My intention is to post a Thoughtful Thursday column each week and share some of the insights I have learned in the past week. Here are some of the things I’ve learned this week:

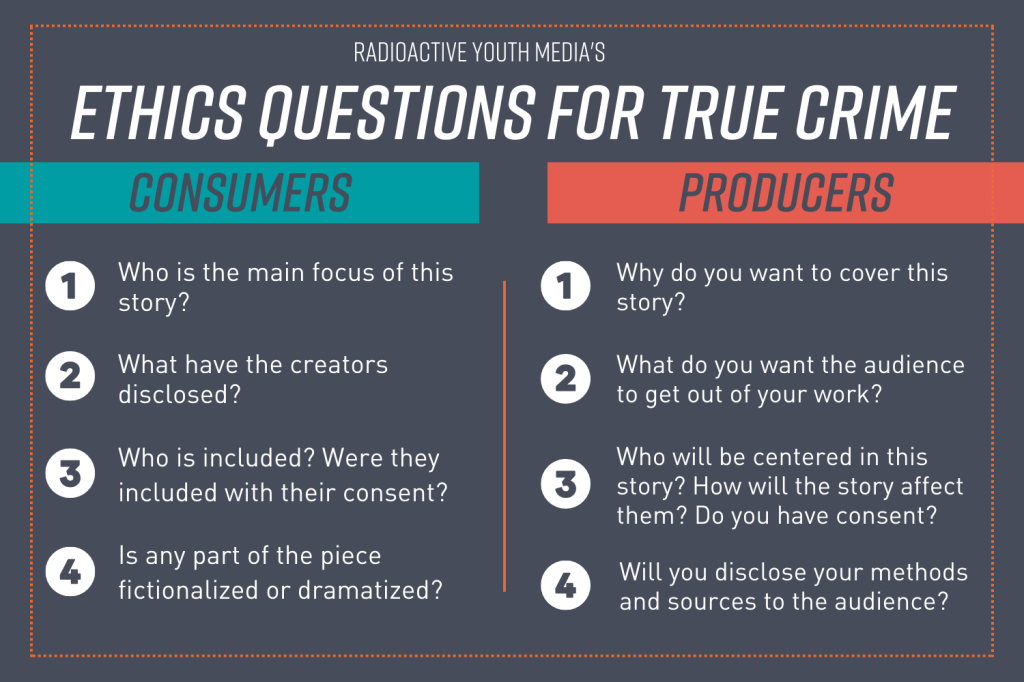

- Ask yourself – Why am I interested in this? Some people are driven by a sense of community or justice, but others are intrigued by horror or morbid curiosity. If that’s the only reason you’re interested, it might be time to try something new.

- How does this make me feel? Hedonic motivations are not ethical.

- How might the people involved in this story feel? Are they being hurt? Is there a justifiable reason to inflict that harm? Can some good come from retelling the story, or is it just for entertainment?

- Am I motivated to act?

- People who are invaluable aren’t just doing their job well. They’re doing the job that needs to be done. They’re paying attention to what’s going on around them and point themselves to the work that has the greatest impact for the organization.

- Indispensable people are high-performing in their realm. They are focused on what they want to do and are focused on what their role/job is. Impact players are oriented on what’s happening around them and what needs to be done.

- Most valuable people figure out how to solve problems and do things. They do the job that needs to be done, move to where the action is, and are ready to learn.

- To go from indispensable to invaluable, train others on the things you’re skilled in. To be invaluable, see the agenda and get on the agenda. Offer help on specific things. Don’t offer to help by saying “let me know if you need anything.” Invaluable people need to be mindful of doing work quietly and behind the scenes. We need to be actively making sure people see our work. Elevate your contribution and make people see the good work you are doing (gracefully).

- Swoop in to fix a problem, make a thoughtful contribution, offer to help, teach others how to do things only you know how to do, look around and above you to learn the company’s agenda and try to do that work. Don’t be afraid to share what you know.

