My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

This episode covered four typical relationship struggles and how to overcome them.:

- Technoference – when your partner is not fully paying attention due to being distracted by tv/phone/computer.

- How to fix it: Set a rule that when you want your partner’s undivided attention, you communicate that. Ask when they are available for undivided attention. That way you won’t be upset or frustrated if your partner isn’t fully present with you and your conversation. Show you are listening to your partner by mirroring and repeating the last few words that your partner says.

- One suggestion: Put your phone away during meals and communicate that expectation.

- Bringing work stress home. This is especially hard when working from home due to having no transitional time to decompress and disconnect through a transitional commute.

- How to fix it: Take a moment to breathe and decompress after work. Figure out your individual and collective recharging exercises.

My recharging exercises: working out, music, reading, podcasts, hanging out with friends

His: tv, Tiktok, podcasts

Ours: talking to each other, tv

- Finances– even if you have separate accounts, it is important to talk about your desires, dreams, and concerns and be on the same page.

- How to fix finance issues: invest in your relationship! Make sure you are doing things that are benefiting you as a couple.

- How much $ is spent on a wedding vs. a marriage?

- Chores– resenting partner when you feel like you are picking up the slack

- How to fix it: Set expectations about who’s doing what and when. It’s unfair to always expect your partner to pick up your slack. Review and reset expectations as needed.

Travel credit cards often come with several benefits, and cards that charge a higher annual fee offer better benefits. Benefits often include no foreign transaction fees, airline benefits such as free checked bags/lounge access/TSA pre-check, rental car insurance, travel insurance, and hotel vouchers or benefits.

- Things to Consider:

- Travel credit cards typically don’t have a set % back. You get points instead.

- It takes TIME to calculate whether travel credit card annual fees are worth it for you, especially if you don’t travel often and won’t use all of the perks!

Cash-back cards often offer no annual fee and a set cash back amount to use as you please. You don’t have to calculate if it’s worth it for you, especially if there is no annual fee.

**It’s not truly this OR that. You can have both a travel credit card and a cash-back card or multiple cards of each if that’s best for you!

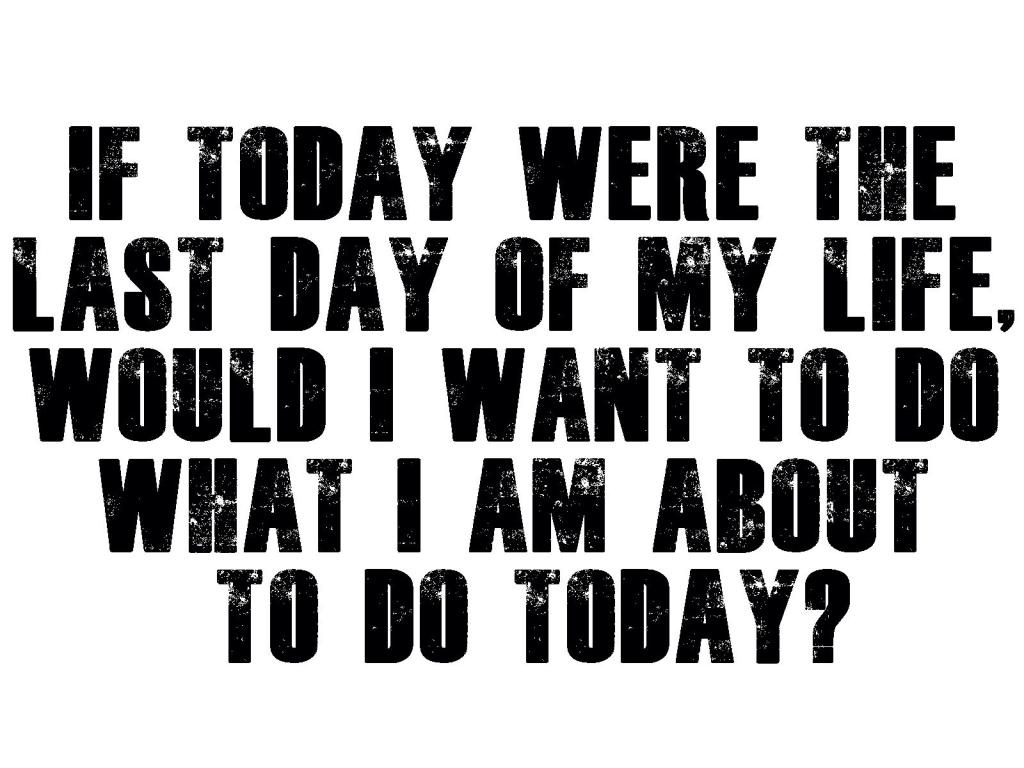

I’ve never really thought about life as presented in the episode. “Waking up is the first thing to be grateful for” was emphasized in two ways:

- There are people who are going to sleep tonight who won’t be waking up tomorrow.

- There are people waking up this morning for the last time and they have no idea.

Imagine if you knew today was going to be the last day of your life. Would you treat your day much differently?

