My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

- Many times our days are filled, but aren’t especially fulfilling. We run from one thing to the next without a lot of meaning. The pressure of things to be done can keep us from being fully present and engaged. We always have the power to make sure our days feel fulfilling and not just filled.

- Plan for “you time.” Actively consider what would be fulfilling. What will have an impact on you and others? What will you remember? What will matter a month or a year from now?

- Consider your priorities for your career, relationships, and self. Consider what is most important for you to do each week. Be intentional about determining what really matters.

- Be present for the experiences you schedule. Take a couple of deep breaths and remind yourself why you are there. This isn’t just one more thing on the calendar; there’s a reason for it.

- Create a life worth living.

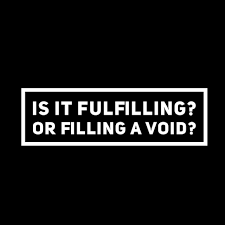

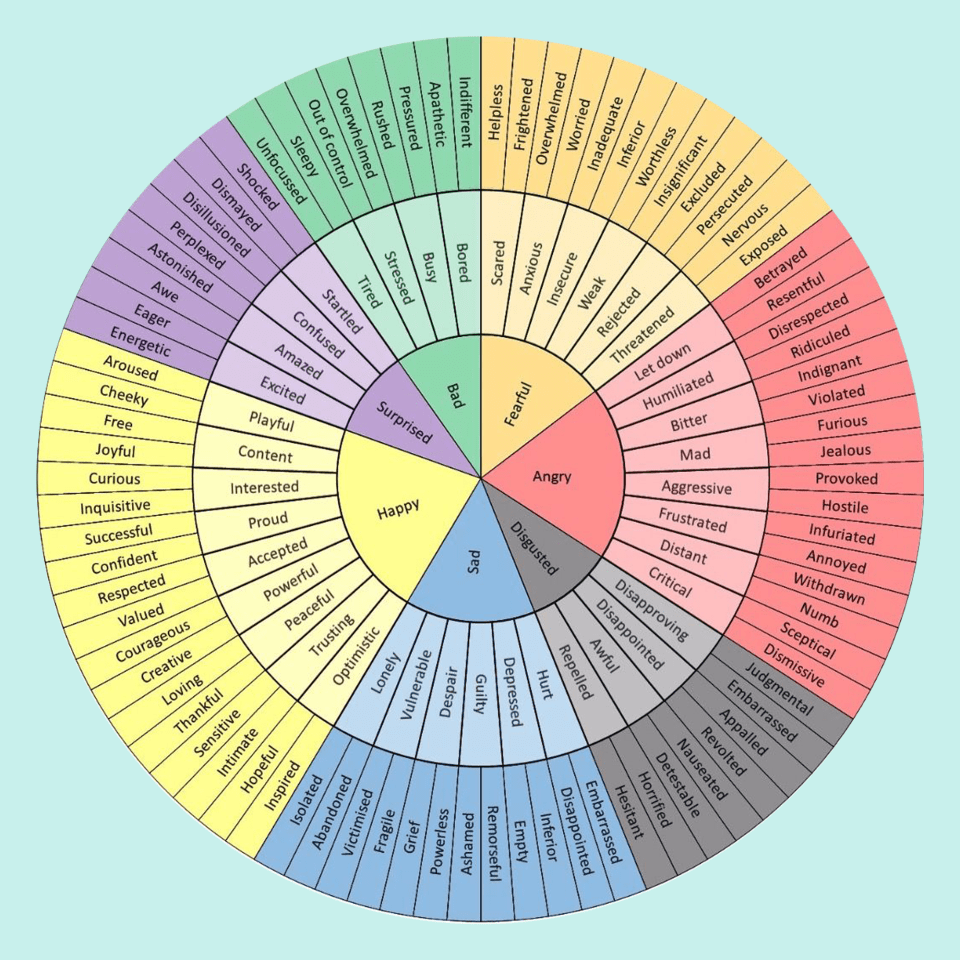

- Put a name to whatever it is that you are feeling right now. Name it to tame it. Labeling an emotion helps your body and brain make more sense of what is going on.

- Ask if that feeling is a friend or an enemy. If it’s a friend, embrace it and let yourself feel that feeling. If it’s an enemy, change the way you think and/or change your behavior.