Here are some recommendations to be invaluable at work:

- Don’t be afraid to take the lead and take ownership.

- Embrace change.

- Derive and offer solutions to challenges or problems.

- Focus more on the work that matters, not the work that spins the wheels. Anticipate needs and be proactive.

- Be a thought leader. Apply yourself in a way that provides new and valuable thinking that benefits your team or company.

- Take initiative.

- Seek to gain more knowledge and always share knowledge and demonstrate your worth.

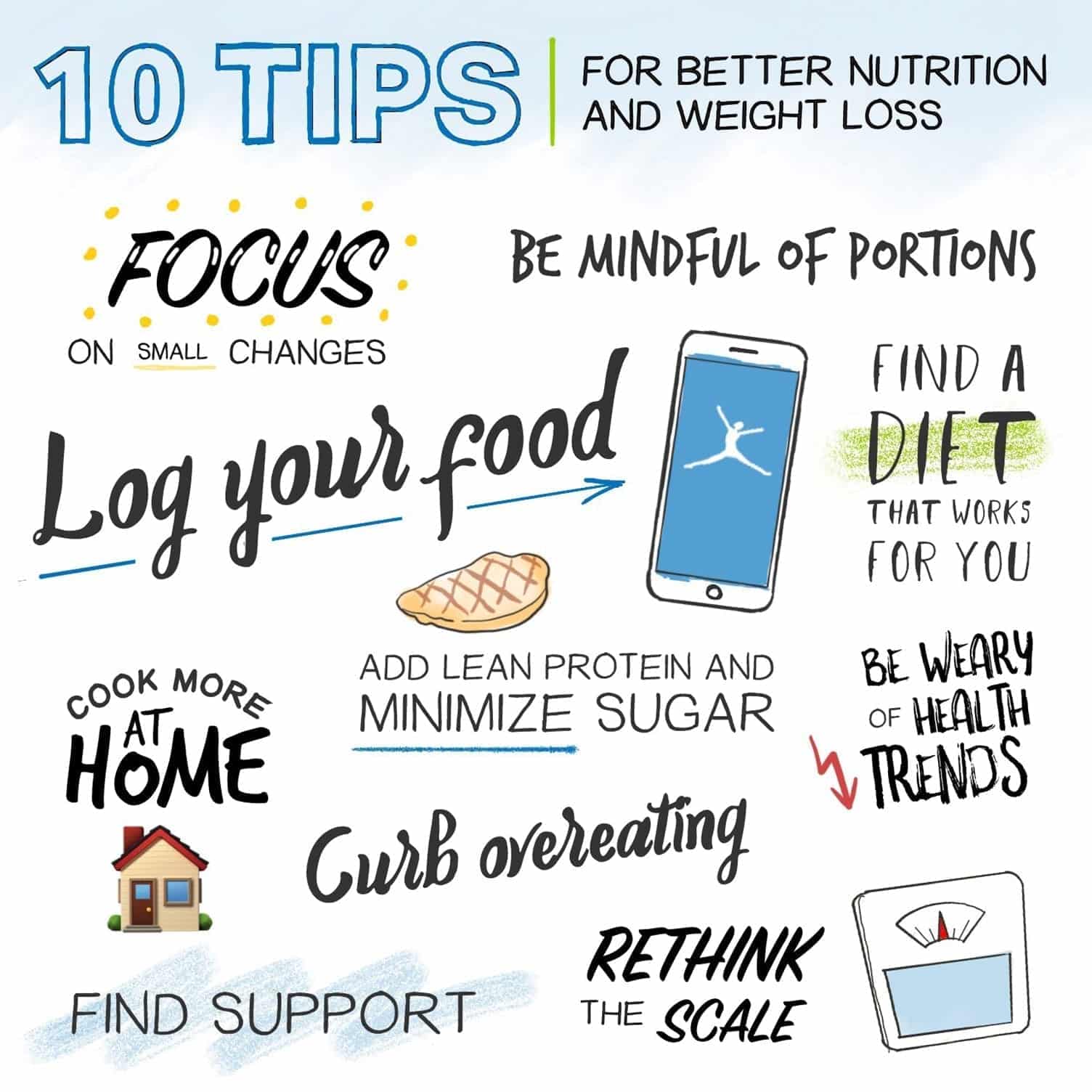

- Restrictive diets – keto, low carb, no carb, fasting. Instead, follow something you can consistently do long-term.

