My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

- You probably don’t need more time in order to do the things you want to do. Instead of looking for more time, change up how you’re spending your time now. You may be surprised at what can fit.

- Getting an extra day in the year (leap day) does not, by itself, change much for most people. Time is about choices. If you’d like to spend time differently, figure that out and make it happen. Make the most of your time.

I recently read the book “How to Break Up With Your Phone” by Catherine Price, an award-winning writer and science journalist and learned that, on average, Americans spend more than four hours a day on their phones! If you were to limit phone use to one hour a day, what could you accomplish with the extra three hours? Our actions often show what our values are. We often don’t need more time; we need to examine our priorities.

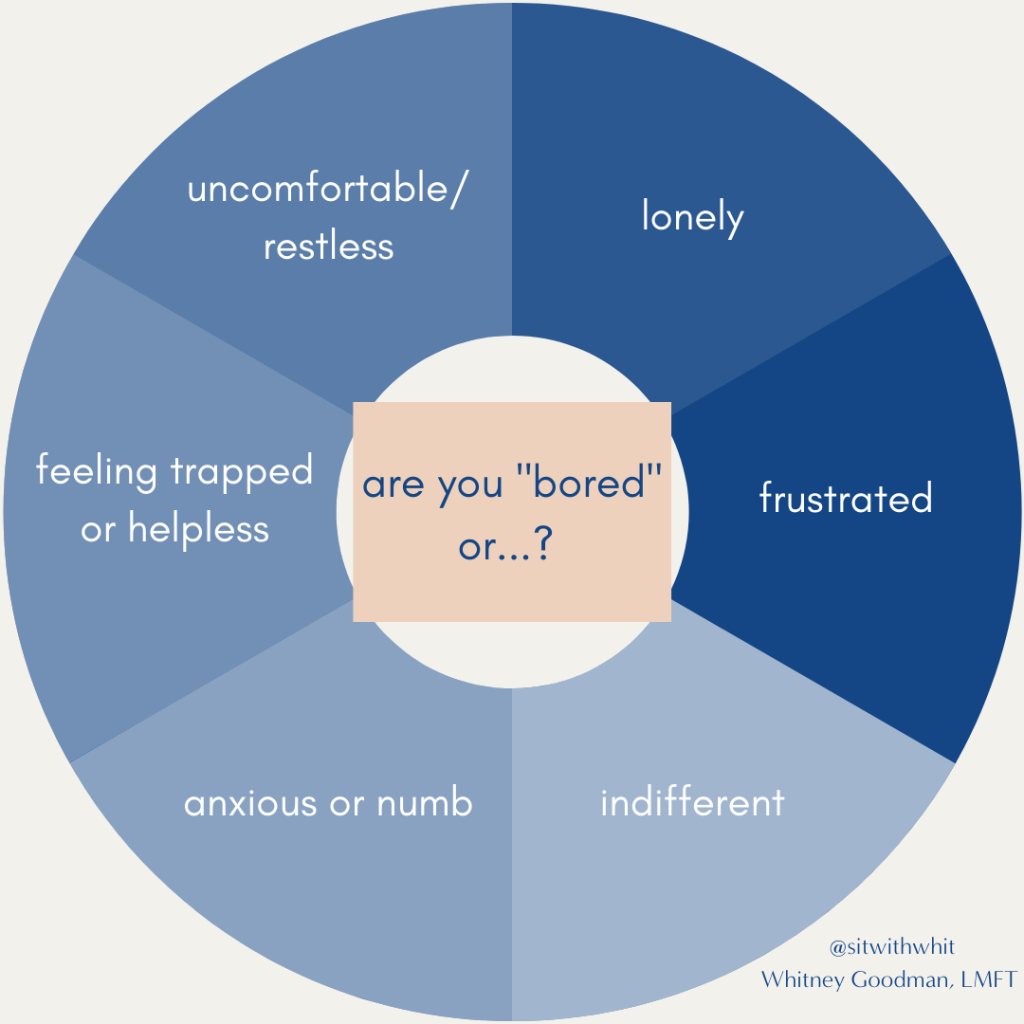

- Our boredom and how we snap out of it can tell us a lot about ourselves.

