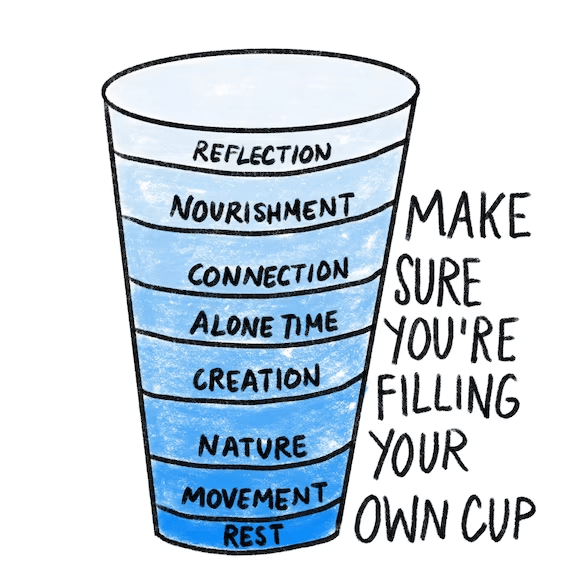

It’s been a while since I’ve posted on this blog since I have had other priorities. I read 2 books in August and gave myself permission to quit 2 other books – a true act of self-care. Previously, I didn’t allow myself to not finish books. Here is a blurb of each of the books I read in August.

“The Ritual Effect: Unlocking the Extraordinary Power of the Ordinary” was written by Michael Norton, professor of Business Administration at Harvard Business School. Here are some main takeaways:

The essence of habit is the what – something we do – brush our teeth, go to the gym, pay bills, etc. The essence of ritual is the how. It matters to us not simply that we complete the action but the specific way that we complete it. When rituals are disrupted, people report feeling “off” all day.

Some rituals become so intricate that the ritual interferes instead of prepares. Ex: performance rituals – baseball players engage in an average of 83 movements when batting.

Rituals and repetition can be powerful tools for honing our self-control, but ritualistic behavior can, over time, start to control us instead. Among the most common treatments for compulsive behaviors is “habit reversal” training – identifying the root behavior that’s causing problems and replacing it with something else.

The 4 Lessons of Relationship Rituals

- Rituals wake up our experience of commitment – doing things together.

- Relationship rituals are exclusive.

- Rituals – not routines – bring the magic.

- Consensus is a critical factor. Do you and your partner agree that it’s a ritual and not just a routine?

- Food and drink are often central to rituals, but how we share them is what shapes family identity.

- Rituals can be the practices that call us home and bring family together.

- Family rituals immerse us in the moment, strengthen identity, and create lasting meaning.

Rituals give us a sense of ownership, an affirmation of identity or belonging, or an increased feeling of meaning.

- Personal rituals are more adaptable and meaningful than inherited rituals since we can shape them to fit our values and goals.

- Rituals strengthen social bonds through shared meals, celebrations, or communal ceremonies.

- Rituals don’t have to be complex. Simple, intentional actions can transform daily life.

4 out of 5 stars

“Crush Your Money Goals” was written by Bernadette Joy, an expert money coach and founder of CRUSH Your Money Goals. Here are some main points.

CRUSH:

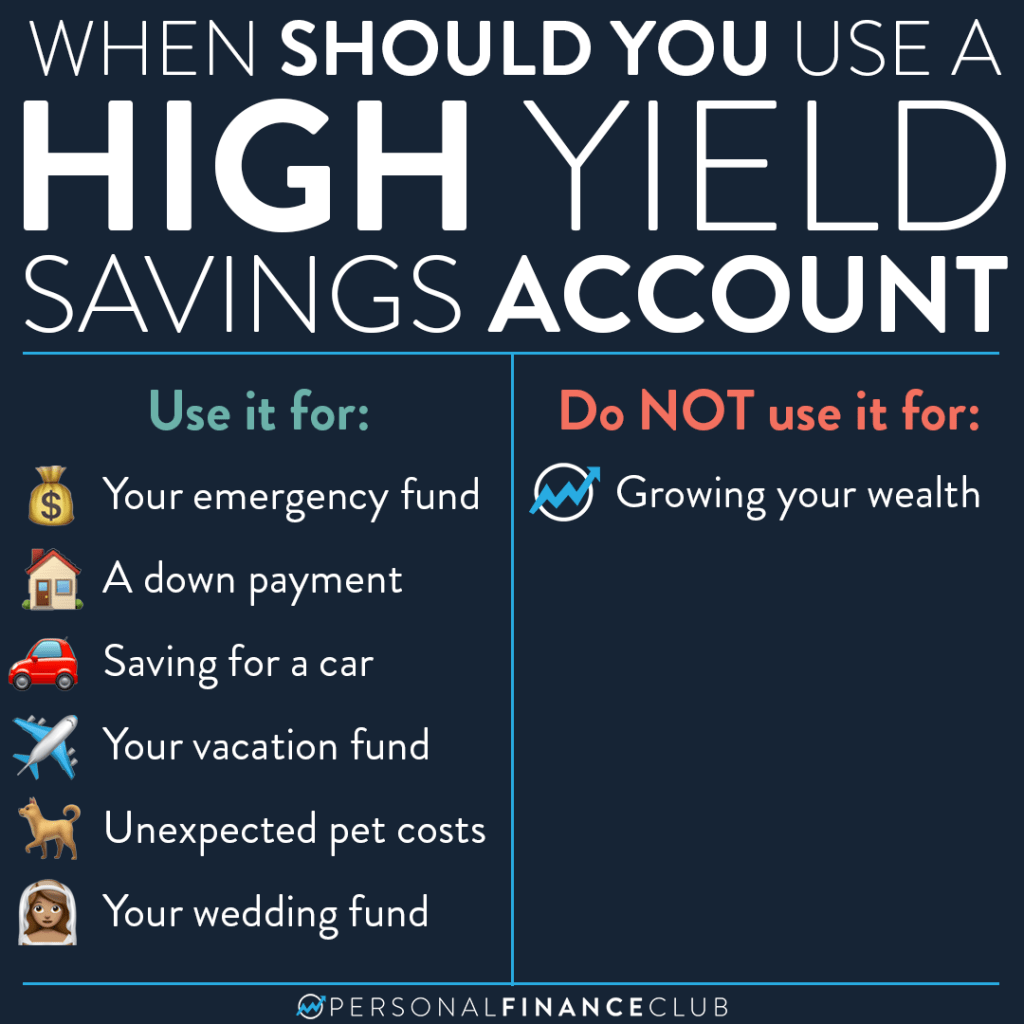

- Curate your accounts. Coordinate accounts and track spending.

- Reverse into independence. Set clear financial independence goals. Use the $1 rule to question non-essential purchases.

- Understand your net worth and track it.

- Spend intentionally. Align spending with values.

- Heal your money wounds. Address emotional triggers that lead to overspending.

