My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

- When someone is happily telling you about something in their life, ask them to show you photos. They will be thrilled to do so, and you will learn more about them.

- Ex: wedding, puppy, gardening, home renovations, vacation, etc.

- It shows you are truly interested in them. You aren’t looking for an excuse to get away. The small talk may become more interesting, as pictures tend to nudge storytelling. It will make the person feel more valued and give you more insight into their life.

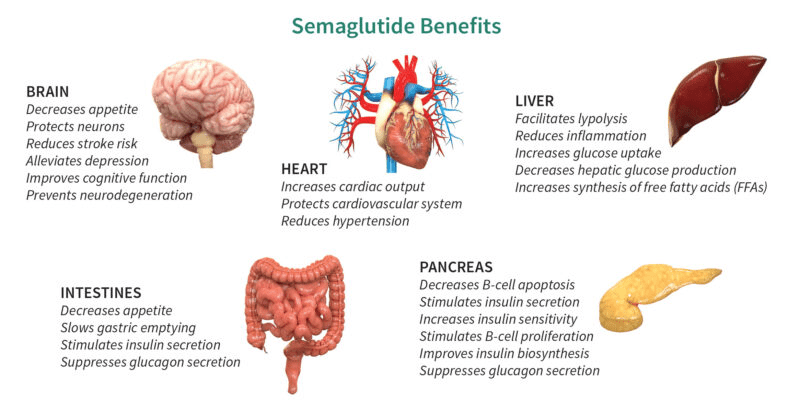

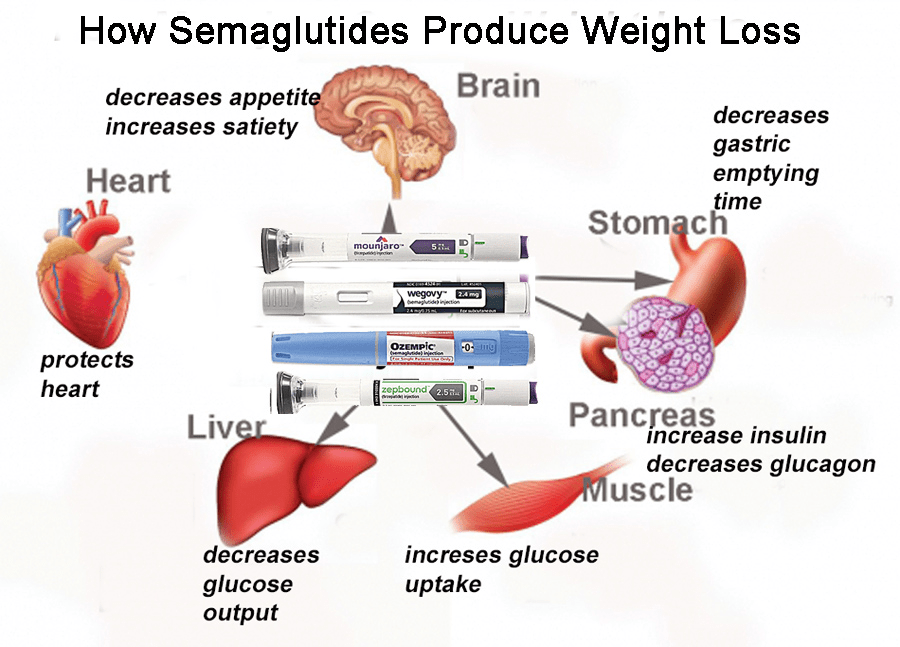

- U.S. healthcare providers wrote more than 9 million prescriptions for Wegovy and other drugs used for weight loss, and that was in the last three months of 2022 alone! Demand has gone up since then and is expected to increase even further.

- Some medications have resulted in 22% weight loss (22% of body weight); prior drugs resulted in a weight loss of 5-10% at the most!

- Ozempic, Wegovy, Mounjaro, Zepbound – Zepbound came onto the market after Thanksgiving and is going faster than any of the previous drugs we’ve seen in this class.

- Price is $900-$1,300/month for these drugs – many people are having problems getting insurance coverage for these weight loss drugs.

- Medicare and Medicaid have a ban on coverage of weight loss drugs. There has been federal legislation introduced that is trying to change that.

- Some people are turning to compounded versions of these drugs.

- Late last year, the U.S. FDA had seized thousands of units of counterfeit Ozempic. The FDA is sending letters to online sellers warning them to stop selling these knockoffs.

- These weight loss drugs are an expensive drug that people take for the rest of their lives – great for the pharmaceutical market

- If you stop taking the drugs, you will probably regain the weight lost.

- Some companies worry that those on these weight loss drugs will purchase less food since they aren’t eating as much, and companies will be impacted.

- Companies are coming out with pills instead of weekly injections. Companies are also looking into the fact that you can have muscle wasting when you lose weight so fast, so some companies are working on trying to support your muscles as you lose all of the weight through combination drugs.

- Stigma – people think others taking the drug are “cheating” and “should be doing the hard work” – they are taking medicines that doctors have prescribed to them because they think they could benefit from it. Some doctors have said that patients not taking the drugs are “choosing to stay the weight they are” because they aren’t taking the drugs.

