My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

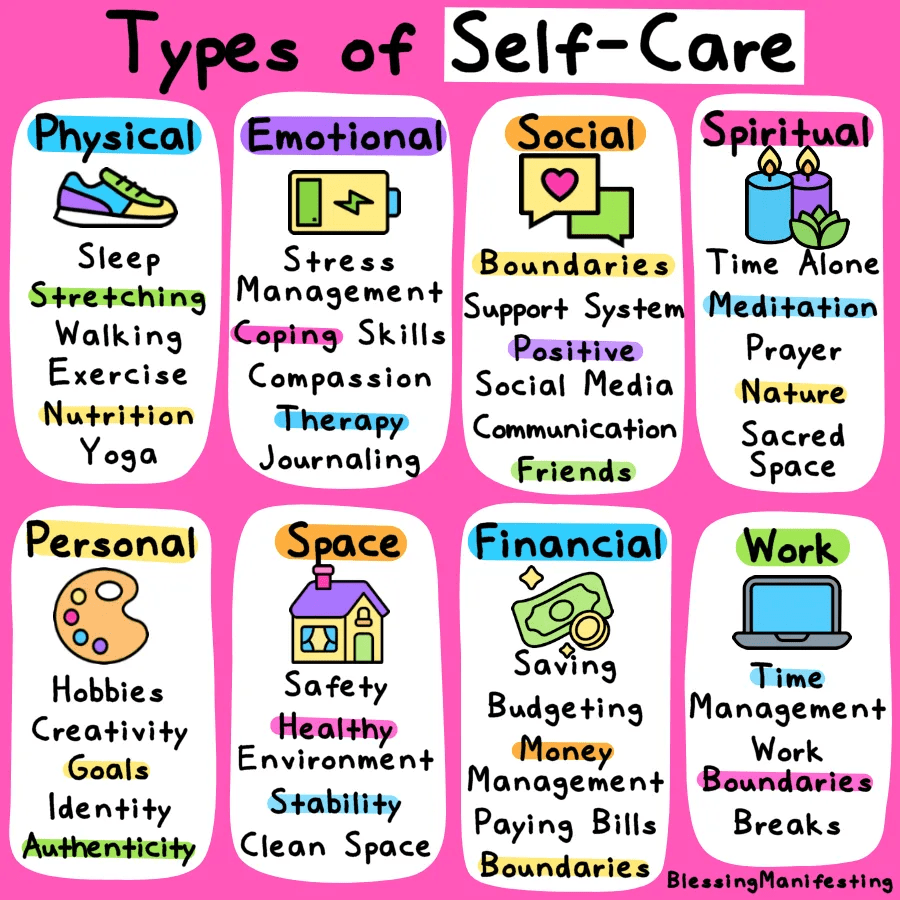

- Prioritize your well-being and yourself first.

- Exercise daily for your physical and mental health.

- Detoxify your social media. If someone makes you feel worse about yourself, unfollow them.

- Go to bed earlier. The easiest way to become a morning person is to get to bed earlier.

- Aim to eat mainly whole foods and drink more water. Ask whether what you’re consuming is adding to your body or taking away from it. Aim for a diet of 80% whole, healthy foods.

- Express gratitude.

- Spend more time in nature.

- Declutter your space.

- Read insightful books.

- Spend time alone just thinking and breathing.

