will take less time.

- Take five minutes for yourself. Before you give it to the television, social media, etc., give time to yourself. You can sit and be quiet, read a book, have a cup of tea, or do a skincare routine.

- Tuck your phone in somewhere other than your bedside table or in your bed with you. It creates fragmented sleep, which impacts your ability to fall asleep and stay asleep. You are more likely to stay up later in bed on your phone if it is near you.

- Be intentional. Pick your bedtime and be very serious about it. Experiment with it until you settle into a consistent bedtime and give yourself a runway for your morning routine.

I am still struggling with setting a consistent evening routine/bedtime and morning routine. I know what I want to accomplish each morning, but often end up snoozing or sleeping through alarms. This is something I am working on! This podcast was a great reminder.

This podcast covered common financial rules and whether the podcasters agree or disagree with them. Here are some of the insights.

Recommended:

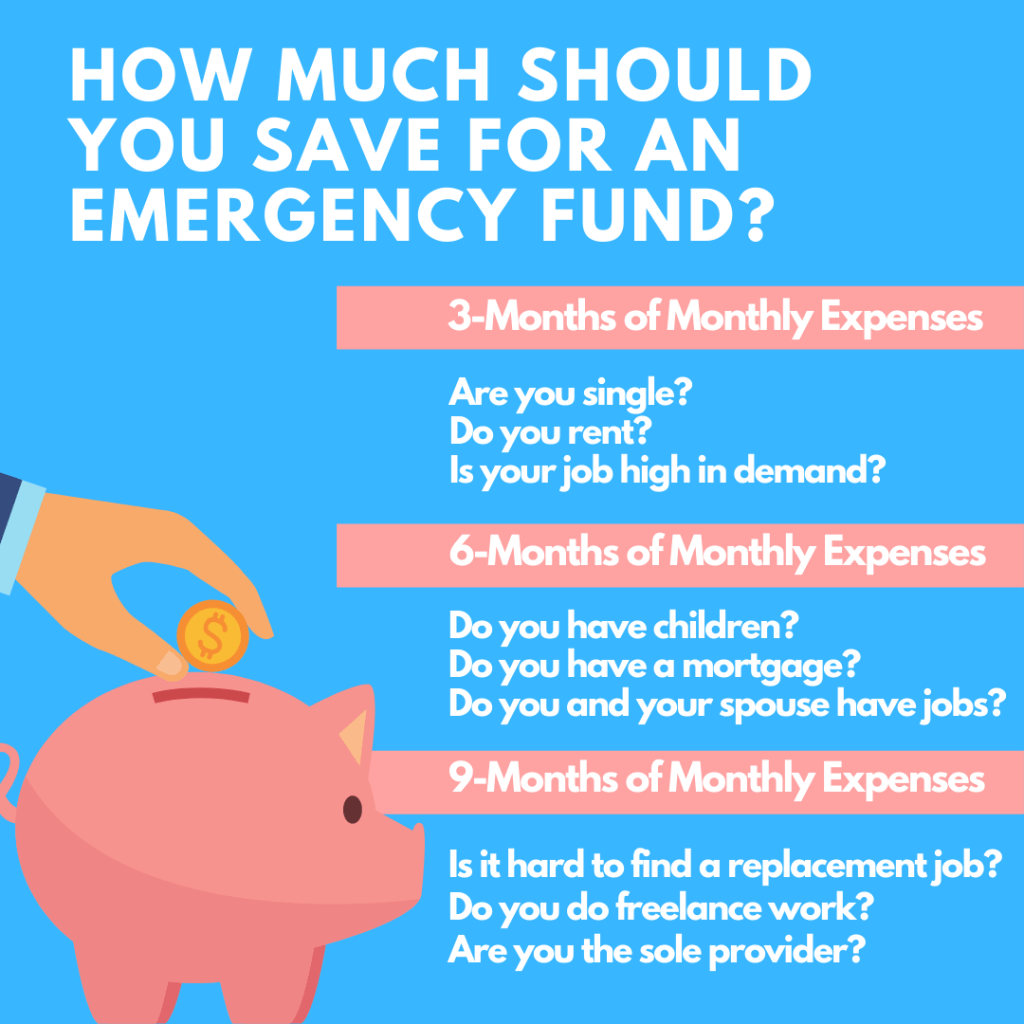

- Hold 3-6 months of expenses in cash in an emergency fund. Some people recommend 6-12 months of expenses in a high-yield savings account.

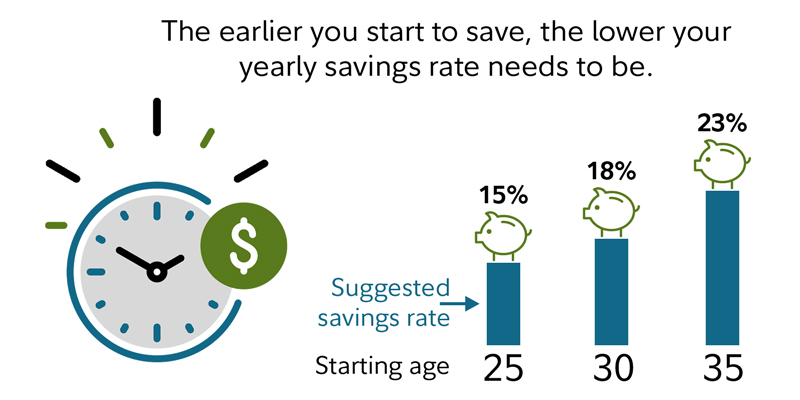

- Save and invest at least 15-20% of your income in a high-yield savings account or in stocks/bonds.