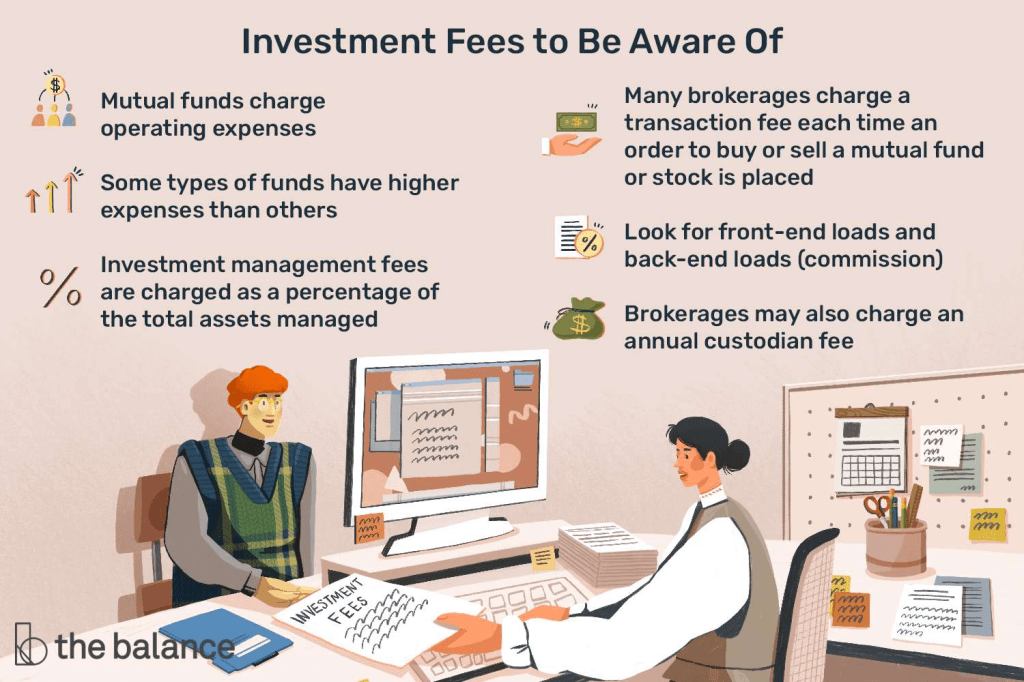

Net worth trackers organize your accounts into cash & cash equivalents, investments, property, credit cards, and loans. Trackers mentioned in this book include Empower (free) and Monarch Money (paid subscription).

Budget:

- Survive – basic necessities, including housing, utilities, food, transportation, and health

- Revive – current expenses that aren’t necessary but make life worth living for you, such as vacations, clothing, entertainment, and hobbies

- Strive – anything that helps you grow your net worth

The CRUSH method consists of 50% strive, 25% survive, and 25% strive. In other words, saving/investing half of your income – which does not seem attainable for most people, especially people who don’t earn six figures. The author mentioned that if this is not attainable, people should work to increase their income.

Other tips:

- Remember that the interest you pay on any debt is making someone else rich by being their passive income stream. Ex: your mortgage, auto loans, and credit cards.

- Unsubscribe from email marketing and digitally detox from constant comparisons. Reduce impulse spending.

- Implement a $1 cost per use rule – technology, furniture, clothing, accessories, home goods.

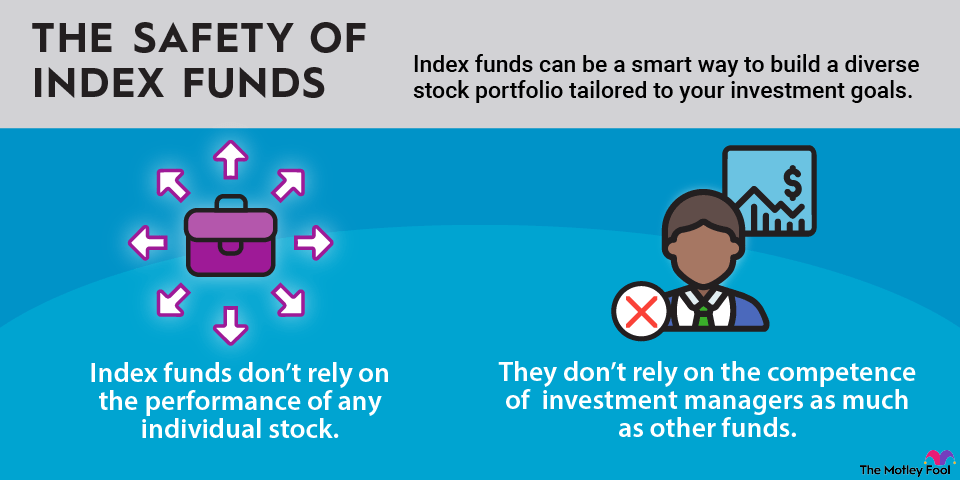

- Invest in a Roth IRA, where you won’t pay taxes on growth. All income earned is tax-free.

- Compare insurance plan rates each year. Ask for discounts from service providers.

4 out of 5 stars

I look forward to reading, learning, and sharing more with you soon!