- Skipping meals – can lead to making poor decisions and overeating later on

- Not reading food labels- try to choose items that have more protein than fat.

- Eating too many processed foods- high in sugar, salt, fat, and preservatives

- Not getting enough fruits and vegetables

- Overeating – usually caused by eating too quickly or not paying attention to feelings of fullness

- Focusing on the micro over the macro – ex: focusing on supplements instead of proper amounts of water, focusing on timing of meals instead of protein intake

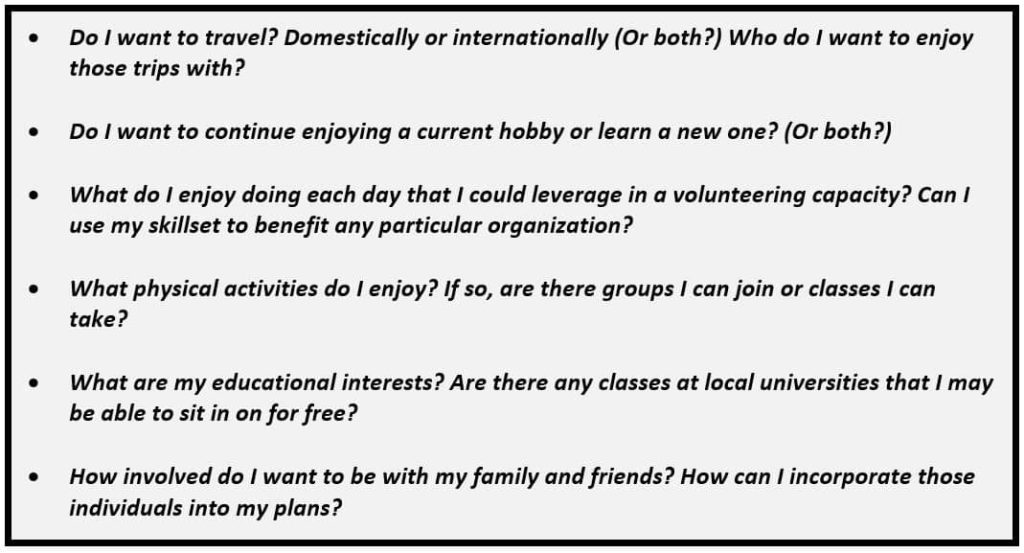

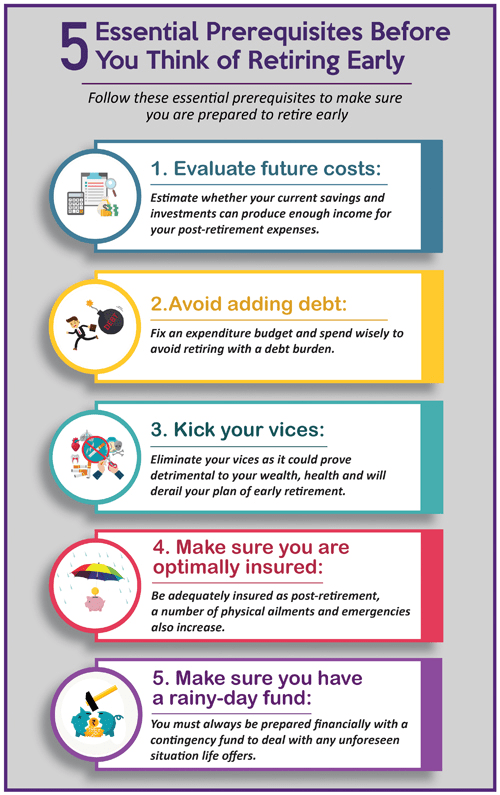

- For many people, retirement is no longer an abrupt end to their working lives, but a slow process of transition. Many people participate in bridge employment, which occurs when they actively retire but still engage in paid work activities part-time. 2/3 of people generally engage in bridge employment before retiring.