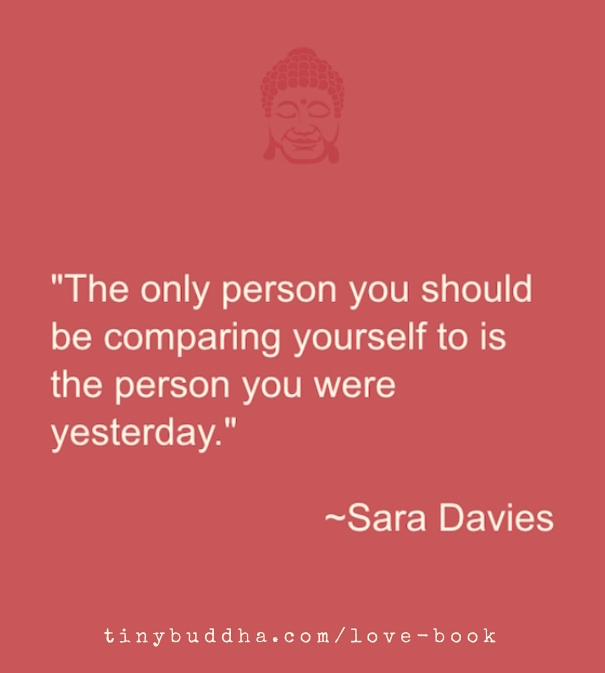

- Ask yourself: Who do you want to become? If you want a certain lifestyle, consider whether you want to take the steps to get there. Ex: waking up early, having consistent daily habits, priorities, etc. For example, some people want a different body figure, but want the magic of a pill instead of making changes to their food and exercise habits.

- When thinking about the person you are envying and the person you want to be, consider: What media does she consume? Who does she spend time with? What does she do when she gets upset? What healthy coping mechanisms does she have? What is the dream morning or night routine? Where does she live? What does she do for work and does she like it? What does she value? What drives her daily actions? What does she do for her mental health and physical health? What does she do for her growth? What do you want to start doing and stop doing? What are some changes that the future you is making? Think about the things you are doing that are stopping you from living your dream life.