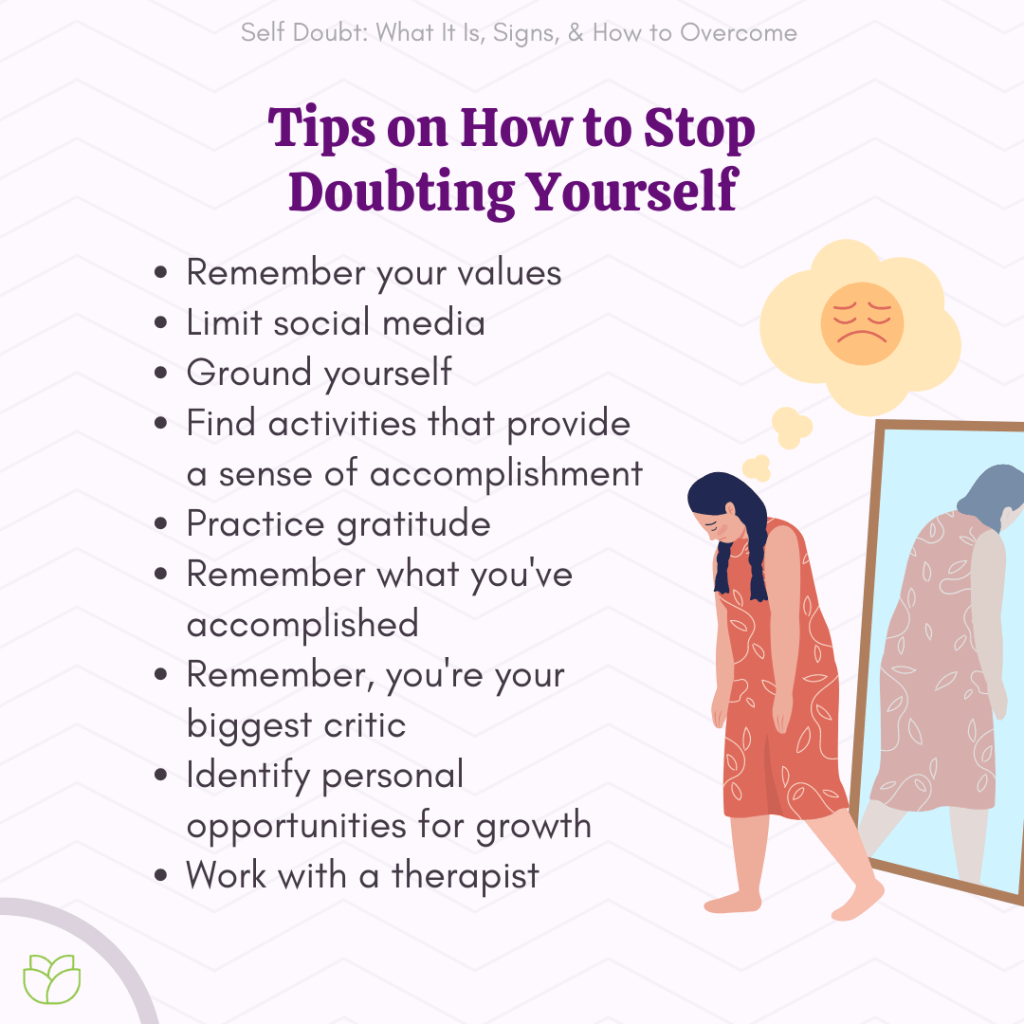

- Identify three things that you are grateful for. Gratitude is a superpower.

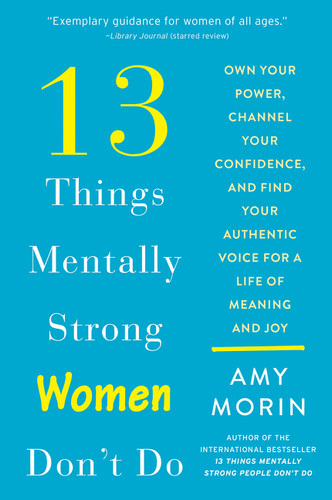

- Write yourself a kind letter. Most of us are too hard on ourselves, which doesn’t drive us to do better. The key to doing better in life involves self-compassion. Write yourself a letter that cheers you on or reminds you that you’re strong and that you can do this. Whenever you need a boost in life, read that letter.

- Plan something fun to do this week. It gives you something to look forward to and boosts your mood. You get a second boost when you actually do that fun thing and a third boost when you create a positive memory.