- Many people are not working for the money in retirement. They instead want a social environment and begin working again.

- When organizations offer flexible work arrangements such as remote work, they are most likely to keep their older employees, who often delay retirement.

- Retirees who retire from stressful or physically demanding jobs often experience an improvement in well-being in retirement. Others experience a decrease in well-being if they had a job with high status or have financial difficulties.

- In today’s current Social Security system, two workers are supporting one retiree.

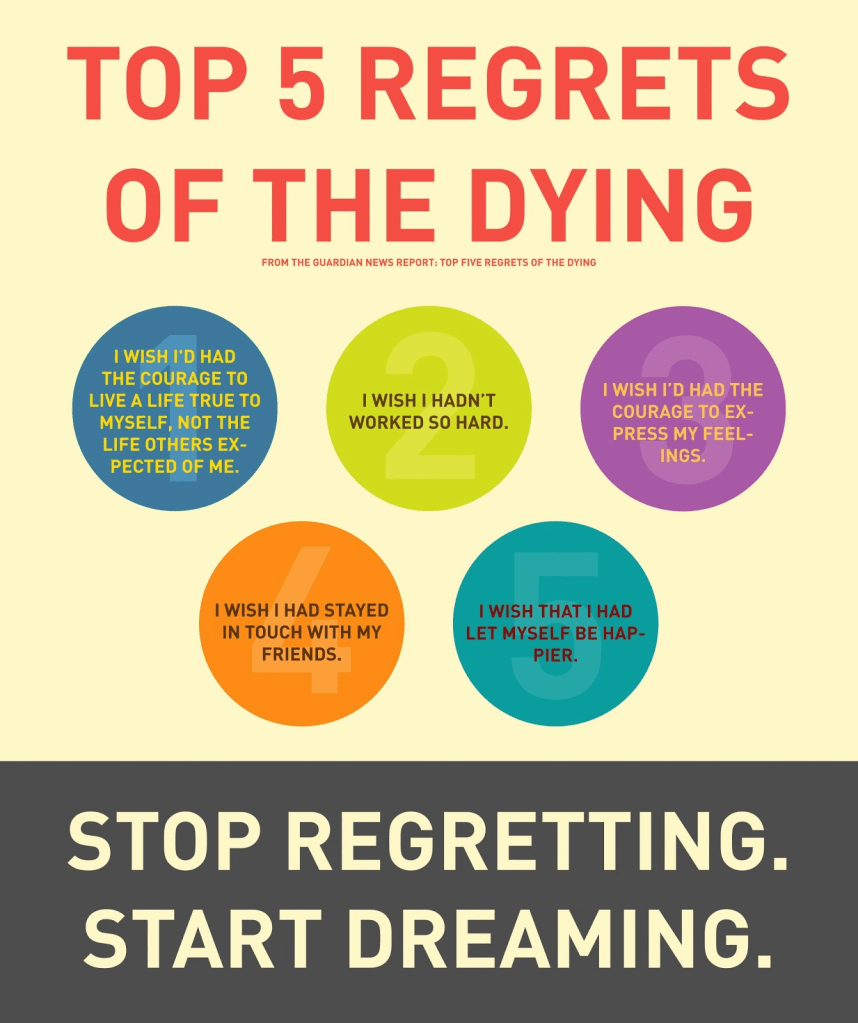

- You need to find an identity outside of your work to maintain a sense of well-being!

- When considering retirement, ask yourself what you would like to do during retirement, have a plan for leisure activities, where you would like to live, and who you want to share retirement with. Without having a plan, many people lose their sense of identity or become bored because work was their entire identity.