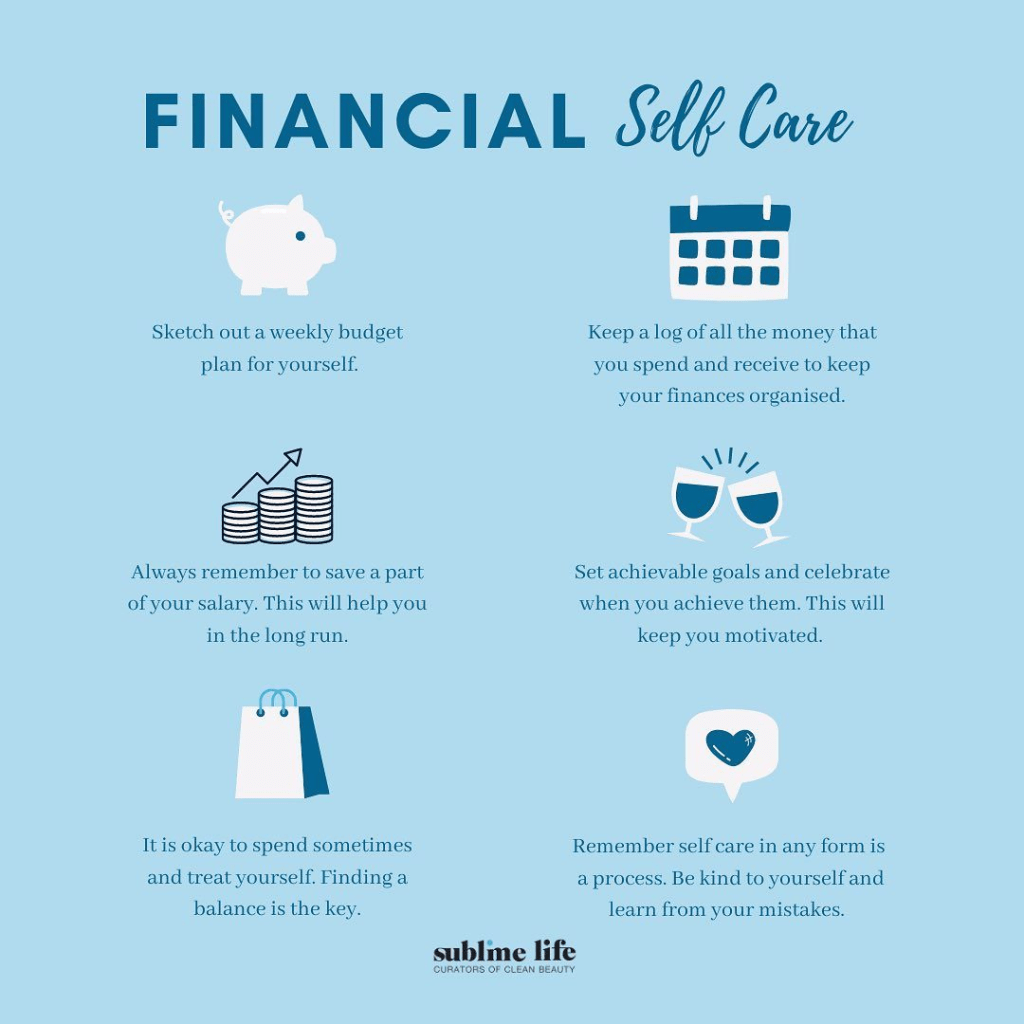

- Your financial goals should get you closer to whatever it is that you want. Then you should create goals to get there: pay off student loans, max out retirement investments, or save up for a down payment on a house.

- Make sure you’re getting a competitive interest rate on the money you keep in the bank. Many large banks pay much less than 1%. It is not uncommon to be getting an interest rate of 0.01%! Some banks are offering between 4-5% interest (CIT bank is one option). Make sure your money is FDIC or NCUA insured.

- Annually:

- Take the time to consider your health insurance plan options, get quotes for other insurance plans (home & auto), check on your retirement plan contributions, and make sure your beneficiaries are up to date. See if there are any benefits you are missing at work, such as a gym reimbursement, 401k match, etc. Check on your subscriptions and consider whether you still need each of them.

- Check on your investment accounts. Look at the rate of return you are getting. Ideally, you will earn at least 10% average over 10 years. Compare your portfolio’s rate of return to the S&P 500 to get a sense of how the market is doing in general. If your investments are doing about the same as the S&P 500, you’re probably in a good position. If your investments are not performing as well as the S&P 500, you will want to rebalance your portfolio. Look into what percentage of fees you are paying (expense ratios). Go for funds with lower expense ratios when you can.

- Get a credit report and make sure that it’s accurate. You can get a free report annually at annualcreditreport.com.

- List your debts and figure out if you need to make any changes. Should you consolidate your loans, refinance, or increase your payments?

- Check on your tax withholding during the year. You may want to change your withholding to avoid getting stuck with a large tax bill.

- Monthly:

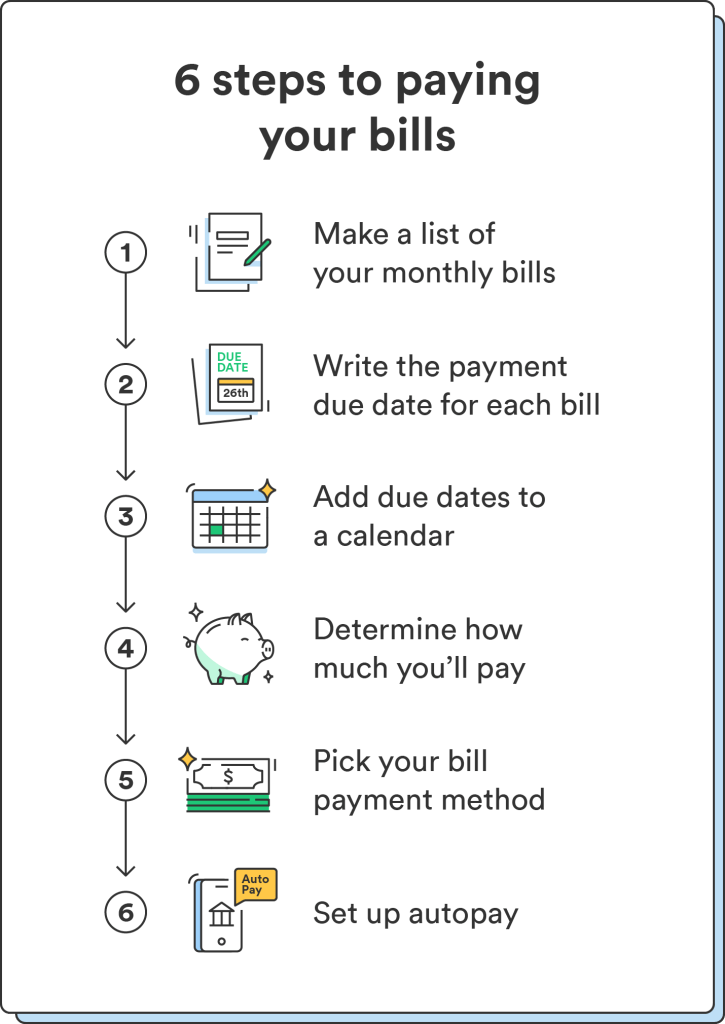

- Pay your bills on time and set bills to auto-pay when possible. Keep a buffer in your checking account to avoid overdraft fees (10%-25% of your monthly expenses). Any amount more than that should go into savings to earn interest!

- Review your accounts monthly for fraud charges.

- Also check on your income and career goals (networking, taking classes or reading more to gain knowledge in your field, updating resume/LinkedIn, applying to jobs).

- Reflect on how you’re taking care of yourself: mind, body, and spirit. It’s much harder to work on your finances when you’re exhausted.

- Set aside money to do things that bring you joy. Say no to things that don’t bring you joy.

- Daily: Make a daily habit of reflecting on your purchases. Are your choices lining up with what matters to you? Are they leading to the life you want?

Some of my financial habits:

- I have nearly all of my bills set on auto-pay. For those that aren’t on auto-pay, I mark my calendar with the dates I should pay them.

- I have a percentage of my salary go directly into a retirement account.

- I keep a financial screenshot of my checking, savings, and retirement account balances and check them twice each month to see if I am on track toward my goals. When I check these balances, I also review my accounts for fraud and maintain an Excel spreadsheet of all of my expenses and income, along with the net for each month. I categorize expenses (recurring, varied, impulse) and note dates, amounts, account or card balances, and my net so far for the month, and I evaluate how much money I spent in each category each month and whether I need to cut back on certain categories.

- I read reviews on products before I purchase them. Most of the time, I no longer want to buy the products after reading reviews. I also take time to consider larger purchases to see if I really need the item. Many times, I decide that I don’t need the item.

- I prioritized paying off my debts, aside from the hefty mortgage, and am committed to being debt-free aside from the mortgage. This leaves little room for impulse purchases and leaves more room for contentment and appreciation for what I have worked hard to have.

**Of note, the information in this podcast was collected from etiquette articles and interviews with professionals. These opinions are not necessarily those of the podcast hosts or my personal opinions.**