- Boredom is a problem in schools. When students are bored in school, they can’t focus, they lose interest, and they misbehave. Students who are chronically bored may drop out. When we’re bored, we drink too much, eat too much, spend too much money, half-listen to people, idle our time with social media and scrolling, etc.

- Boredom tends to objectify things. Ex: that’s a boring person, that’s a boring book, etc. What bores one person can be very interesting to another person, so boredom is a curious and perplexing mood state and is not objective.

Boredom itself allows creativity to flow. However, modern society with all its gadgets has gotten really good at distracting us from this boredom.

In the right environment, boredom fuels creative people. Instead of staring at your phone, stare at the blank page. Instead of sitting in front of the TV, sit in front of the canvas.

- Avoidance – many of us who are in a boring situation question how to get out of the situation. We don’t sit with our feelings; we often check our phones to avoid boredom.

- Resignation – endure boredom.

- Boredom is often viewed as a lack of imagination and a loss of agency: “I’m so bored. There’s nothing to do.”

- As a teacher, the podcaster usually gathered with other teachers to complain about administrators, students, parents, etc. and got bored with it. It was the same complaint culture every day. Eventually, he found other teachers who, instead of complaining, talked about books they were enjoying, hobbies they loved, or what went well in their teaching. These conversations were restorative.

- Takeaways:

- Boredom should not be trusted. We tend to trust boredom and make an implicit judgment about something or someone and it is often wrong. It is arrogant.

- We need to protect our attention. A bored mind is looking to be distracted. If we are in an environment where we are easily distracted, boredom will get the better of us.

- We need to talk about boredom. We all have strategies we employ and we need to talk about them. We can share them and give our attention to the things we love and the people we care about.