Myths:

- Myth: Money is the root of all evil. Fact: Money in itself is not evil. Change your mindset and think of money as a tool.

- Myth: You cannot negotiate your bills. Fact: If you don’t ask, you aren’t going to know.

- Myth: Building generational wealth is for the rich. Fact: Anyone can do this. Transferring generational knowledge (lessons about responsibility, lessons about investing) is a way of transitioning generational wealth. It doesn’t always need to involve monetary assets. Invest small amounts of money as you can. You choose what aspects you want to transition, whether it’s assets or knowledge or both.

- Myth: Personal finance is confusing and complicated. Fact: It can be but doesn’t have to be. It’s up to us to take the time out to understand the basics of financial literacy. Personal finance can become easy to understand by taking action and reading a book or researching. Knowledge is power.

- Myth: You should always buy the cheapest option. Fact: Sometimes the cheapest option is not the best option. Sometimes it is worth investing a little more to get quality over quantity.

- Myth: It is impossible to have fun and save money at the same time. Fact: It is possible with good planning to live a good life and do things that make you happy while also saving money at the same time. It’s all about prioritizing and determining where you are going to spend your money. It’s all about doing things that matter to you that you enjoy and compromising priorities so that you can do both.

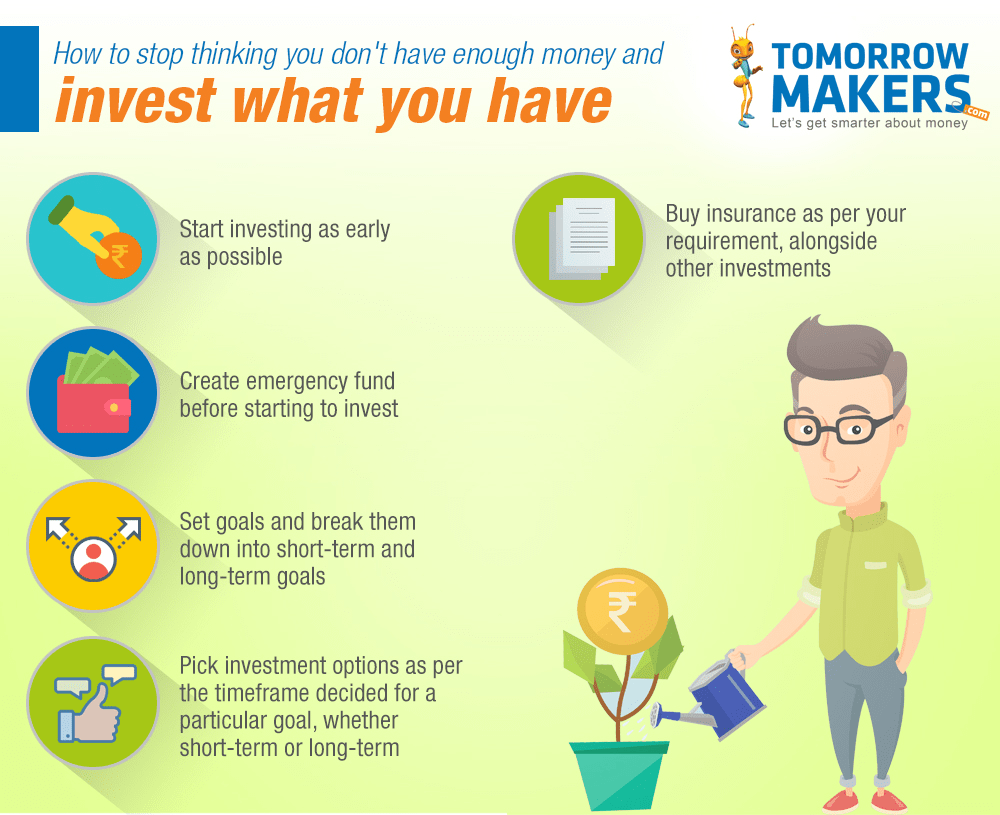

- Myth: You need tons of money to start investing. Fact: You can start investing with small amounts. The key to investing is investing consistently over time. Small amounts add up due to compound interest.

