My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

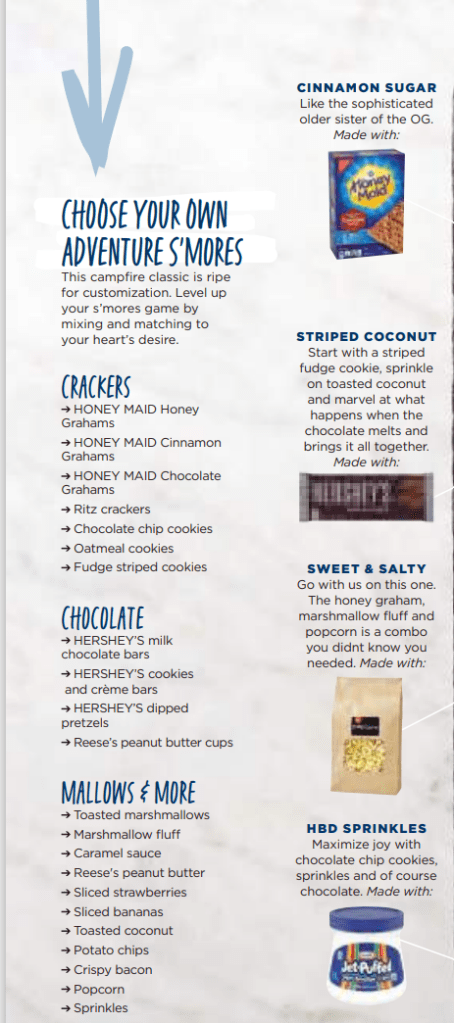

S’mores are a classic bonfire food. I have been wanting s’mores recently, but the weather has been too hot for a bonfire. I stumbled across an article in a Cub Foods magazine that mentioned different methods of cooking s’mores and included different varieties of s’mores. Here are some methods:

- Roast a marshmallow over an open flame (classic method)

- Bake at 400 degrees Fahrenheit for 4-5 minutes

- Broil in the oven for 1-2 minutes on each side

- Grill for about 2-4 minutes

- Microwave for 30-60 seconds

- Air fry for 2-3 minutes

I learned a helpful (yet embarrassing) tip on TikTok. I, and apparently many others, thought that you say the first word that comes to mind when spelling out something on the phone. Example: “A” as in apple. Apparently there is a standardized phonetic alphabet called NATO that military, police, pilots, and others use!

- Know what the most important part of your workouts are (usually compound movements: squat, deadlift, bench). Start with that. If your goal is to put on muscle, focus on lifting instead of cardio.

- Challenging movements that you hate are the things you should be doing. It will pay off with physical and mental benefits.

- Track the weight you’re lifting to see your results.

- Be on a great workout program that progresses over time. There’s no one-size-fits-all program. Consider your goals, situation, workout history, equipment, timeframe, etc.

- Have a no social media rule while you are working out.

- Know the difference between soreness, discomfort, and pain. You’re going to be sore and have discomfort, but you need to work through it. You need to be real with yourself and realize that you need to be intentional and work out anyway as long as you aren’t in actual pain due to injury.

- Aim to be consistent: consistent quality, intention, and small improvement is how you will get phenomenal results.

- Know your why. Why are you in the gym? What are you striving for? What are your goals? What motivates you? What do you want to do?