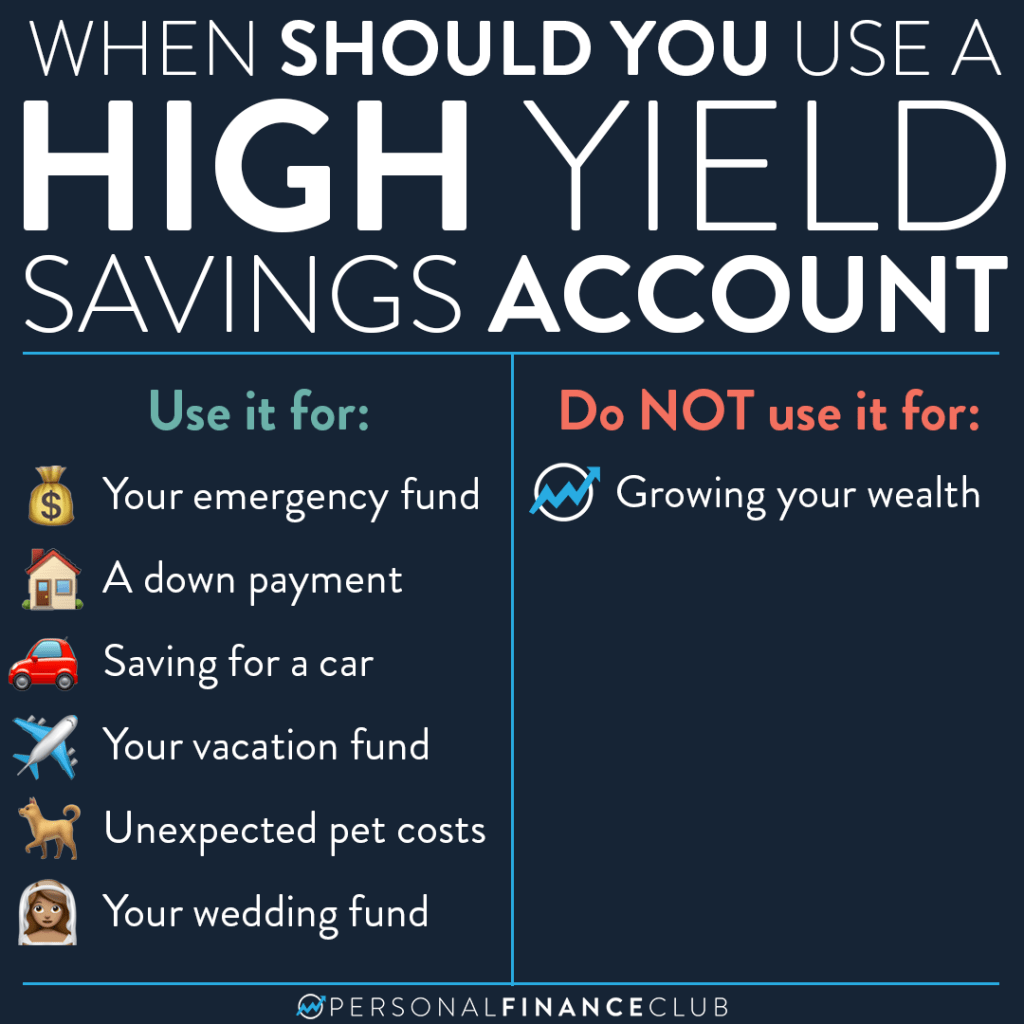

- Don’t keep an emergency fund at a bank that doesn’t really give you any interest (most big banks don’t).

- Look for a bank that will give you over 4% per year in interest. Many online banks and credit card companies offer high-yield savings accounts with great rates.

- Keep 3-6 months of expenses in an emergency fund and a separate $1,000 of “fast cash” in an account that you can get immediately. Ex: for a car repair

- Interest rates fluctuate, so you don’t need to keep searching for where you will get the highest yield once you already have found one.