- Myth: Credit cards are bad for your finances. Fact: Credit cards are a tool. You need to build a budget and be able to pay the balance in full each month. Leverage credit cards as an option to built your credit.

- Myth: Renting means you’re throwing away your money. Fact: You aren’t building equity, but renting offers flexibility and can be less expensive, especially if you need to move a lot. You don’t have the home expenses of repairs and renovations. Homes come with their own set of expenses and they can be very costly. Plan out your finances so that you are able to rent or buy a house AND invest at the same time.

- Myth: Having a balance on your credit card is good for your credit. Fact: Avoid paying high interest by paying your balance in full. Credit companies want to see use of credit as well.

- Myth: You can’t retire until you’re 65 or older. Fact: You choose when you want to retire by determining how aggressive you want to be with your retirement goals and exploring options to accelerate your goals toward early retirement. Early retirement is not for everyone. If it’s something you want to pursue, you will need to restructure your plan and save aggressively for retirement.

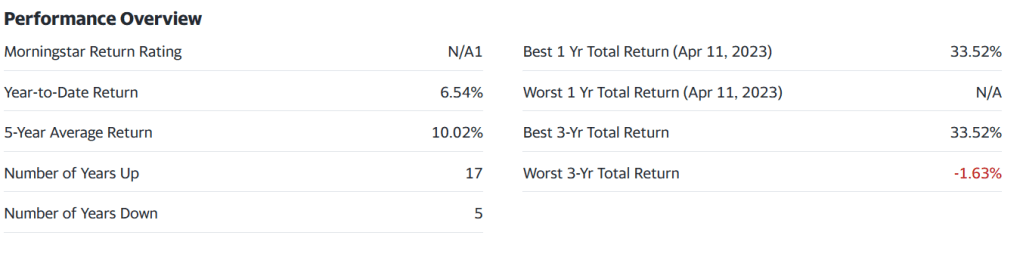

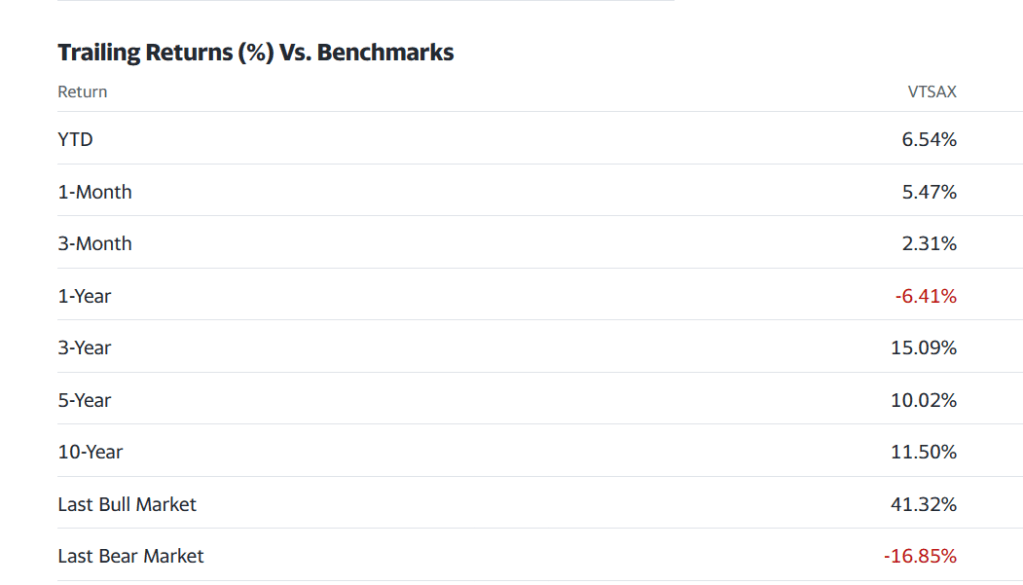

- Myth: Investing is hard. Fact: Investing CAN be hard but doesn’t have to be. Learn how investing works by learning the basics and picking a low-maintenance low-cost index fund. Do your research, understand your risk tolerance, and get clear on your goals and objectives about why you are investing.