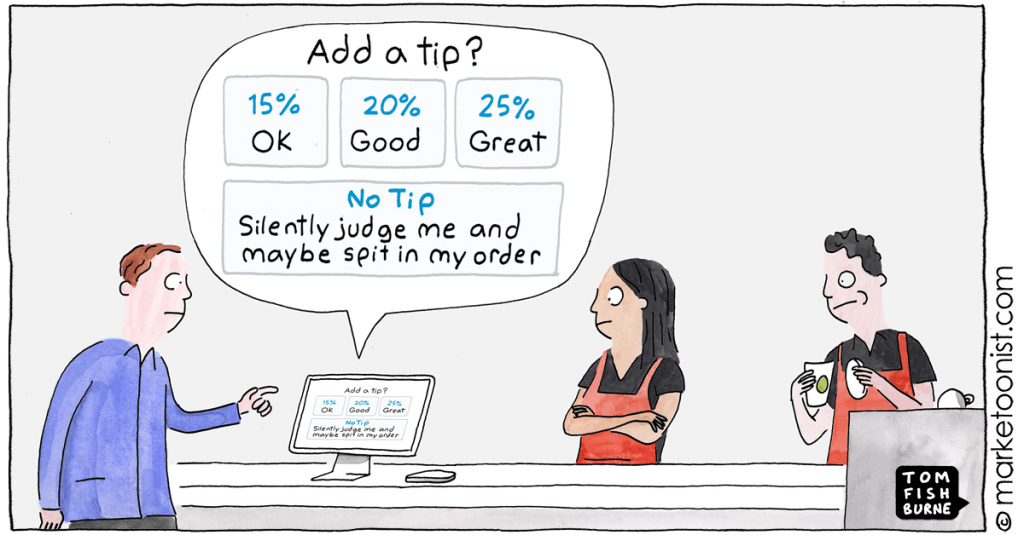

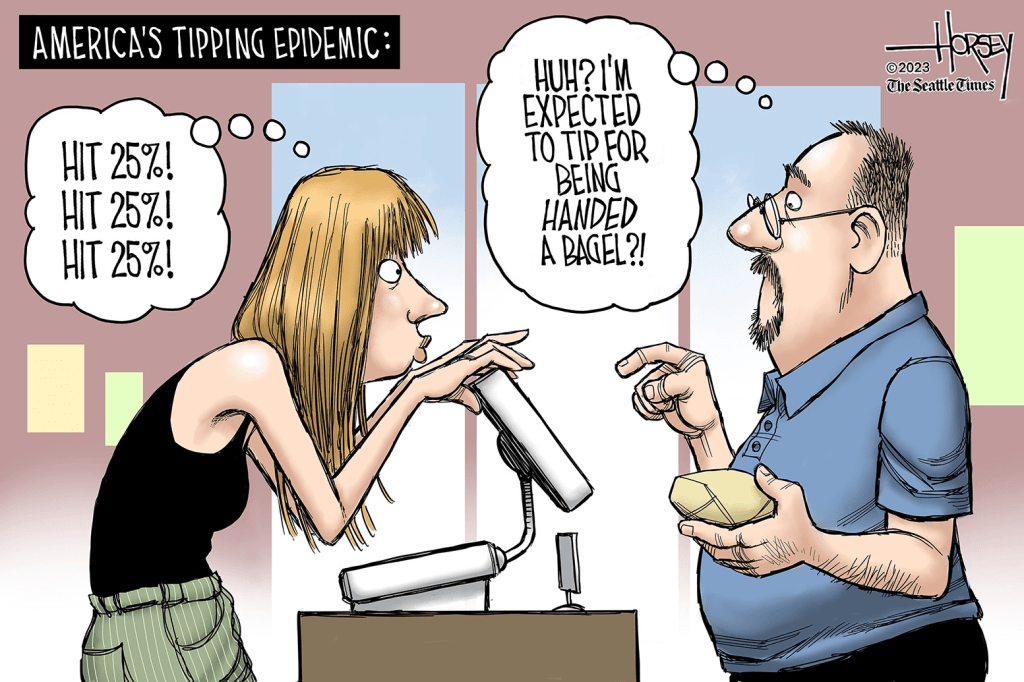

Non-negotiable:

- Restaurants (20%). If your service was poor, you can do less.

- Bars: if only a bar/drinks, flat rates are acceptable. $1 per beer, $2 per cocktail

- Taxi or rideshare: 15-20% for taxi ride, $2 per ride for Uber or Lyft (from a former Uber driver and director of outreach at Ridester)

- Hotel: $2-3/day for housekeeping

- Hair & nail salons: 15-20%

- Babysitter or nanny: round up (example: $50 instead of $45). Nanny- end of year bonus equivalent to 1-2 weeks of pay

- Coat check: $1 per coat/$2 for a large bag

- Gray areas/not mandatory (according to etiquette experts):

- Food delivery (a tip should be required- podcast suggests $3-5 per delivery)

- Coffee shops (etiquette articles they used suggest rounding up to the nearest dollar or 20% for difficult orders)

- Self-serve (like frozen yogurt places)

- Don’t need to tip: doctors, lawyers, teachers, plumbers, therapists, cable technicians, counter service (these people are earning a wage)

I recently came across a set 15% tip option for donating to a GoFundMe fundraiser! I thought that was very bizarre given the fact that GoFundMe takes a portion of proceeds, and the tip option had to be manually set to 0 to not tip.

I look forward to reading, learning, and sharing more with you soon!