- These podcasts were based on the book “Your Face Belongs to Us” by Kashmir Hill. I haven’t read the book, but I found these podcasts intriguing. In a nutshell, the author’s take is that our face belongs to lots of people who want to get good at tracking and identifying us.

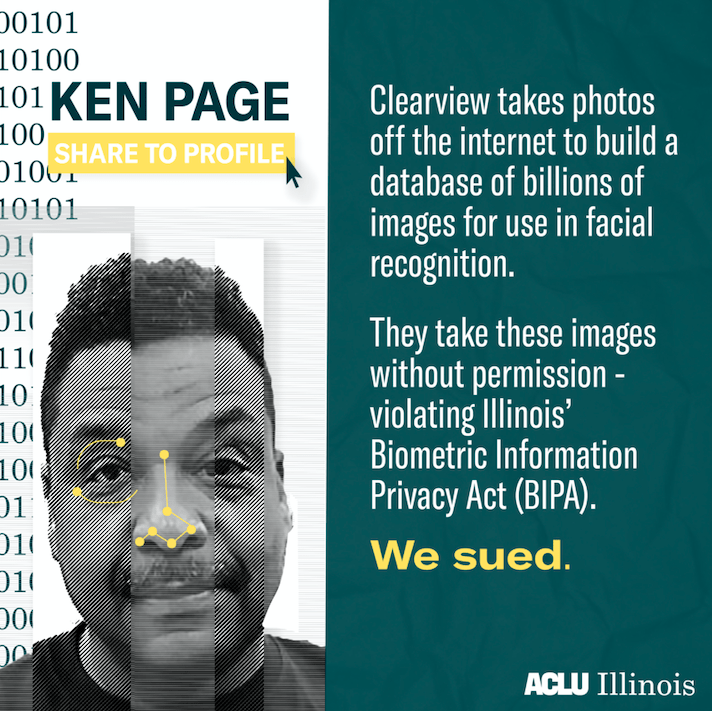

- Clearview AI went out and scraped billions of photos from the public web from social media sites and did it without anyone’s consent, and their database has 30 billion photos. You can upload a photo of someone you don’t know to Clearview’s app and it will pull up all of the photos of them that appear on the internet and will show you their name, social media profiles, etc.

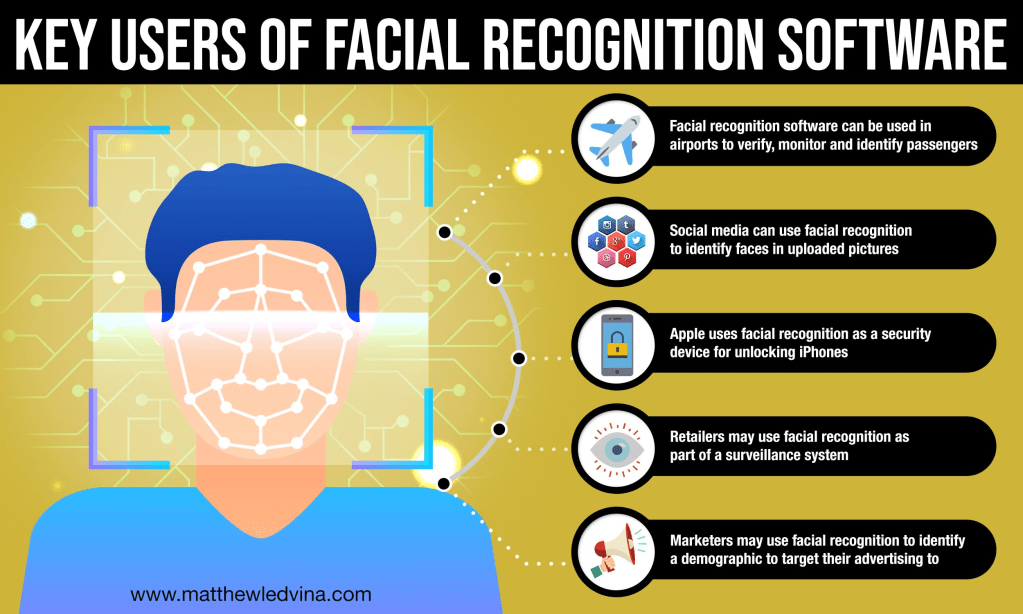

- Clearview limits use of its app to police and law enforcement agencies. Clearview made money off of their database by selling it to police departments and thousands of agencies around the world. Originally, they wanted to sell it to companies, grocery stores, hotels, and airports.

- Clearview can show you headshots you know about, but can also show you Flickr photos, photos where you’re in the background of someone else’s photo, etc.

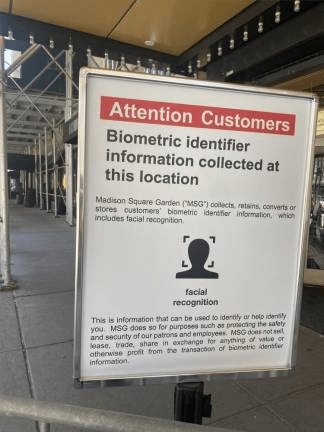

- Casinos use facial recognition to keep out card counters.