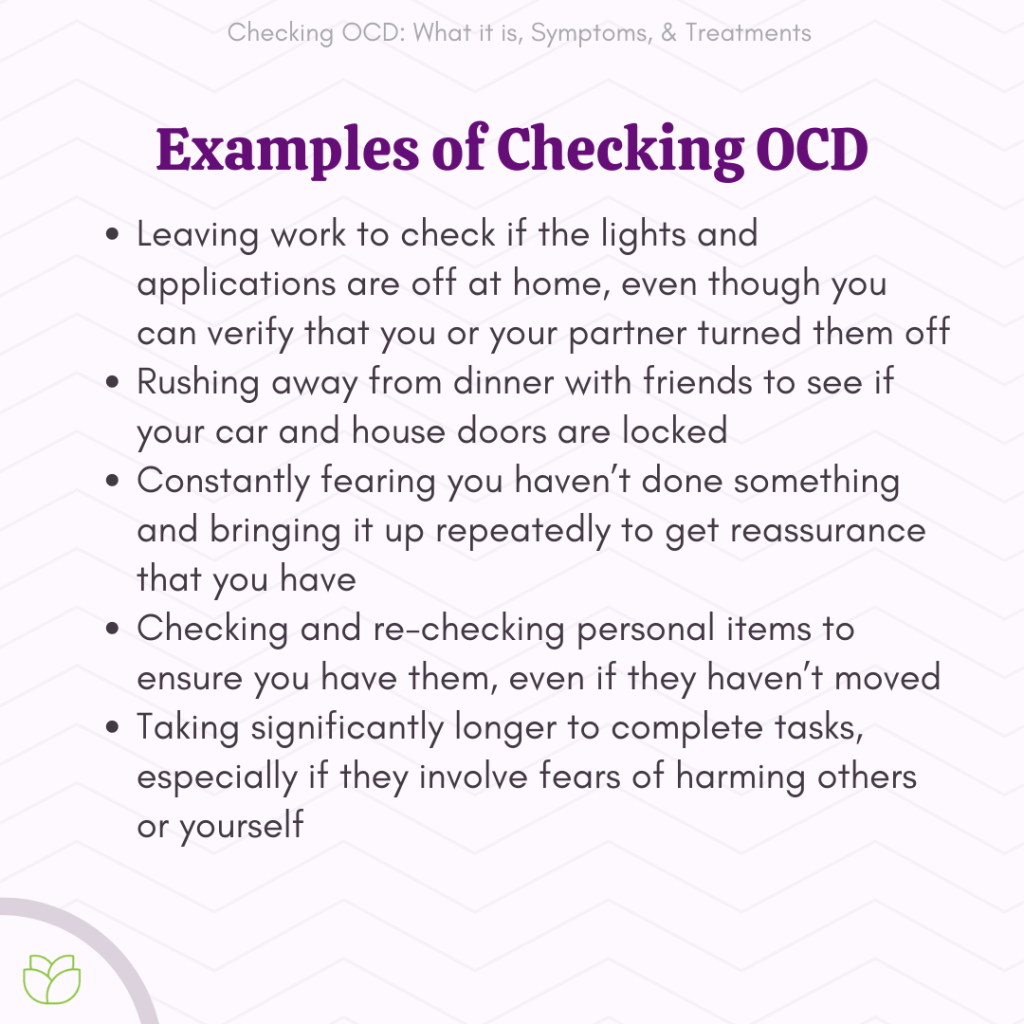

OCD is a mental illness that is exhibited by repetitive, unwanted, or intrusive thoughts (obsessions) often followed by the urge to do something repeatedly (compulsions). There can be many different ways in which OCD manifests itself:

- Intrusive thoughts and rumination: repetitive and constant thoughts ranging in topic, but common ones are violent intrusive thoughts, sexual intrusive thoughts, obsessions, and analyzing things followed by rituals or compulsions to make the bad things not happen. Ruminations are when one dwells upon a question or theme that is unproductive and likely to lead nowhere.

- Checking: OCD can present itself in the need to check on something (acts on the compulsion). This can display itself in a variety of ways: checking in with family members to gain reassurance about their firms, unrelenting need to check the door repeatedly to make sure it’s locked out of fear of a burglary, checking an e-mail over and over analyzing imperfections, etc.