- Myth: Your 401(k) can serve as your emergency fund. Fact: You should not be leveraging your 401(k) as an emergency fund. You will be hit with fees, penalties, and income tax. Save your 401(k) for retirement.

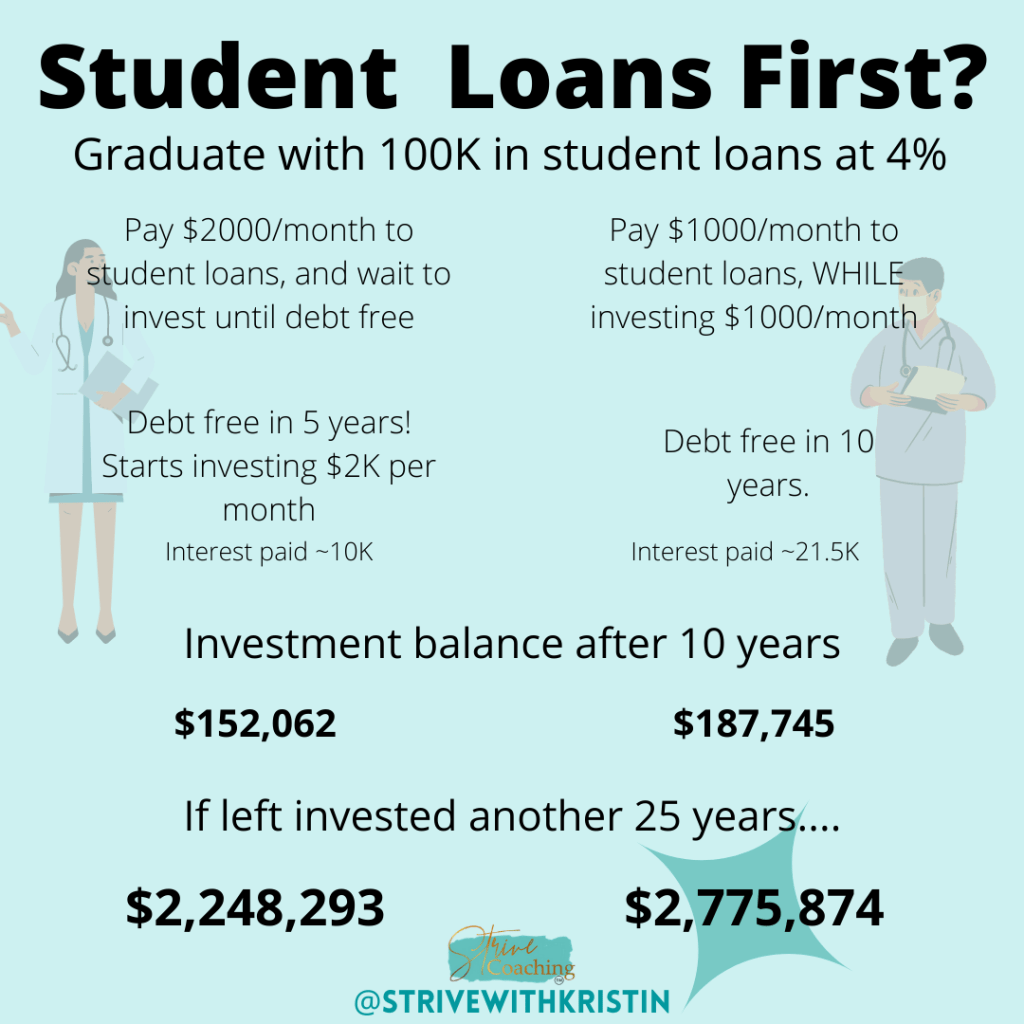

- Myth: You cannot save if you have debt. Fact: You may have a mortgage, student loans, and credit card debt, but you can still save for retirement and should contribute up to your employer match due to the power of compound interest. Debt payoffs can take several years. That’s years of time that you are missing out on compound interest.

