“Killing Sacred Cows: Overcoming the Financial Myths That Are Destroying Your Prosperity” was written by Garrett B. Gunderson and was both educational and interesting. In the financial world, sacred cows are the myths and traditions that distort our thinking about money, wealth, success, and prosperity. I don’t agree with all of the information provided, but this book left me pondering and learning about new perspectives.

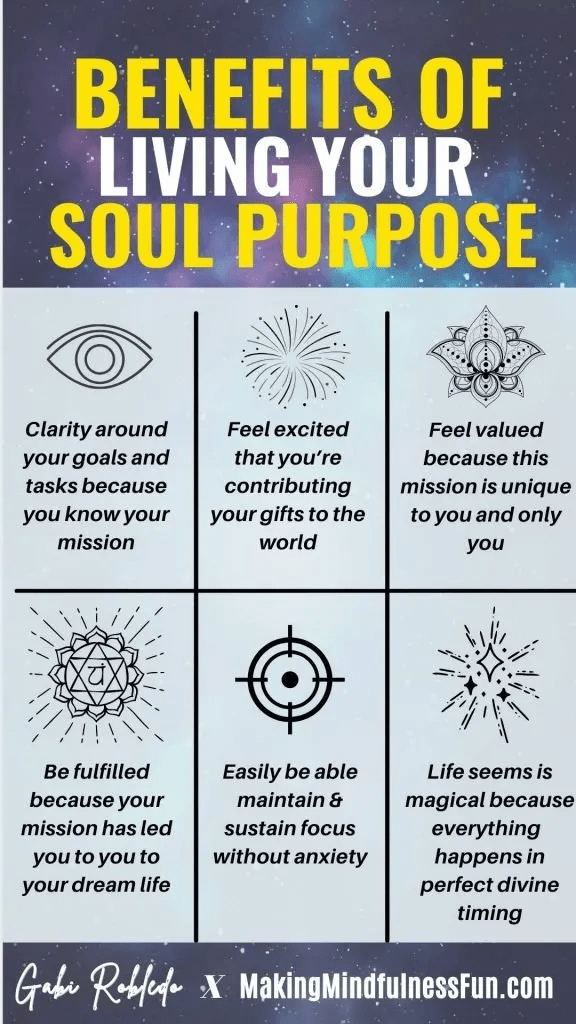

This book emphasized finding your soul purpose and maximizing your human life value. In a nutshell, your soul purpose is utilizing your talents, abilities, and passions productively and effectively to make an impact on the world and bring joy to you and others. Human life value is your combination of knowledge, skills, and abilities you can use to increase your income.

The first step to increasing our human life value is education. Then, we must take action on what we have learned and dedicate ourselves to finding and living our soul purpose. The ultimate end of every one of our decisions should be to get us closer to finding and living our soul purpose. What strengths, abilities, skills, or advantages do you feel could be utilized to create maximum value in the marketplace?

Learn to prioritize value and utility over price. Would you buy it if it weren’t on sale? Consider opportunity costs. Most financial advice focuses on cutting costs and saving. This book takes a different approach. Instead of “I can’t afford this” ➠ “How can I create more value in the world so that I can afford this?”

Banks make $ without big risks. They check your credit, secure their investments with collateral, require a down payment, determine interest rate/payment/period, sometimes impose prepayment penalties, cover their investments with insurance, and transfer their risks to the borrower in any way possible. We as investors/gamblers don’t have any of these risk management tools.

Three quotes about retirement resonated with me:

“Our goal should never be to become millionaires; our goals should be based on what will bring us our ideal quality of life and the highest level of happiness.”

“The ultimate end of every one of our decisions should be to get us closer to finding and living our soul purpose. If you found your soul purpose, would you ever want to retire?”

“What are you waiting for? Why not live like you really want to today instead of buying into the financial myths that tell you that your dreams are only possible in retirement?”

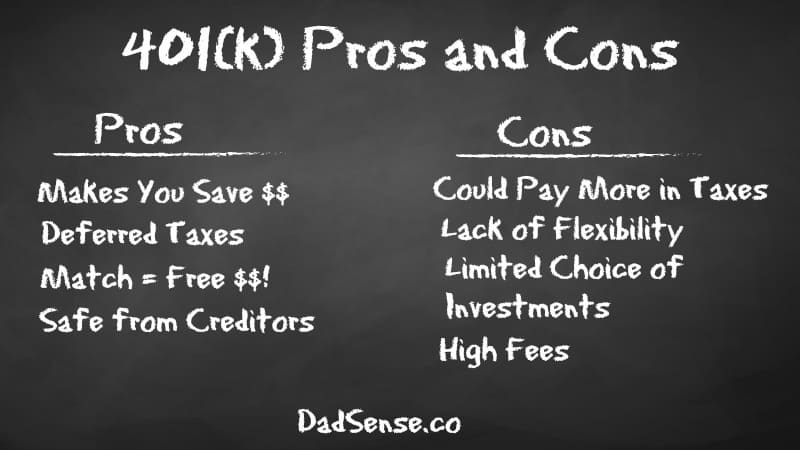

This author really emphasized that 401(k)s are a “scam” due to limited opportunity for cash flow, lack of liquidity, market dependency, lack of knowledge, administrative fees, underutilization because of tax deferral, higher tax brackets upon withdrawal, estate taxes, no exit strategy, no guarantees, no control of performance, and a penalty for withdrawing early. While I understand his points, I’m unsure of alternatives, as the author didn’t delve into them. It is important to be aware of fees, investment options, and vesting schedules when contributing to a 401(k).

This book presented some new information and perspectives, but was not comprehensive. It can be part of your financial education, but there are better financial books out there that are more educational.

I love forward to reading, learning, and sharing more with you soon!