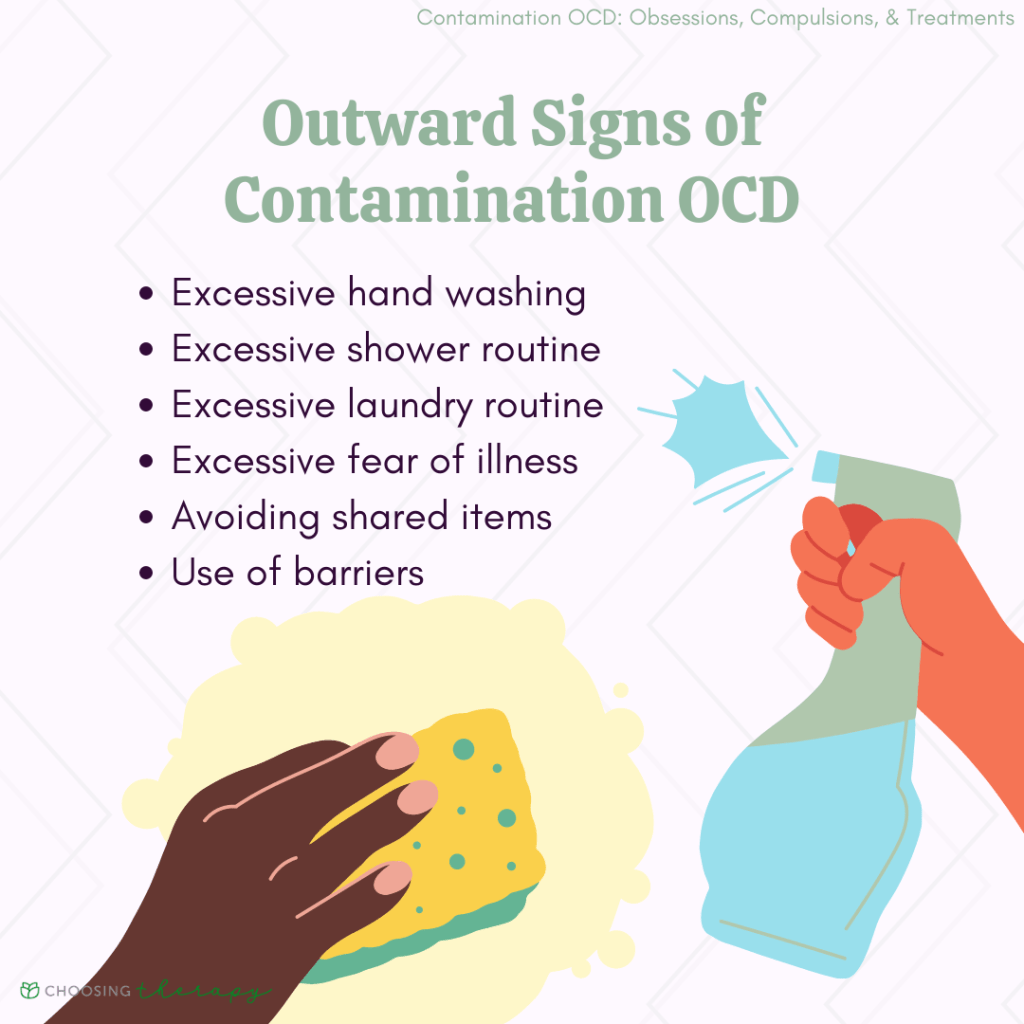

- Contamination or mental contamination: characterized by the strong fear of being dirty or contracting germs from objects or people. Could excessively brush teeth or scrub hands or shower to wash away bad thoughts.

- Symmetry and orderliness: organizing books or dvds, making sure everything is neat, clothes folded perfectly and hanging the same way. Can’t shake the strong feeling that it isn’t “just right.” With OCD, the compulsion only provides relief for a short amount of time

Treatment: cognitive behavioral therapy

When you wake up each day and decide which clothes to wear, you can also choose the attitude you bring into the day. Your attitude is your way of thinking or feeling about something, which is usually expressed through your behavior.

Choosing to have a good attitude is to be intentional knowing that there may be challenges, inconveniences, and stressful things that will come up throughout the day, and telling yourself the attitude you want to have about things will change the way you feel about them.

One of humanity’s fatal flaws is that we are so incredibly biased by our emotions, and if affects our decision making and causes us to do things that we later regret.

Brian Ford

As you get ready in the morning and choose your outfit, decide which attitude you want to wear for the day and see how it looks on you. A good attitude may be your favorite! When I’m feeling annoyed, down, or upset, my husband always reminds me “Make today a great day.”