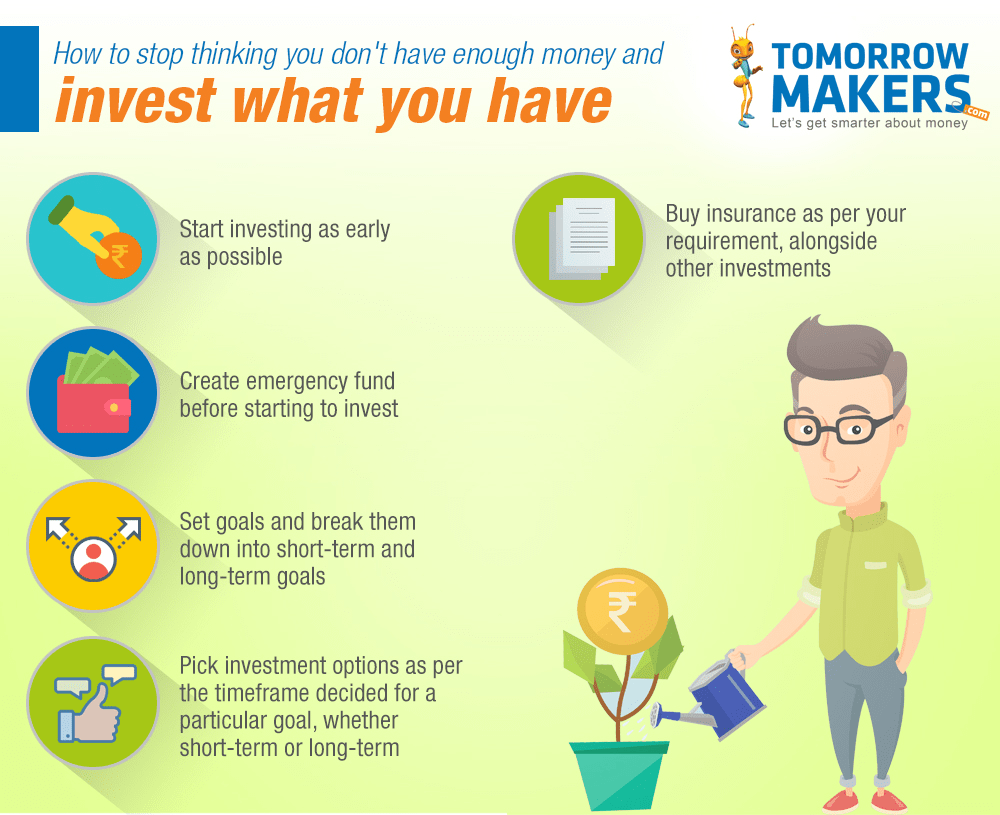

- Understand your cash flow.

- Set goals.

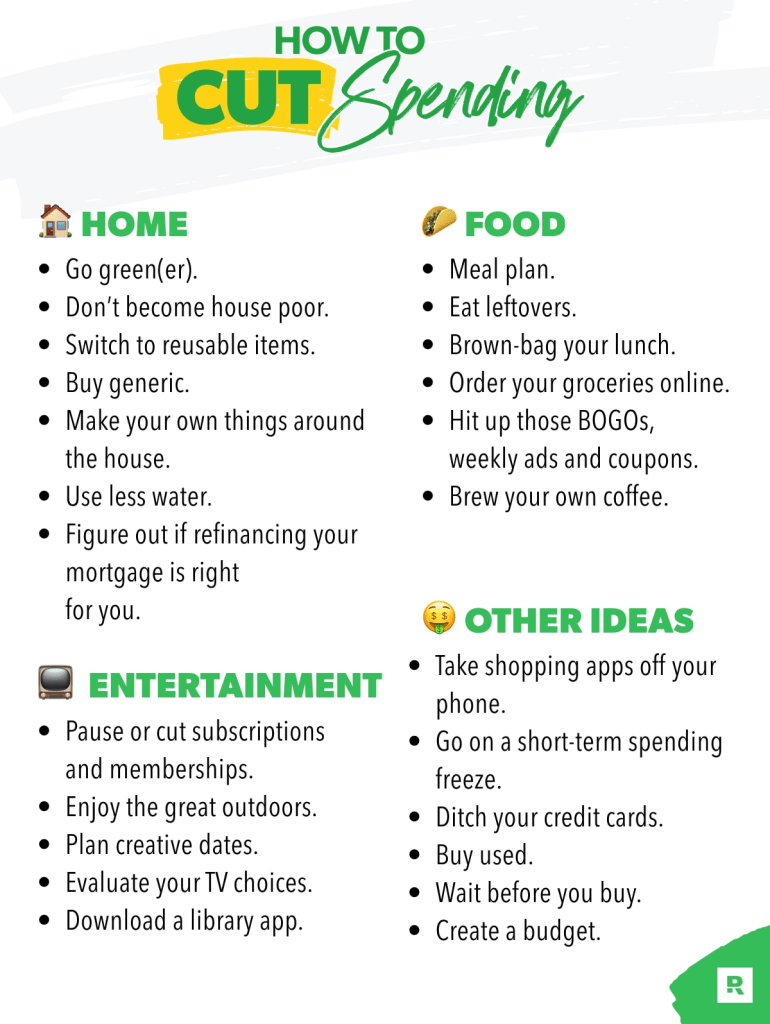

- Cut down unnecessary expenses. Big dreams ask for big sacrifices.

- Start investing.

- Increase your income. Earning more could be the main ticket to your success. In order to improve your finances, you need to either earn more or spend less.