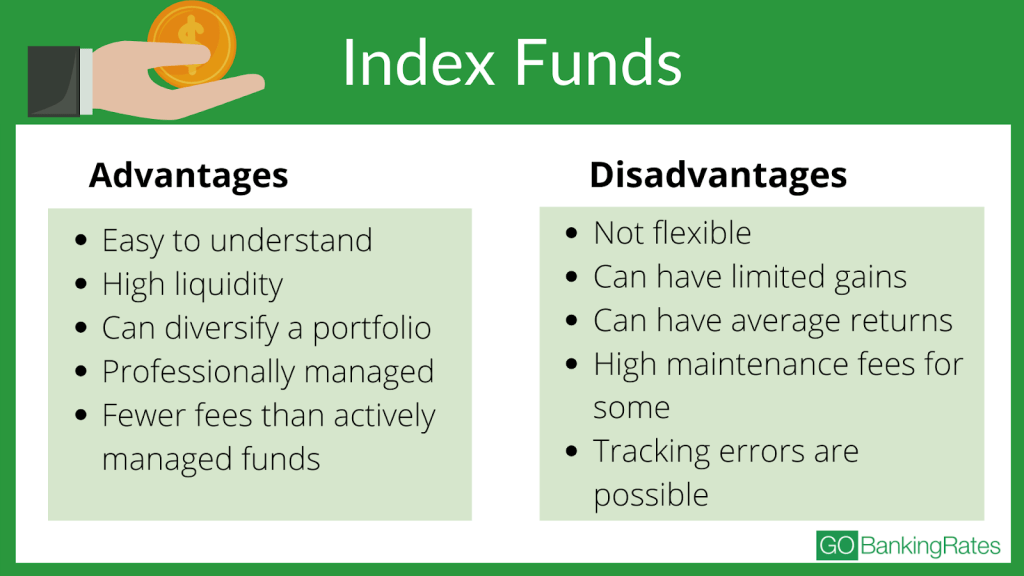

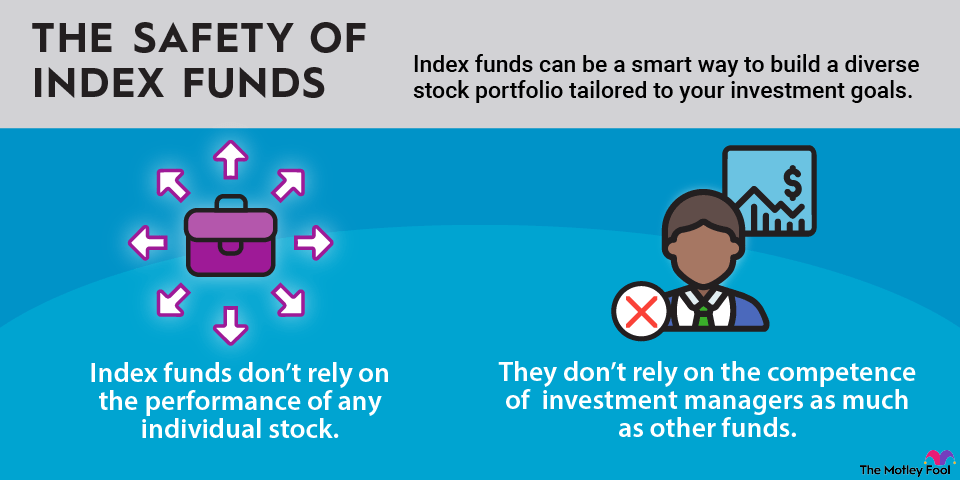

- You need to be invested in the stock market! Stocks have a much better return than bonds and other investments. It isn’t a good idea to buy individual stocks; it’s almost impossible, even for professionals, to pick individual stocks that outperform the overall market. 80-90% of mutual fund managers fail at this!

- Don’t buy individual stocks. Buy the entire stock market using index funds.

- Don’t buy a bunch of stocks when performance goes up and sell stocks as soon as performance is down. Losing money feels painful but selling your stock at the bottom locks in those losses. If you don’t sell, you can ride the rollercoaster back up when the market recovers.