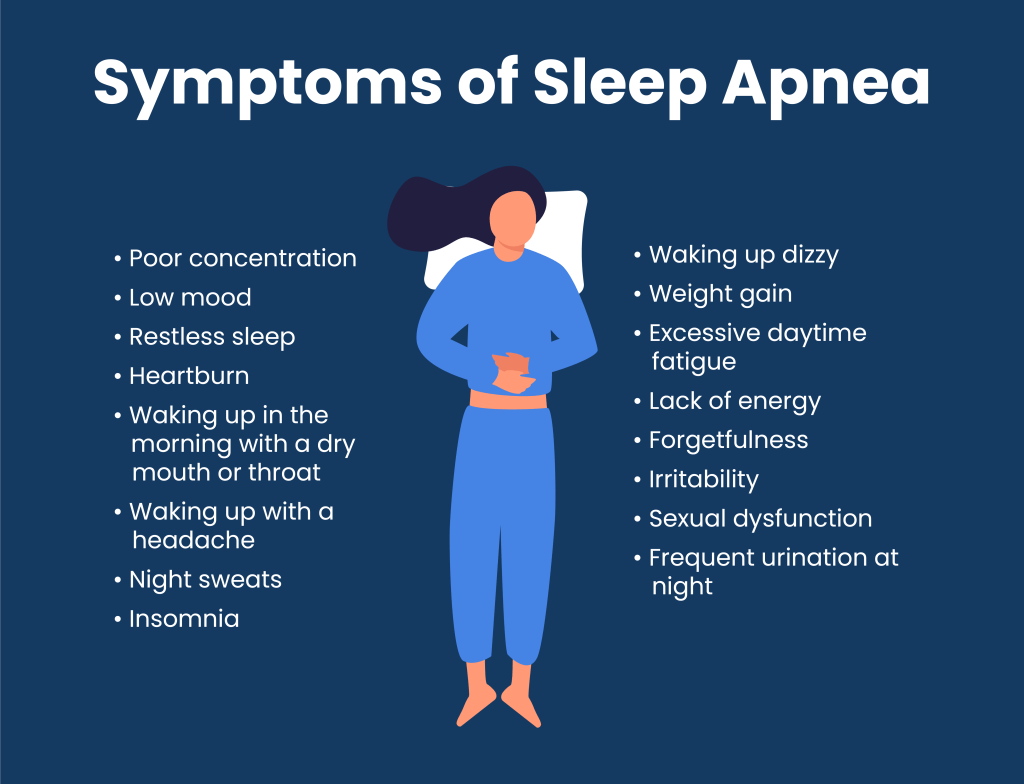

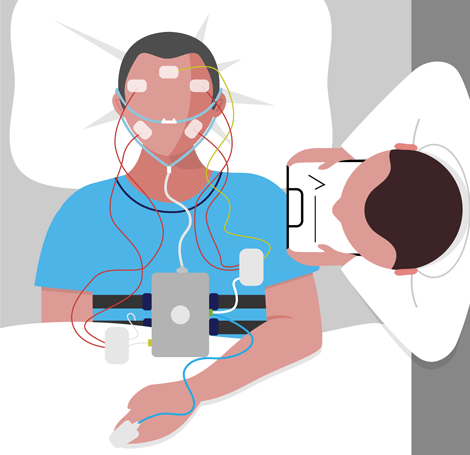

- Sleep apnea is the periodic disruption of normal breathing during sleep, resulting in lowering the oxygen levels in your blood and fatigue.

- Sleep apnea leads to snoring, sore throat, and swollen tonsils and can lead to cardiovascular disease, diabetes, obesity, and irritability.

- One of the primary treatments is a CPAP, which opens up airways so you can actually breathe.

- Different types of sleep apnea: obstructive sleep apnea (airway narrows), central (natural breathing reflex doesn’t respond appropriately to blood carbon dioxide levels – rare), and mixed/complex (mix between obstructive and central)

- Diagnosis: sleep study done in a clinical laboratory setting – monitors the occurrence of paused breathing and shallow or slow breathing, looking for neurological stuff, limb movements, body position, and sleep-wake state

- Home sleep apnea testing is available for patients suspected of milder forms of sleep apnea.

- Exercise alone, whether you lose weight or not, can help with sleep apnea.

- Head and neck position can make a difference.

- Treatments: CPAP, sedatives, meds for daytime sleepiness, acupuncture (10 treatments), reduce smoking, lose weight, n-acetylcysteine (NAC) (thins and loosens mucus in the airways), Co-Q10, vitamin D, magnesium, and B vitamins

- If you get on a CPAP related to weight gain, allergies, or dehydration, you can get off of a CPAP someday.

- Practice nose breathing on a daily basis.