- 24/10 rule for buying a vehicle. Put down at least 20%, limit the car loan to no more than 4 years to avoid excessive interest, and spend no more than 10% of your gross income on transportation costs (car payment, gas, insurance, maintenance). If you have to drag out your car loan longer than four years to be able to afford it, you probably can’t afford it. The loan may be longer than the life of the car to you.

- Only buy a used car to minimize the depreciation. Caveat: Only buy a new car if you can afford to buy it outright (no financing).

Common financial rules the podcasters do not recommend following and why:

- Some people say your asset allocation of your investments should be 100 minus your age to determine the percentage of your portfolio that should be in stocks versus bonds. For a 40-year-old: 100 – 40 = 60% in stocks, 40% in bonds. Reasoning: That seems too high for a percentage of bonds and is not risky enough for long-term gains.

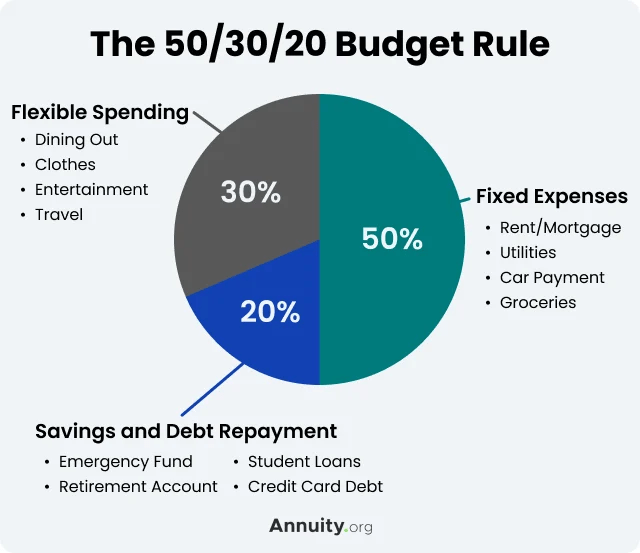

- 50/30/20 rule for budgeting after taxes= 50% necessities, 30% for “wants”, 20% for financial goals (saving for retirement and paying off debt). Reasoning: It depends on your income. Sometimes housing and bills take up more than 50%. Try to save 20% minimum.

- Gross monthly income (before taxes) – debt for housing shouldn’t be more than 28%. Debt-to-income ratio – no more than 36% of your total income should be going toward debts (car payments, credit card debt, student loans, etc.) Reasoning: 36% seems too high for debts.

- Spend 3x your income on a house. Reasoning: It is overly simplistic and doesn’t take many factors into account. It depends on what interest rates are, how much debt you have, what the cost of living is, how much you’re putting down, etc.

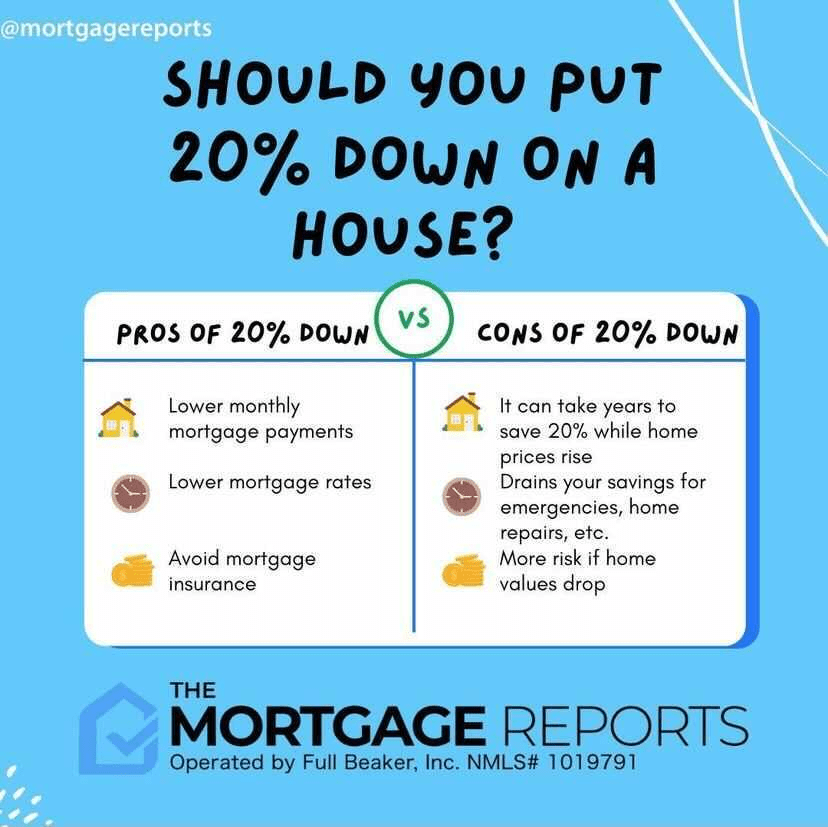

- Always put 20% down. Reasoning: That would limit many people from buying a house. If your interest rate is lower than a high-yield savings rate or lower than your investment returns, no need to put down 20%.

- Cars should cost 10% of your annual income. So, if you make $50k, your car should be worth no more than $5,000. Reasoning: You wouldn’t be able to buy much of a car in that price range.

- You should own a car for at least 10 years. It’s a solid rule. Reasoning: It isn’t advantageous to keep buying cars, but it may not work for everyone. Your needs may change.

I look forward to reading, learning, and sharing more with you soon!