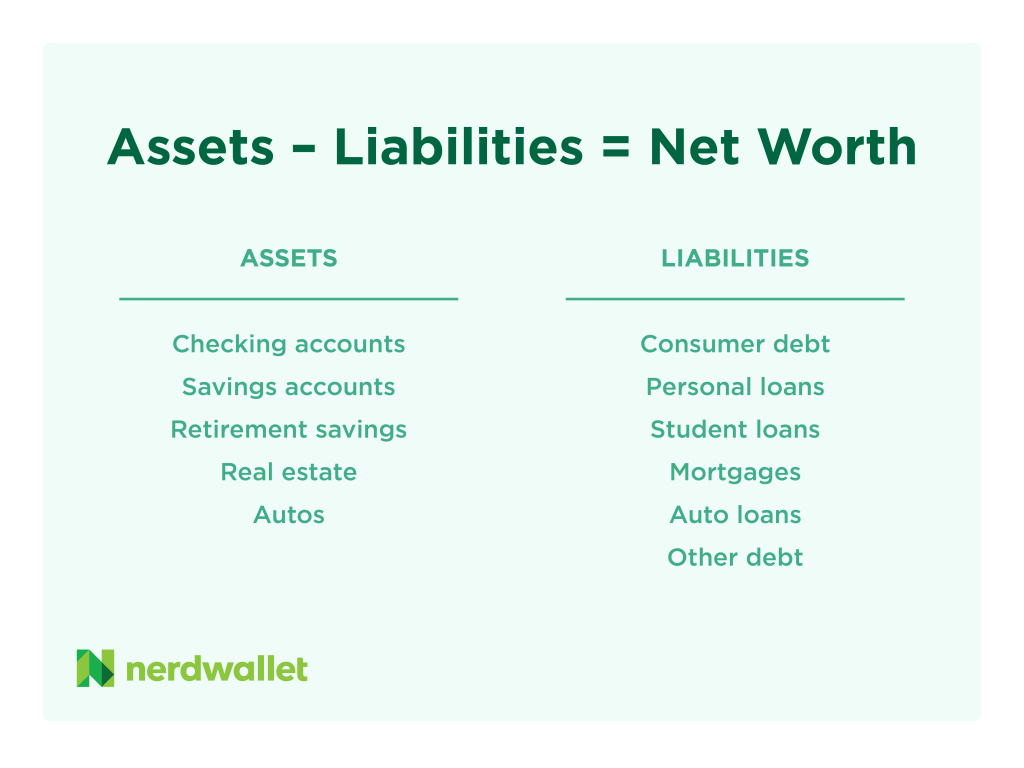

- Calculate your net worth. List all of your assets (savings, real estate, investment accounts, etc.) and list all of your liabilities (line of credit balance, mortgage balance, credit card balances, etc.). Subtract the total liabilities from your total assets to get your proper net worth. You should use your net worth to track your progress from year to year.

- Find the best resources. Be well informed and accumulate knowledge.

- Use a budgeting tool.

