“The Simple Path to Wealth” was a very interesting, educational, easy read written by JL Collins, author of the blog jlcollinsnh.com. This was an excellent book I read as part of a book club I’m in. This book contained so much useful information and emphasized Vanguard as a stellar option for investments due to low fees and the self-cleansing Vanguard Total Stock Market Index Fund (VTSAX).

Main take-aways:

Seek the least house to meet your needs rather than the most house you can technically afford.

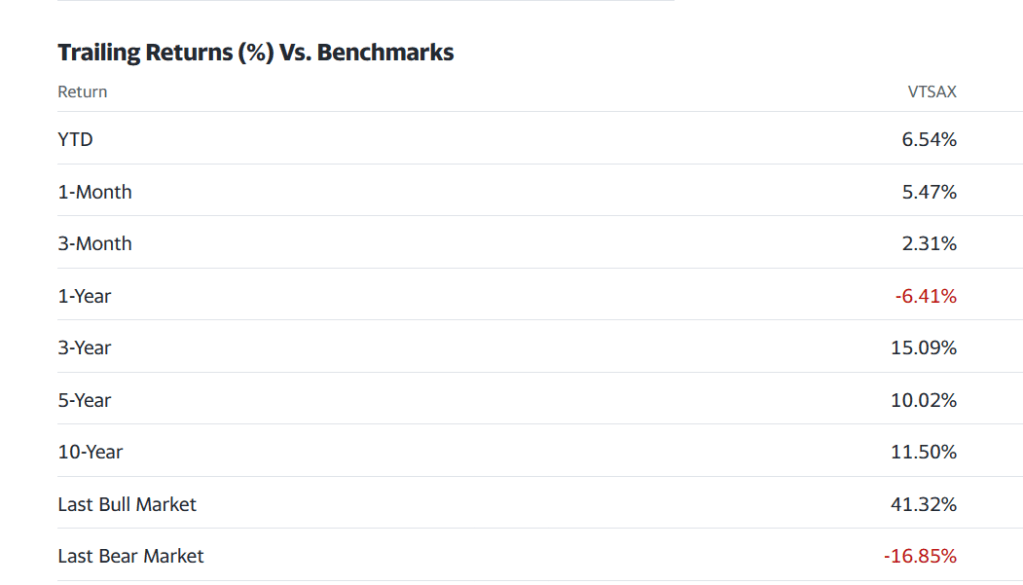

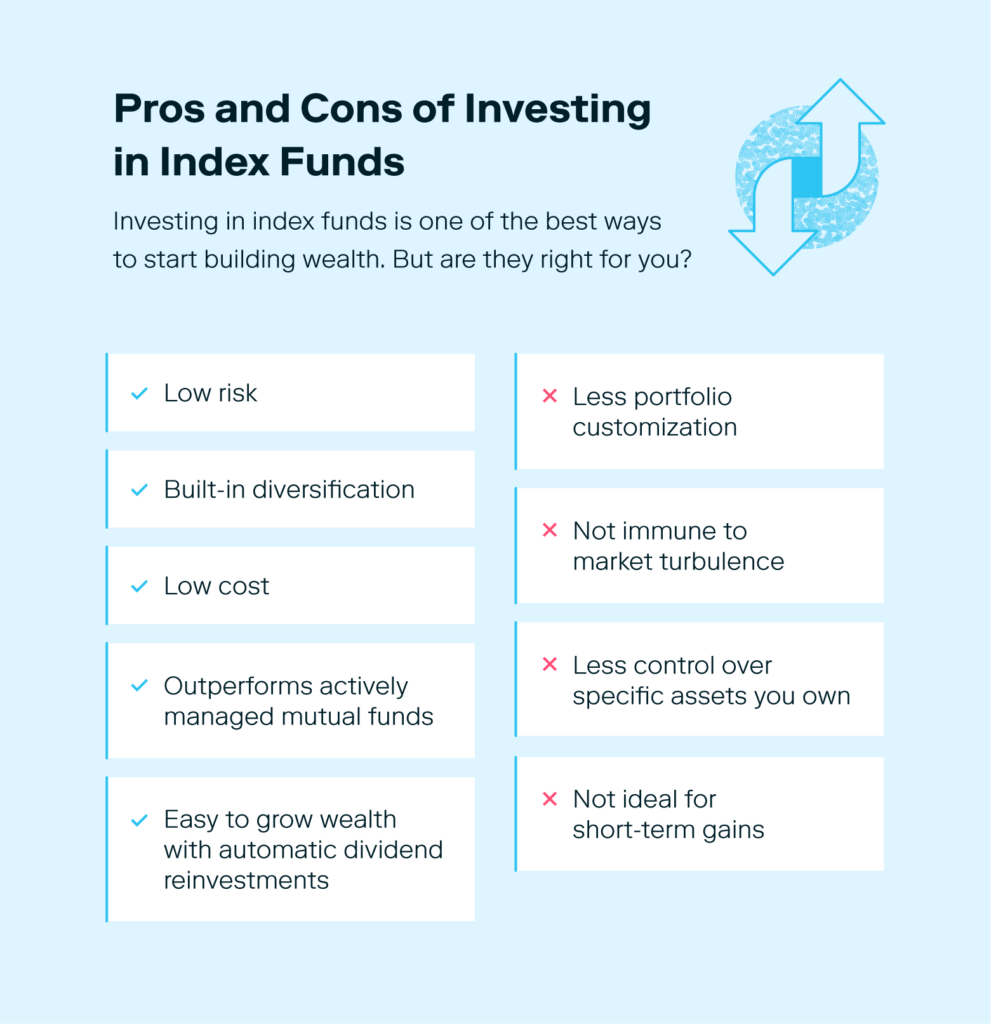

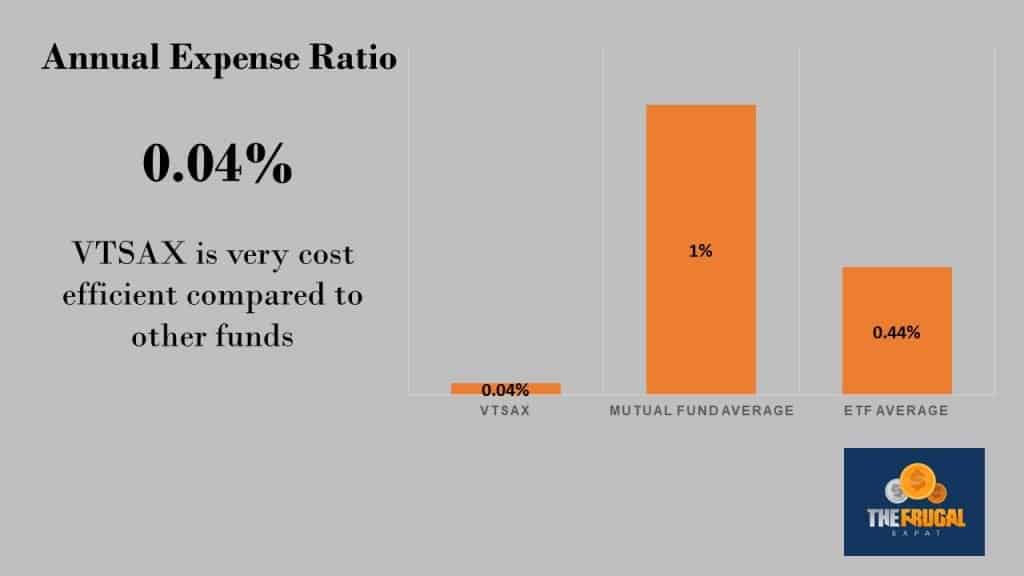

The Vanguard Total Stock Market Index Fund (VTSAX) holds about 3,500 companies and is self-cleansing. The expense ratio is only 0.04% and it is low-maintenance.

International funds are an added risk with added expense and are already covered with VTSAX (U.S. and international businesses). If you still want international funds with Vanguard, you can include VFWAX, VTIAX, or VTWSX.

Target retirement funds (portfolios based on the year you plan to retire) are also an option, although expense ratios are higher (0.14%-0.16%).

3 tools: stocks (VTSAX), bonds (VBTLX), and cash. You can do 100% stocks now (VTSAX) and then later include bonds.

If there is no VTSAX option for your retirement account, look for a low-cost index fund or target retirement fund.

With Vanguard, you own your mutual funds – and through them – Vanguard itself. It operates at cost, resulting in lower expense ratios. There are no shareholders to pay, and no one at Vanguard has access to your money.

Why most people lose $ in the market:

- We think we can time the market.

- We believe we can pick individual stocks.

- We believe we can pick winning mutual fund managers. 82% failed to outperform the unmanaged index in 2013. Only about 1% of active traders outperform the market.