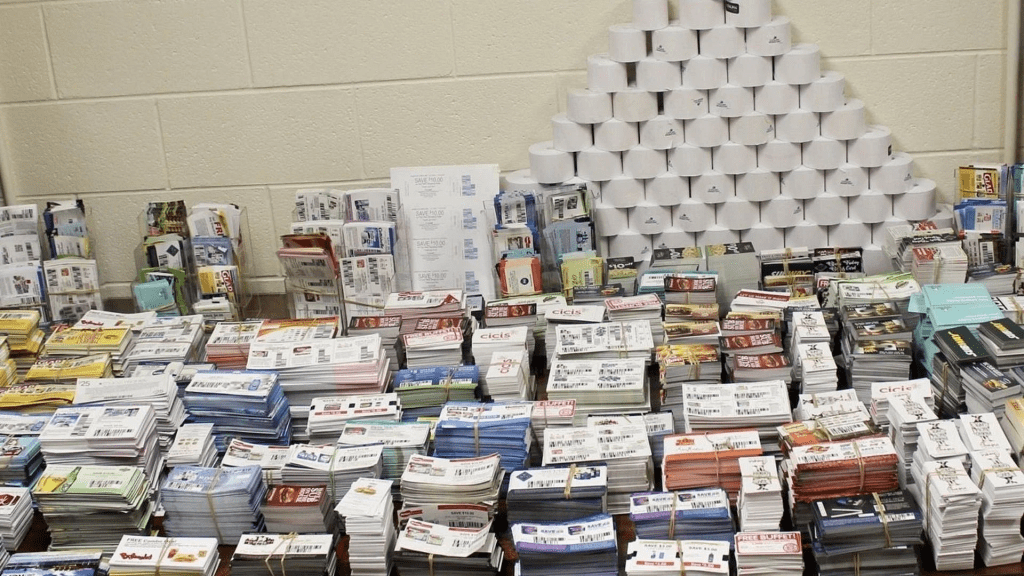

One of the most fascinating things I learned this week is that counterfeit coupons are a nationwide problem and there is a Coupon Information Corporation that investigates counterfeit coupons! I recently watched an episode of “The Con” that highlighted “Coupon Con” Lori Ann Talens. This was the largest coupon scam in U.S. History.

Lori took to couponing while on bed rest, and, using her graphic design skills, she created realistic counterfeit coupons to score free meals, household supplies, and money. She used social media sites and apps to sell counterfeit coupons from April 2017-May 2020 and made about $400,000, and an investigation revealed her computer contained over 13,000 barcodes she created for products she designed coupons for! Counterfeit coupons were also found all over her house and valued at over $1 million. The businesses victimized suffered over $31 million in losses, and Lori and her husband were sentenced to prison.

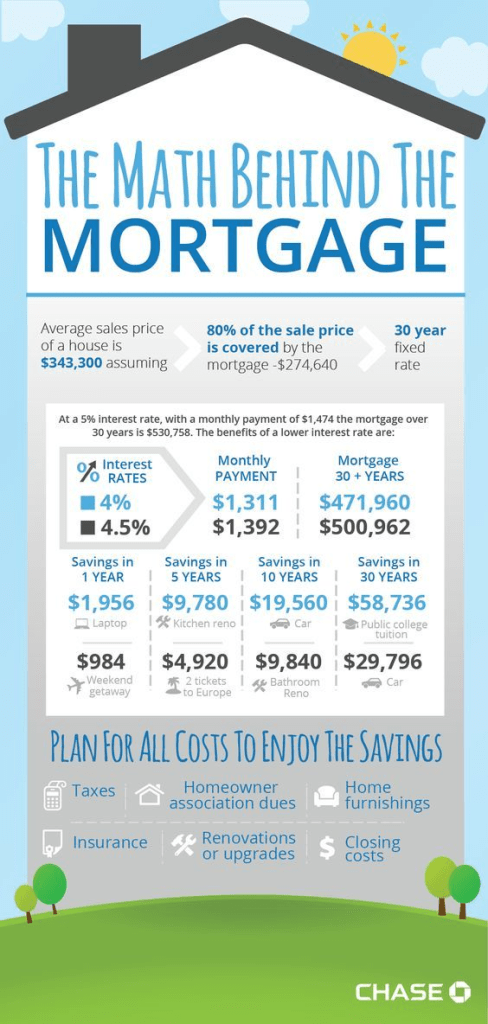

This week I read that houses are generally a terrible investment for all but real estate brokers, the government, insurance companies, and banks. In the first nine years of a standard thirty-year mortgage, around 50 percent of your total payment goes toward interest, while the rest goes toward paying down the principal. In order to figure out whether it makes sense to buy or rent, we need to consider the interest, add the extra costs of owning a house (property tax, maintenance, homeowner’s insurance, utilities you wouldn’t be responsible for in an apartment, etc.). This is where the Rule of 150 comes from. Multiply your monthly mortgage payment by 150 percent and that is how much your house will actually cost per month, once all expenses are factored in.

In 2022, which was our first year of owning our house, we paid over $11,000 in mortgage interest and over $3,500 in property taxes. We also paid PMI, homeowner’s insurance, and some utilities I was not used to paying for while I lived in an apartment. Not considering homeowner’s insurance, PMI, and utilities, we paid over $14,500 in just mortgage interest and property taxes that we have nothing to show for!!

Homeownership is not cheap and it is not for everyone. I love living together and having designated spaces to work, sleep, cook, relax, and work out, and I love the location. However, this past year, all things considered, it was not a good financial investment last year.

I look forward to reading, learning, and sharing more with you soon!