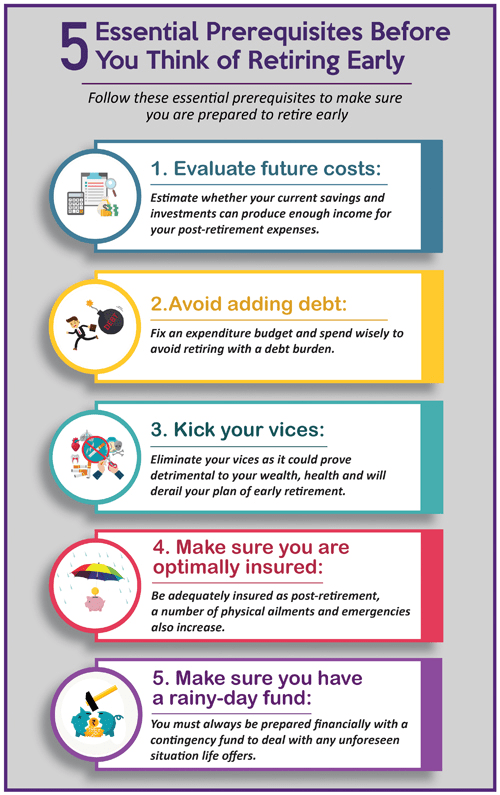

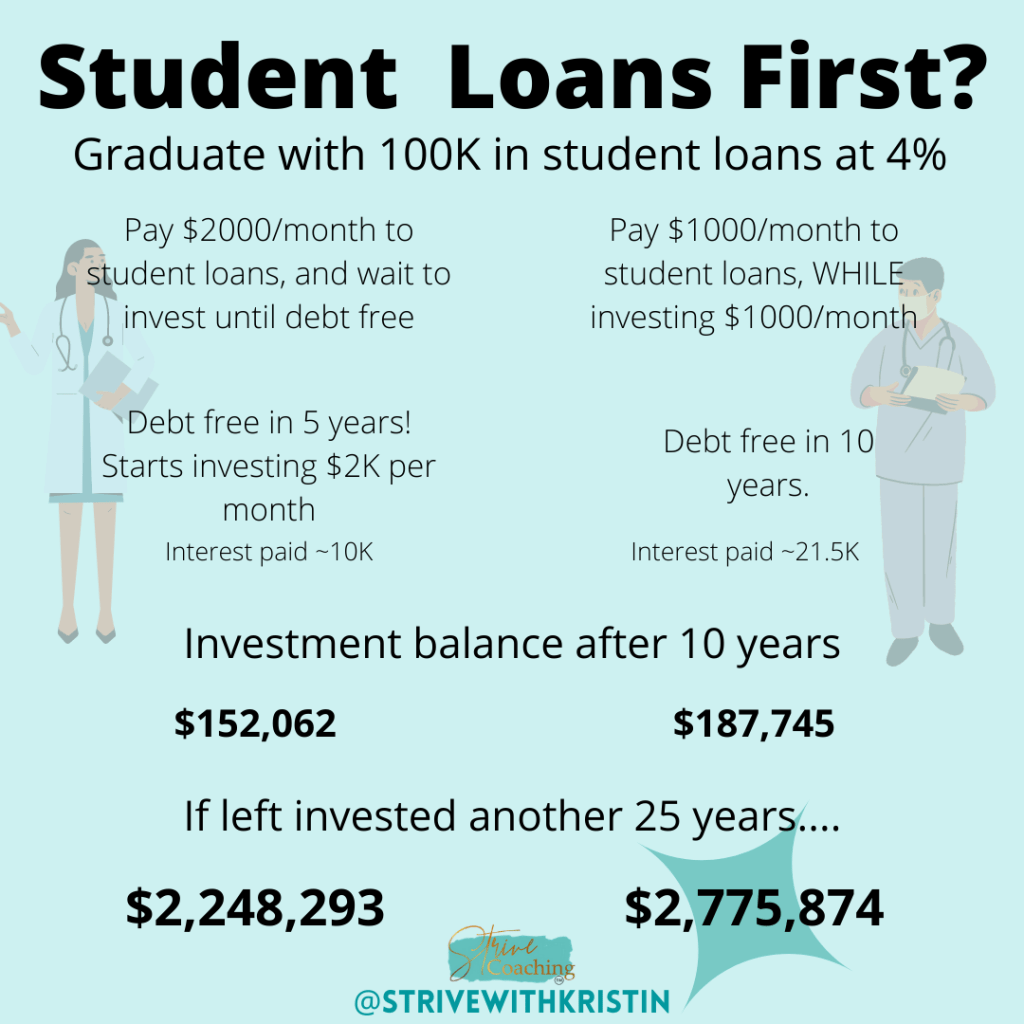

- Follow a debt plan. The more time you wait to pay off your debt, the more interest you will be paying.

- Save for your retirement. The sooner you invest for your retirement days, the better life you will get in your golden years.