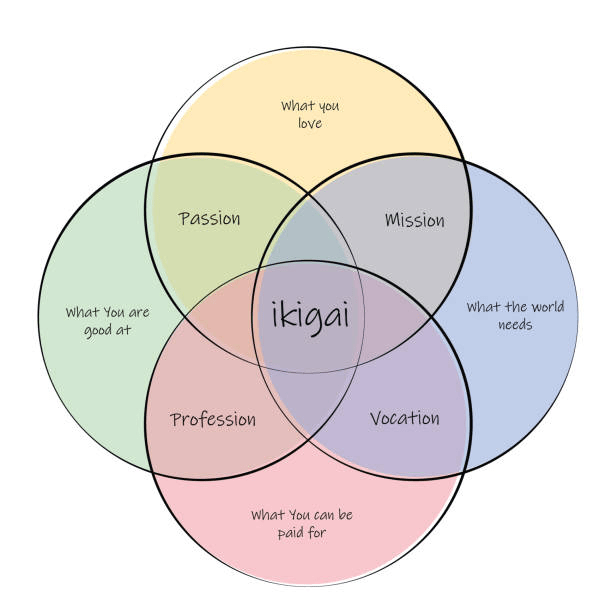

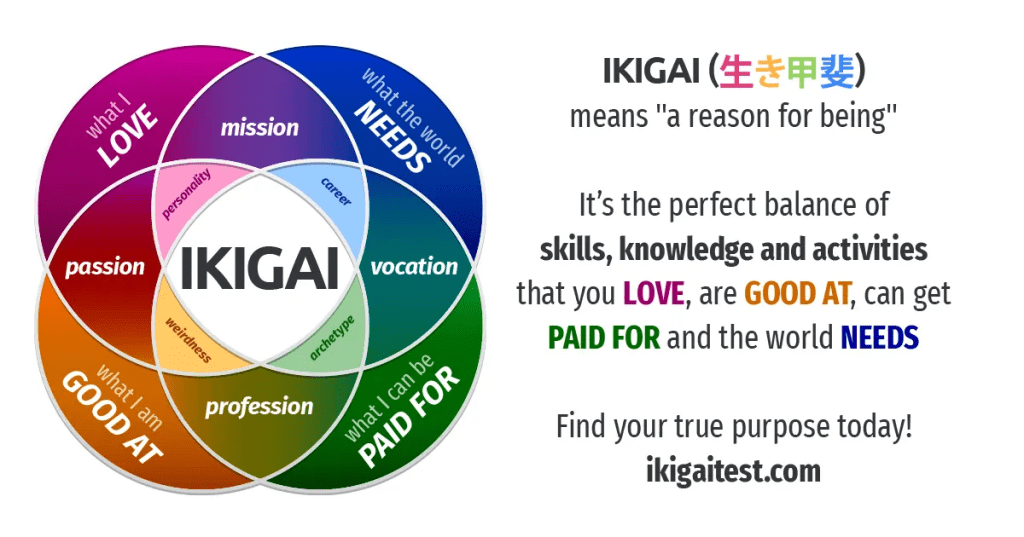

- Pronunciation: Eye- key- guy

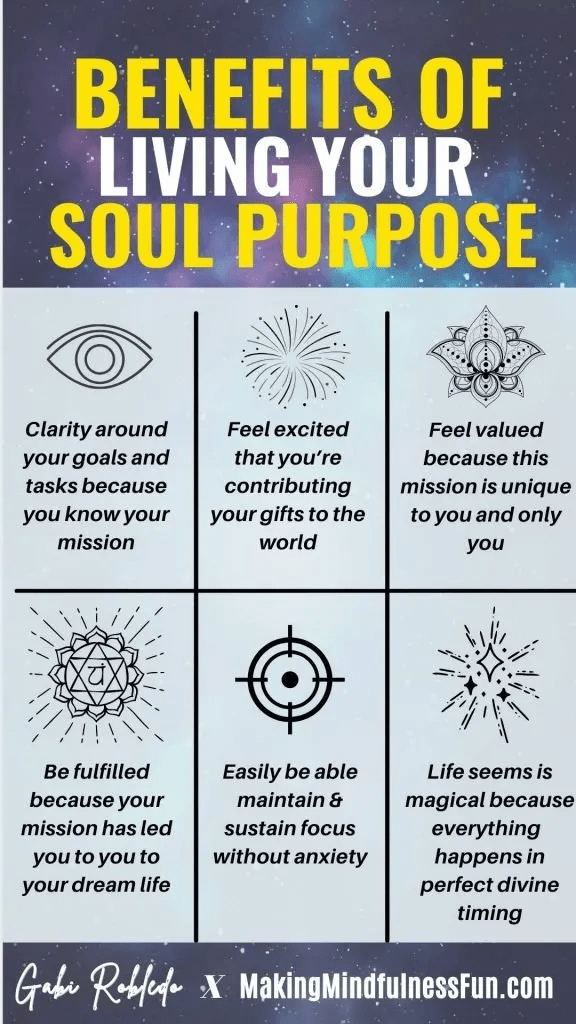

- What is ikigai? Reason for being – reason we get up in the morning

- It takes some reflection and awareness to find it: what you are good at, what you love, what the world needs, and what you can be paid for. Ikigai is a balance between these four areas.

- Ikigai is important so that you can live more intentionally with your life and career and think about what you’re uniquely positioned to offer.

- Answer these questions: What do you love? What are you good at? What does the world need? What can you be paid for? Your ikigai overlaps all of these areas.