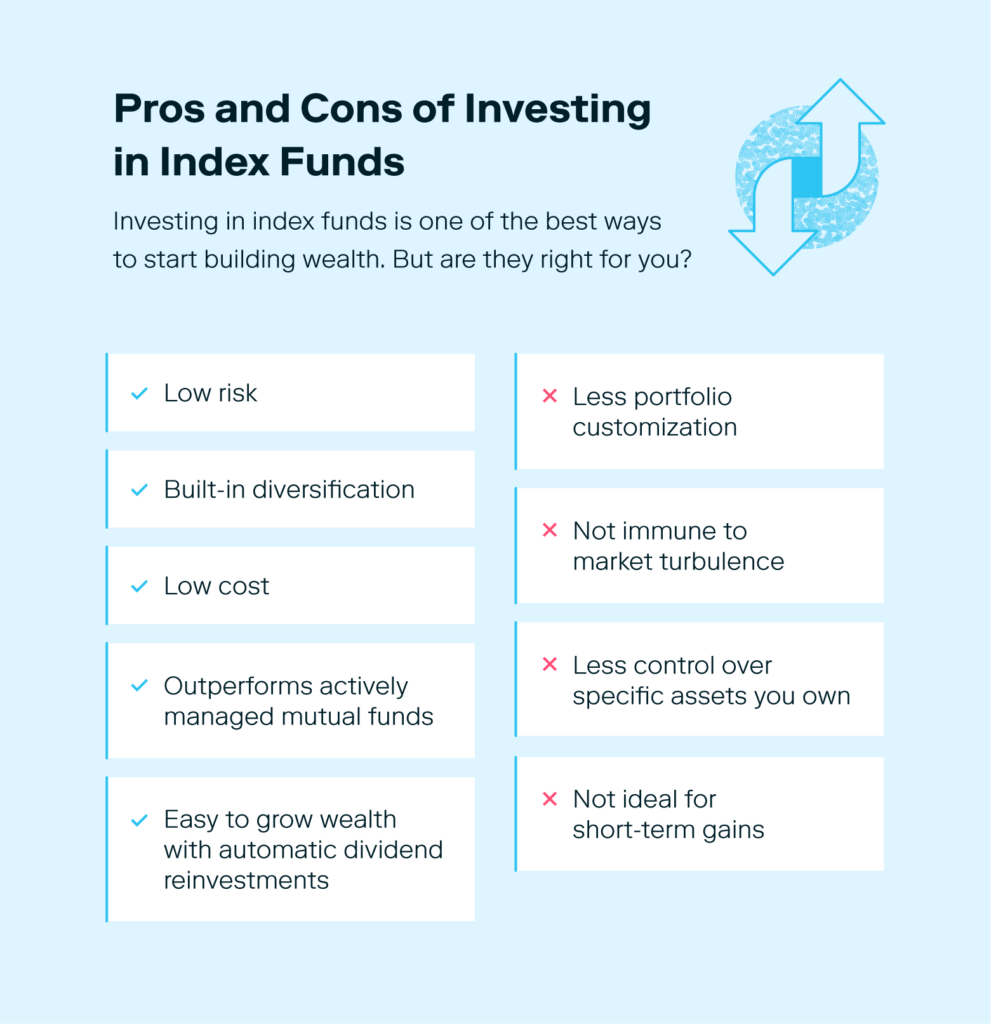

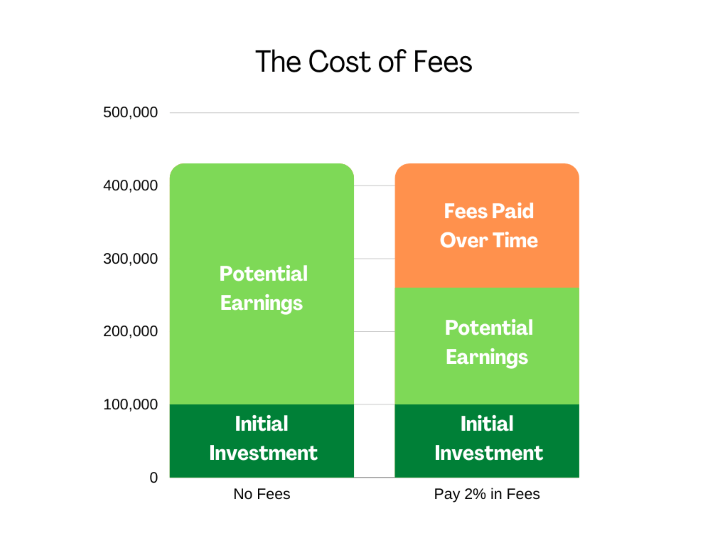

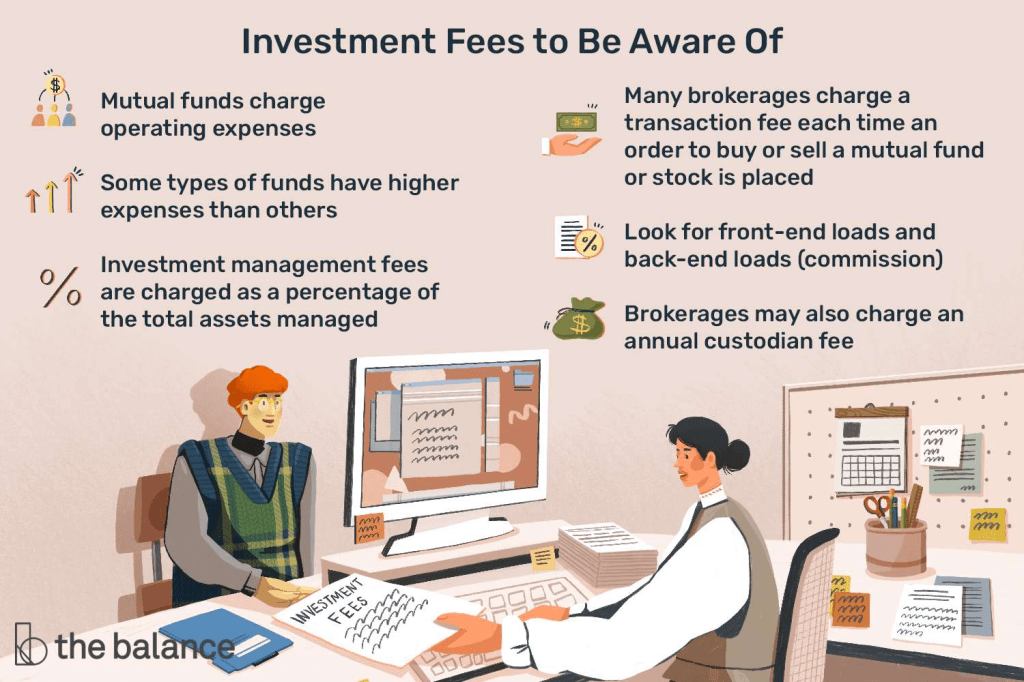

- Make sure you aren’t paying much in fees! Fees are not charged as a separate line item. For example, 2% seems like a small number to pay in fees, but 2% off of a 5-10% return is a huge chunk. A 2% fee could eat up to 40% of your investment returns, which has a huge impact on how quickly your money accumulates. Many people don’t even know what fees they are paying.

- Taken together, you shouldn’t be paying more than 0.15% in annual fees in your mix of index funds and other investments.

- Passively managed index funds are the way to go. Ex: S&P 500. Index funds are far better off than actively managed alternatives. Look for lw-cost broad based index funds.

- Vanguard is different than all of the other investment firms because it is structured as a nonprofit. Vanguard offers a range of index funds with very low fees. You don’t need to have an actively managed portfolio.

- Rebalance your investments at least once a year. Sell what has gone up in value and buy what has gone down in value. Make sure your portfolio is where you want it to be.

- Obsessing doesn’t help and is likely to lead to interventions that would be counterproductive. It’s really easy to let our emotions take over and make mistakes.

- Don’t pay someone else to pick stocks for you.

- You communicate openly. A great relationship starts with transparency.

- You argue. Arguing is sometimes healthy in a relationship; otherwise, you are likely bottling up your feelings and letting them turn into resentment.

- You keep relationship details private. You don’t post your relationship problems on social media.