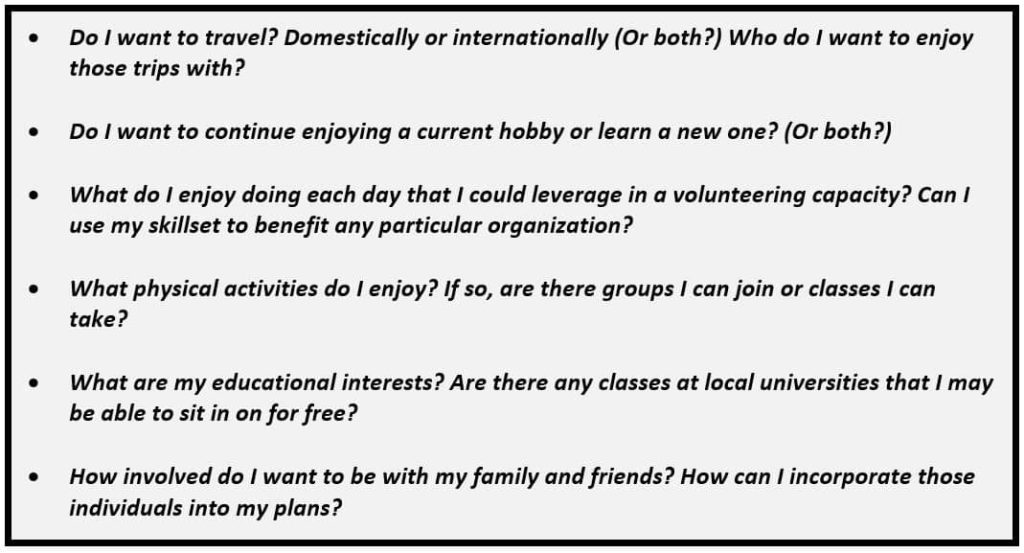

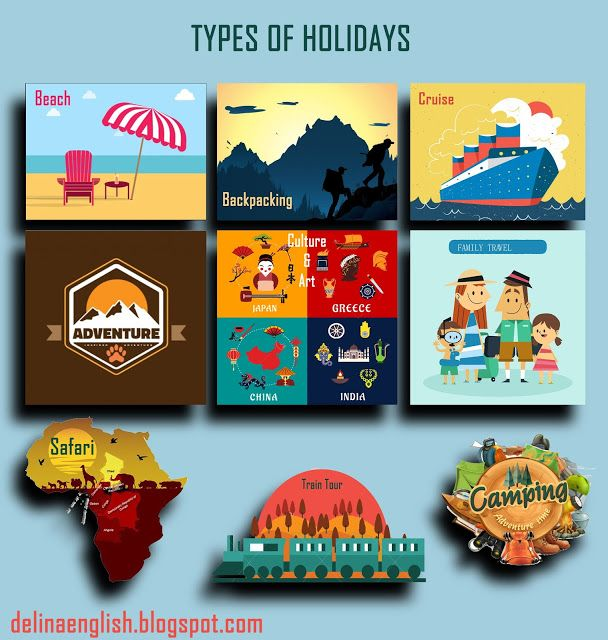

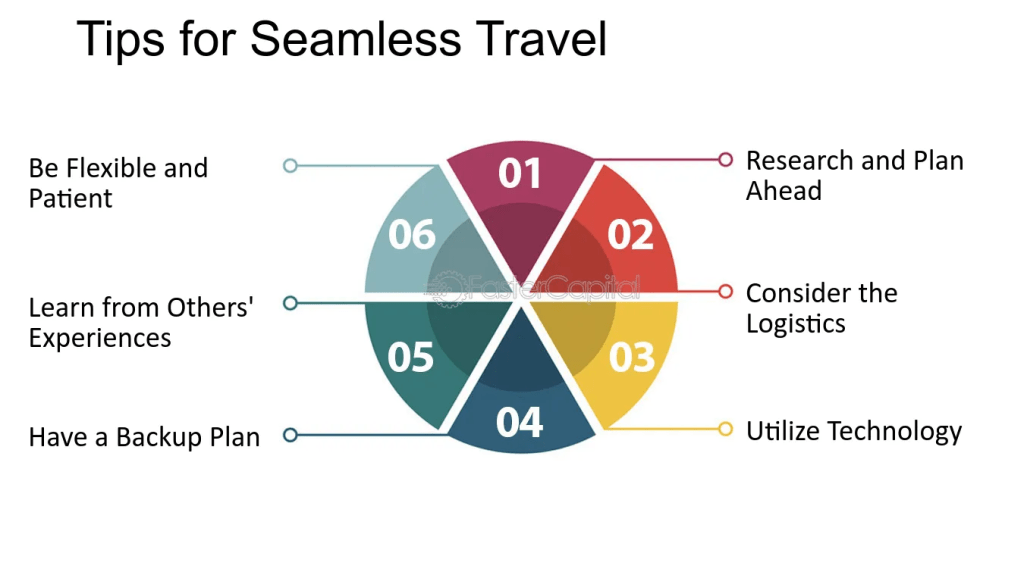

- Vacations can vary depending on your travel style and budget – a long road trip, a stay at a cottage in the woods, a multi-city tour on another continent, etc. It is typically something you save for and plan months in advance.

- The planning starts with thinking about what you want to get out of the trip. Do you want to decompress, relax, and rest? Do you need excitement and adventure? Do you want somewhere that feels comfortable to you as a solo traveler? Set the mission of your trip.

- Set a budget. How much money do you want to spend or how much can you afford to spend? Plan ahead and figure out how much money you need to save each month.

- How much vacation time do you have? If you look at the calendar and look at where the holiday weekends fall, you can turn your limited number of vacation days into an extended trip. However, that is also the most expensive time to travel.

- Is the season important to you? Do you want to go during peak season of that destination? Do you want hot weather and a beach? Do you want to experience winter somewhere?

- Think about your constraints: budget, time, time of year, etc.

- Travel responsibly. Research the places you’re interested in and make sure they want tourists at the time you’re looking to visit. When you’re booking, consider putting your money toward the local economy rather than national or international chains. Learn about whatever destination you choose and be open to learning about the culture there. Be a respectful visitor.

- Think about who you want to travel with. Find someone who has the same travel goals – the pace, activities, and how much money you can spend. Be honest with each other about finances. Some people will want to spend more money on certain things on the trip than others.

https://www.twowanderingsoles.com/blog/11-questions-to-ask-a-friend-before-traveling-together

- Find the destination. Use the internet or travel magazines to conduct research. Consider keeping a list of destinations you most want to visit.

- Do your best to think outside of the current travel trends. You don’t need to go somewhere just because everyone else goes there or wants to go there. Don’t overschedule yourself or overbook yourself. Find one thing on each day of your trip and build a flexible itinerary around that. Think about what’s most important to you to do on your trip.

- Something on your trip is bound to go wrong. Once you’re there, sit back and surrender. Roll with the punches.

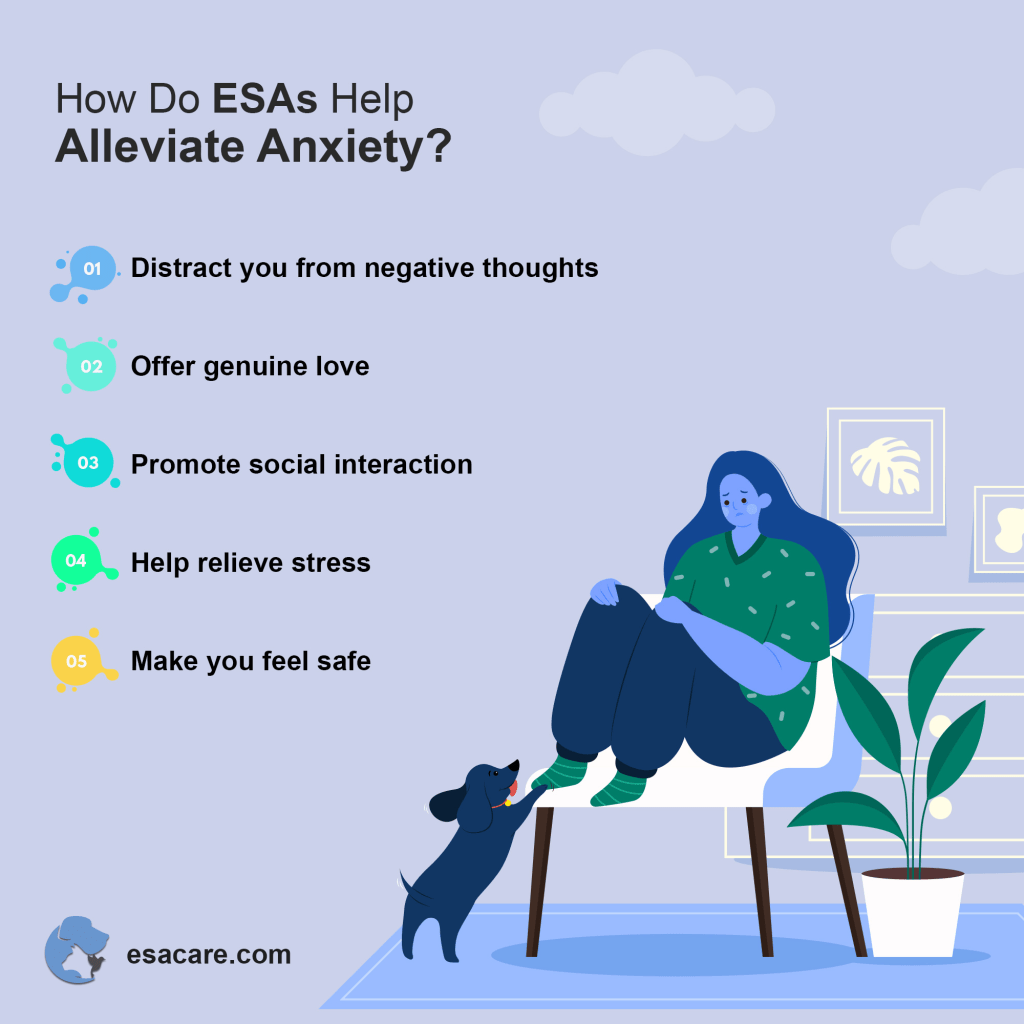

- Emotional support animals are everywhere – planes, restaurants, grocery stores, etc.