- “Do what you love and you’ll never have to work a day in your life.”

- We all have a need to matter. How do you help others and inspire others? Our deepest satisfaction comes when we feel we make a difference in the world. Live with purpose in your ikigai today.

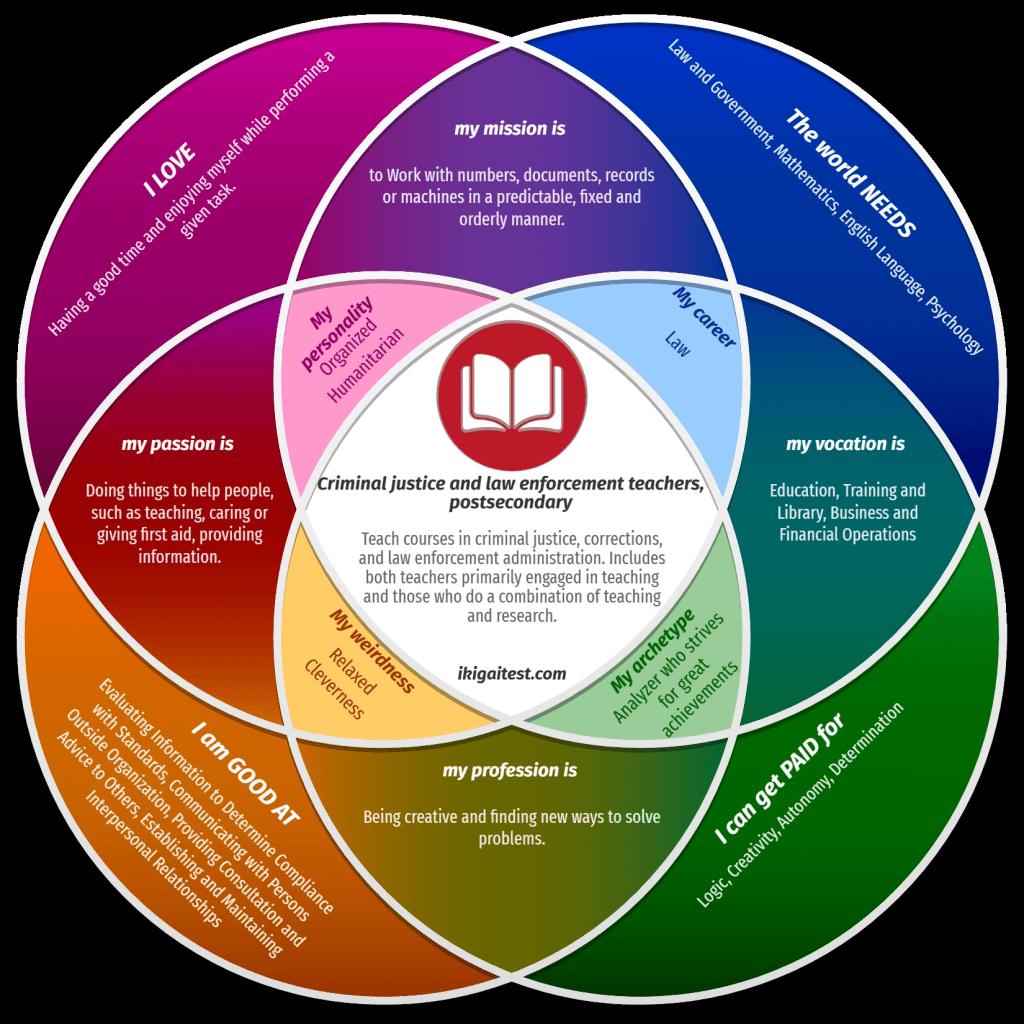

I recently took the ikigai test at ikigaitest.com with these results:

I recently read “Dig Your Well Before You’re Thirsty” by Harvey Mackay, which was about networking. Here are some tidbits I took from the book:

- “If I had to name the single characteristic shared by all the truly successful people I’ve met over a lifetime, I’d say it is the ability to create and nurture a network of contacts.”

- A network can provide you with new experiences and knowledge. You don’t have to know everything as long as you know the people who do.

- As the world changes, one thing will remain constant: the relationships you develop over a lifetime.

- The four best places to build your network: alumni clubs, industry associations, social clubs, and hobbies. Finding common ground leads to making better and faster connections.

- The main ingredients of a network: R.I.S.K. : Reciprocity, Interdependence, Sharing, and Keeping at it.

I look forward to reading, learning, and sharing more with you soon!