- You don’t hold grudges. Be sure to talk it out and learn to let go.

- You have realistic expectations. The perfect partner doesn’t exist. Healthy couples understand that the key to a long-lasting relationship is commitment, open communication, and compromise.

- You take time and space for yourself. You can have separate lives, interests, and friends and maintain your own sense of individuality outside of the relationship.

- You trust each other. You respect your partner’s decisions and feel secure.

- You enjoy spending time together. A healthy relationship means taking time out of your busy schedule to connect with your partner.

- You’re friends. Great couples share common interests, enjoy hanging out together, and making each other laugh.

- You make decisions together. Healthy relationships allow partners to have equal say. Compromise is key.

- You get intimate. Intimacy can mean different things. Show affection through love languages: gift giving, words of affirmation, quality time, physical touch, acts of service, etc.

- You make each other better. Fixing is not the same as supporting. You love each other for who you are.

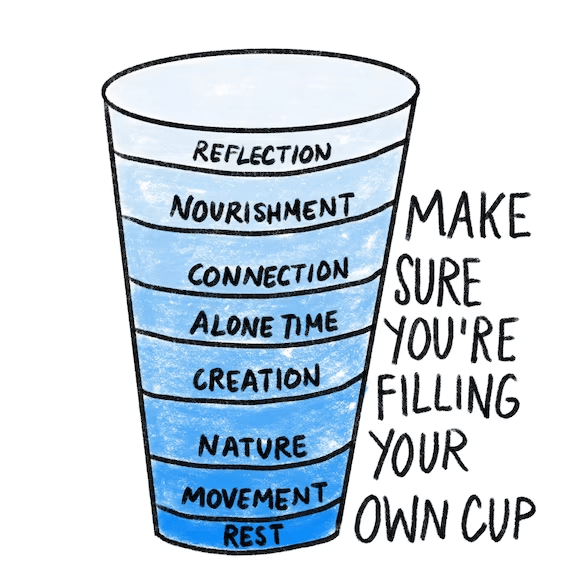

I really enjoyed this post from Gabe the Bass Player this week:

https://www.gabethebassplayer.com/blog/out-of-gas

Out Of Gas

March 5, 2024

When the car runs out of gas we don’t call the car broken. It just needs gas.

Same thing with us…when we’re out of gas we might feel broken but really we just need to be filled up.

The metaphor is easy to understand.

The hard part is knowing what fills you up and having the guts to make time for it.

I look forward to reading, learning, and sharing more with you soon!