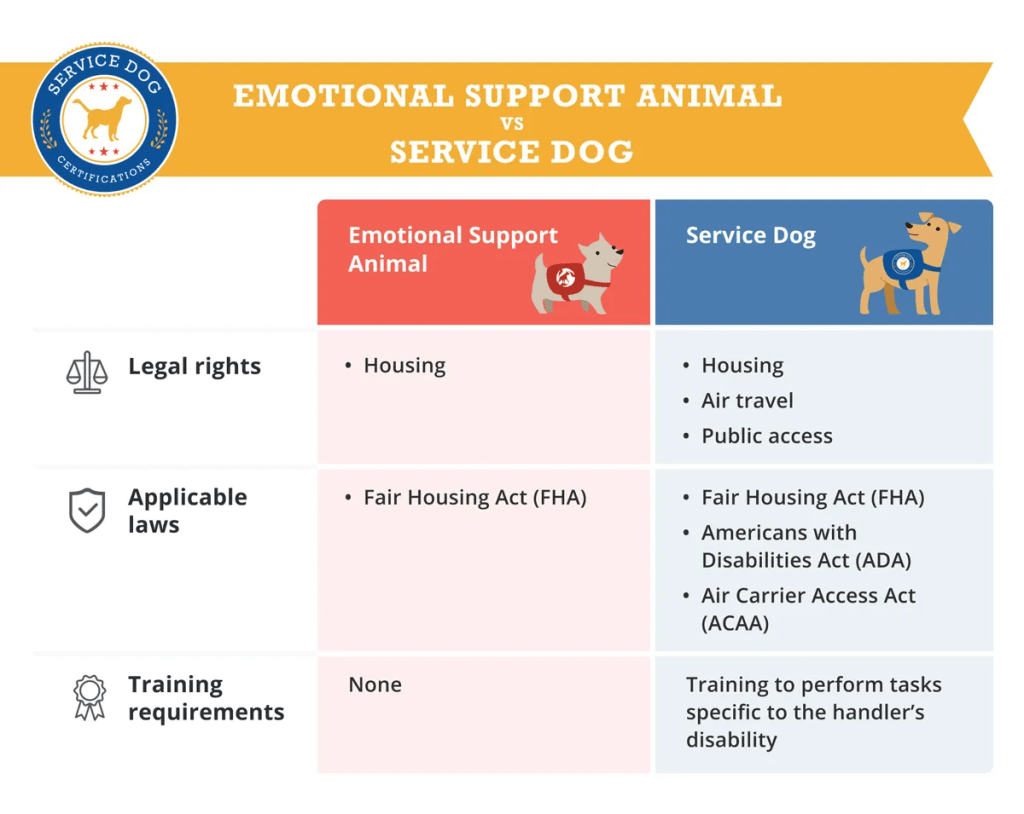

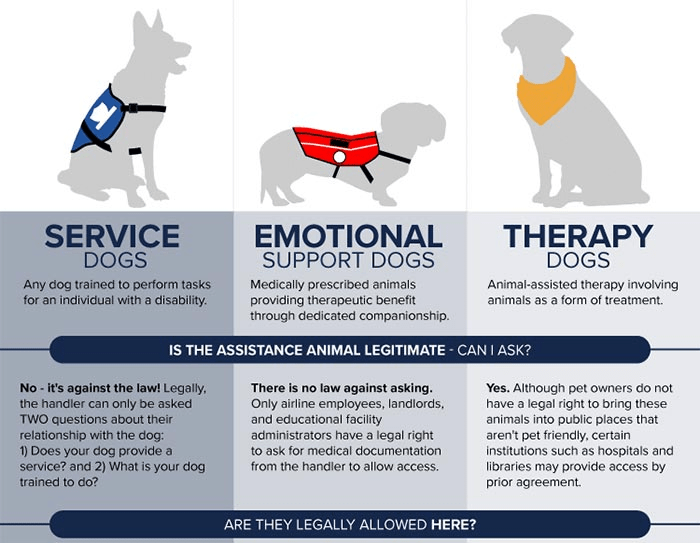

- Service animals do things – guide the blind, alert the deaf, retrieve items for people with mobility issues, help people with disabilities, etc. They require intensive training and certification by the state to behave amongst the public.

- Emotional support animals just are. They have no training. Often, they are ordinary pets of people exploiting the rules.

- ADA – a service dog can legally accompany their handlers almost everywhere. It is illegal to ask people what their disability is or to see the dog’s certification. Service animals don’t have the same protection. The law doesn’t provide for bringing emotional support animals into restaurants.