Downsides of having an advisor:

- Cost

- Drawn not to the best investments, but to those that pay the highest commissions and management fees

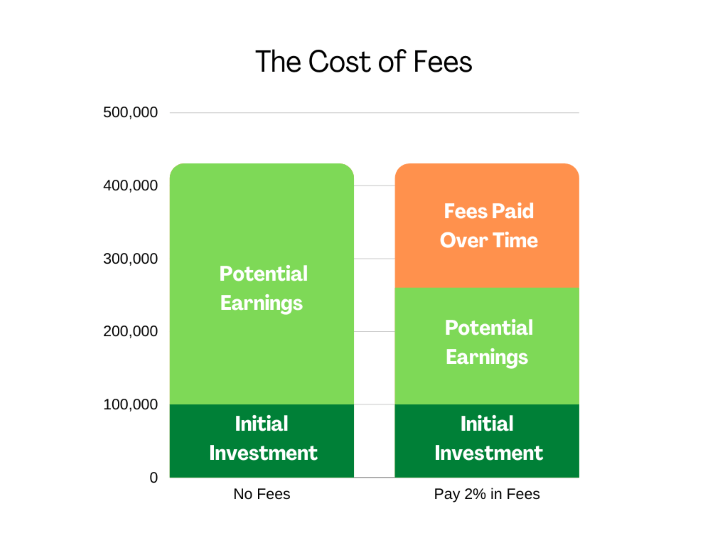

- Assets under management (AUM) fees cost you a lot in terms of compounding.

You are considered financially independent and ready to retire if you have saved 25x your annual expenses. Let’s say you pay a 1% management fee in retirement (most advisors actually charge more than 1%). If you are living on 4% of your retirement funds each year (the recommended amount), your advisor is costing you at least a full 25% of your income!

Using the 4% model, you may want to have a balance of 50% stocks and 50% bonds. 96% of the time, you will be able to live off of 4% each year for 30 years without fees. If you are paying a 1% fee, this drops to an 84% success rate. If you are paying a 2% fee, this drops to a 65% success rate. The solution is to have more cash saved, withdraw 3% of less, and be open to working part-time or relocate to save money. Do not set up an automatic 4% withdrawal plan! Instead, withdraw as needed.

A 401(k) or IRA is generally better than a Roth IRA. If you put $5,000 into a Roth IRA at a 25% tax bracket, you’d need $6,250. If you fund a 401(k) or IRA instead of a Roth IRA, you would still have the $1,250 to invest and would have huge returns over the years. Fully fund a Roth IRA only if your income is low enough that you’re paying little or no income tax.

When you leave a job, roll over your 401(k) or 403b into a personal IRA.

You are required to take minimum distributions at age 70 1/2 for your IRA/401(k)/403b. Shift your IRA to a Roth IRA to decrease the minimum distributions. Also, fully fund your HSA if you have one because it grows tax-free.

When I was reading this book, I had Roth IRA funds with an advisor that was charging over 1.25% in assets under management (AUM) fees + portfolio fees, and I didn’t even get to pick my investments! My money was not performing well with the portfolios he selected. I also had old 401(k)s with former employers.

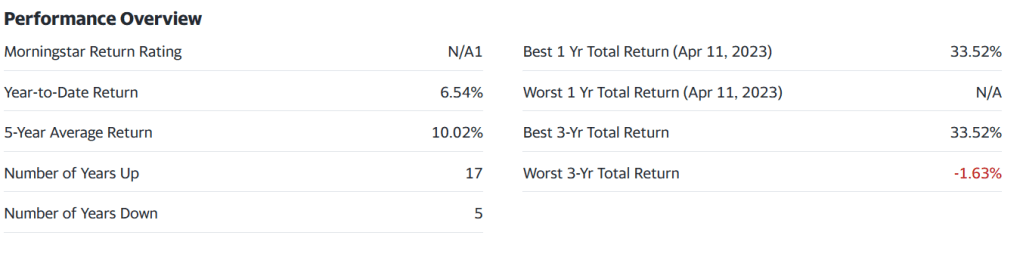

Months after reading this book and researching on my own, I decided to combine my old 401(k)s into an IRA at Vanguard and I also transferred my Roth IRA to Vanguard. Through the conversion process, I learned the investments the advisor previously selected were awful, had high expenses, and probably resulted in high commissions, I had to pay various conversion fees to get out of those portfolios, and I transferred everything I previously had over to VTSAX with Vanguard. I also have a retirement savings plan with my current employer that is NOT at Vanguard.

My funds have been performing really well and I am on my way to achieving a big financial goal in the next year or two: have the equivalent of my annual salary saved for retirement (a goal many experts say you should achieve by age 30). I am behind according to experts, but I am grateful for the progress I have made and especially grateful for the low-maintenance portfolio with minimal expenses that Vanguard offers.

I look forward to reading, learning, and sharing more with you soon!