- Airports and airlines use facial recognition.

- Facecheck.id – upload your face and see where else it appears on the internet.

- Madison Square Garden installed facial recognition technology in 2018 for security threats. The owner, James Dolan, realized he could use the system to keep out his enemies, namely lawyers who work at law firms who have suits against him, who he doesn’t like because they cost him a lot of money. In the last year, they scraped lawyers’ photos from their firm’s websites and created a ban list of thousands of lawyers. When they try to get into a game or concert, they get turned away. An entire firm gets banned, not just the lawyer working on the case. They are banned until their firms drop the lawsuits against Madison Square Garden.

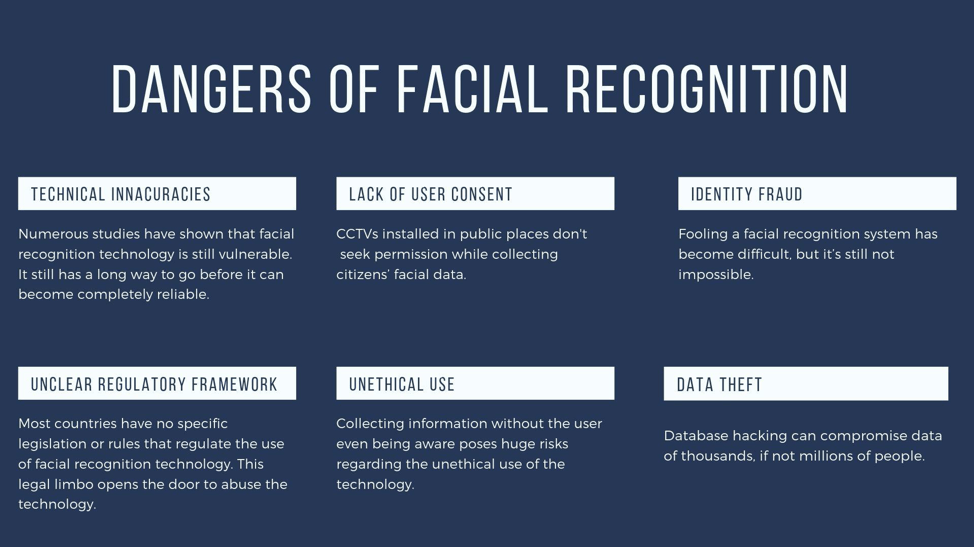

- Some people say it’s illegal because they didn’t obtain consent from the people included in the database. They claim they are just “Google for faces” – they are taking public photos that are on the internet and organizing them by face and making them easier to find. They take public and private information and make it easier to sort through.

- We love to post faces and tag people online on social media. We are essentially handing over a bunch of information that helps companies make their facial recognition technology better.

- More people are posting privately on social media now. People who have posted publicly have had photos come back to haunt them, have given people access to photos and information they didn’t want them to have access to, and have been included in databases they didn’t consent to.

Regulations:

European Privacy Law – you can go to Clearview AI and give them your face and ID and request that they remove you from their database. The drawback is that keeping you out of the database requires them to keep your face to create a “block list” so that your photos don’t surface.

- Illinois has a law where you can’t use people’s voiceprint, faceprint, or fingerprints without their consent. Many states don’t have laws like this.

- There are so many questions raised with facial recognition and voiceprints and a lack of regulations. We are relying on the benevolence of technology companies and hoping that they make good decisions.

- We can pass laws and regulations about the use of facial recognition.

How far is too far?

- Facial recognition ends anonymity as we know it. Police using it within reason can be a good thing. Companies using it to keep out shoplifters can be a good thing. Maybe we don’t want companies using it to discriminate people based on where they work or because they are a government official or investigative journalist.

- How far will this go? Could stores use facial recognition to discriminate against those who have left a bad review previously, who support a different political party? etc.

- Russia uses facial recognition technology to identify protestors there against the war in Ukraine and gives them tickets for unlawful assembly for gathering to protest the war. China has used facial recognition technology to target people who look like Muslims entering businesses. A public restroom in Beijing kept people from stealing toilet paper by requiring them to look at a facial recognition camera, gave them a certain amount of toilet paper, and they couldn’t get more for several minutes!

https://passionplanner.com/blogs/content/self-love-affirmations

With Valentine’s Day this week, I enjoyed reading these self-love affirmations, even though I have a loving husband. Here are some of my favorites.

Self-Love:

- I am proud of who I am.

- The beauty of the world is reflected in me.

- I am enough.

- I will speak my own Love Language to myself.

Confidence:

- What I have to say is worthy of being heard.

- I am capable of great things.

- I am exactly who I am supposed to be at this moment in time.

Anxiety:

- I will survive this moment, as I have survived them all before.

- I trust the process.

Success:

- I trust the timing of my journey.

- I define my own version of success.

- I am qualified and exceptional.

Health:

- I trust my body to know what it needs.

- I know my body best.

- I deserve rest.

Healing:

- I grow through all that I go through.

- I am the writer of my own story.

- I am grateful for who I am becoming.

I look forward to reading, learning, and sharing more with you soon!