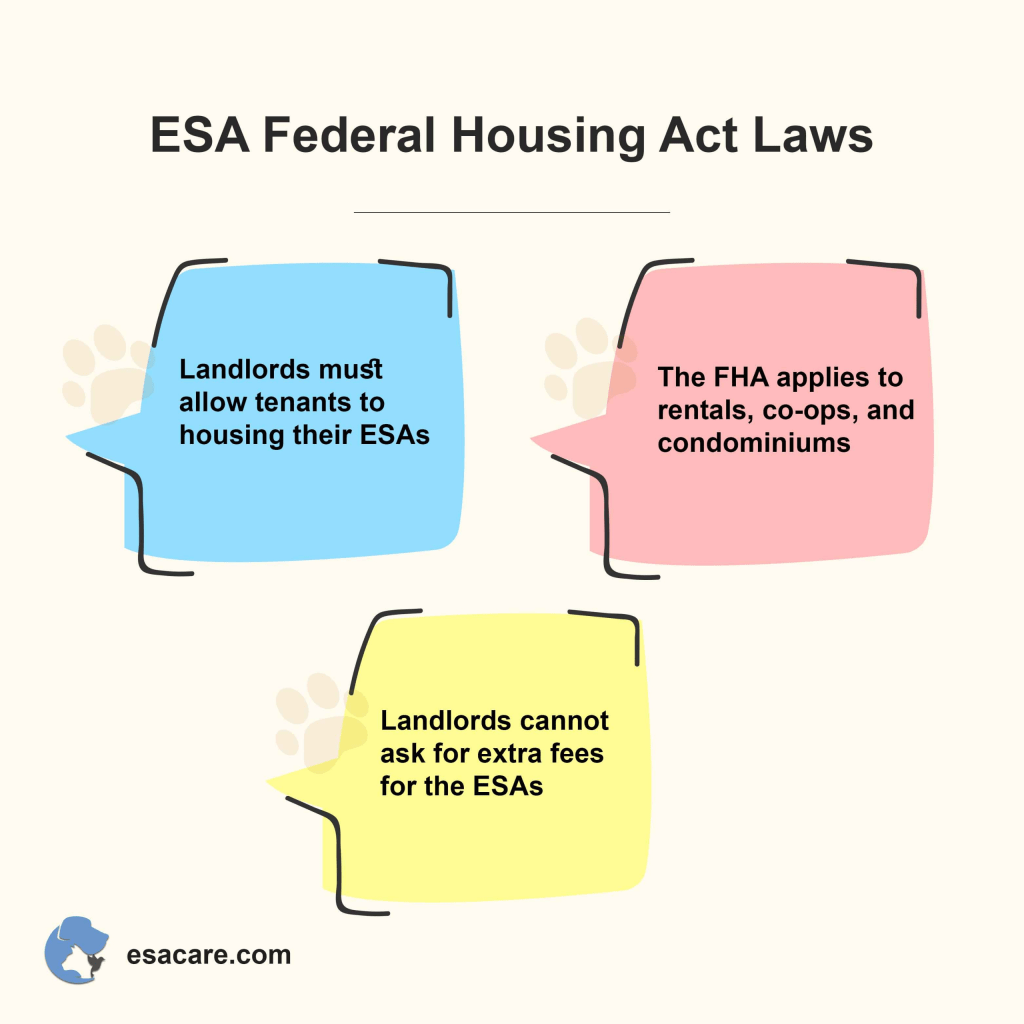

- Many people get their emotional support animal “certified” by filling out a form online or getting a note from a doctor. The Fair Housing Act does not require training or certification; a doctor’s note is all that is needed! You can register as many emotional support animals as you want as long as your therapist believes that all of your pets are there for your well-being.

- The ADA doesn’t acknowledge emotional support animals. The Fair Housing Act provides the right for an emotional support animal to live with its owner even if the housing doesn’t allow pets.

- Top complaints from airline passengers and employees are about untrained dogs – growling, barking, defecating, biting, etc.

- If you can’t control the dog you have, you can’t go around with the dog you have.

- “If you actually suffer from anxiety, what is going to happen when your dog bites a stranger on a plane and you’re forced to make an emergency landing? The ironic thing is that, most of these people give the animal that’s supposed to be curbing their anxiety, anxiety medication before the flight. My emotional support animal needs an emotional support prescription.”

- The evidence to support the notion that emotional support animals do anything is surprisingly weak.

- There are treatments for anxiety that work really well, such as facing your fears gradually. In the end, it is the individual who overcomes their fear and gains a feeling of empowerment. Some psychologists have found that the support animal becomes a crutch; people don’t want to face their fears alone and feel emotionally crippled without their pet. If someone cannot be apart from their pet, there might be a bigger issue.

- Some studies show that petting an animal can have a calming effect, as measured by cortisol levels, but blankets and stuffed animals have the same effect.

- What can be done? There are new rules that restrict free air travel to service animals only. Delta requires a note from a veterinarian confirming the animal is trained and can be around people. We can bring about change in a social realm. When you show up for a lunch date and your friend brings an emotional support animal, say something. It should be treated the same as someone unhandicapped who parks in a handicapped spot.

- Any laws regarding emotional support animals need to be enforced! Online websites that provide emotional support animal letters need to be taken down.

I look forward to reading, learning, and sharing more with you soon!