- Myth: If you have a credit card, you do not need an emergency fund. Fact: A credit card is not an emergency fund because you will need to pay interest – often a high interest rate. Do not leverage a credit card as emergency savings. Instead, put money aside for emergency savings.

- Myth: You should pay off your mortgage as quickly as possible. Fact: You should pay off high-interest debts first (such as credit cards).

To date, the biggest money mistake I’ve made is that I waited to save for retirement until after I paid off my student loans.

- Myth: Don’t worry about retirement until you’re older. Fact: You want to begin saving for your retirement as soon as possible!

- Myth: Student loans are the best way to finance your education. Fact: You should explore other options such as grants, scholarships, help from family members, and working part-time first.

- Myth: You can never pay off debt. We are not all meant to be in debt. Fact: Prioritize paying off debt, especially high-interest debt. It is possible to pay off debt.

- Myth: Money is a private topic and should not be talked about with anyone. Fact: Money can be private, but you grow from sharing and learning from others’ experiences and getting support and accountability. Find people and resources that you trust and leverage them to help you navigate through any financial situations you are facing and educate and empower yourself to do well with your money.

- Myth: Money can’t buy happiness. Fact: The bottom line is that money is a tool and you can leverage money to achieve the things and buy the things that truly bring you joy.

It’s fascinating to think about how a car is capable of producing its own energy, but it loses that ability with a dead battery. It has wasted potential because it cannot self-start and initiate the process that could fix it, yet a small outside spark is all it takes to kick the engine into gear so that it can return to its normal energy producing process.

There’s a similar process without ourselves, but instead of it being useful when we’re out of electricity, an outside force can help to reignite our self-belief. In the face of a major setback or failure, we sometimes find ourselves completely drained of self-belief and incapable of restoring it. The outside spark in this case is encouragement. All it takes is a little encouragement to jumpstart your self-belief and get you back on a better path.

We need more people seeking out opportunities to help each other, uplift each other, and to see the good in others that they fail to see themselves. There may be someone in your life who needs to be seen, acknowledge, supported, and encouraged. Be that person for others and let them reignite their self-belief.

I have finished reading two books in the past week.

“The Mountain is You” was written by Brianna Wiest and emphasized the many ways self-sabotage obstructs our paths to becoming our best selves. I read this book as part of a book club I’m in. This book was very reflective and educational and covered patterns indicative of self-sabotage and how to tell if you’re in a self-sabotage cycle. ![]() Aside from the many examples, here are some of my favorite points:

Aside from the many examples, here are some of my favorite points:

![]() “Arriving” often makes us hungrier for more. When we want something really badly, it is often because we have unrealistic expectations associated with it. We imagine it will change our lives in some formidable way, and often, that’s not the case.

“Arriving” often makes us hungrier for more. When we want something really badly, it is often because we have unrealistic expectations associated with it. We imagine it will change our lives in some formidable way, and often, that’s not the case.

![]() What you do every single day accounts for the quality of your life and the degree of your success. It’s not whether you “feel” like putting in the work, but whether or not you do it regardless.

What you do every single day accounts for the quality of your life and the degree of your success. It’s not whether you “feel” like putting in the work, but whether or not you do it regardless. ![]() Listen to your behaviors. Filter out the noise. Manage your discomfort by making small changes. Become the best version of yourself. Find your inner peace.

Listen to your behaviors. Filter out the noise. Manage your discomfort by making small changes. Become the best version of yourself. Find your inner peace.

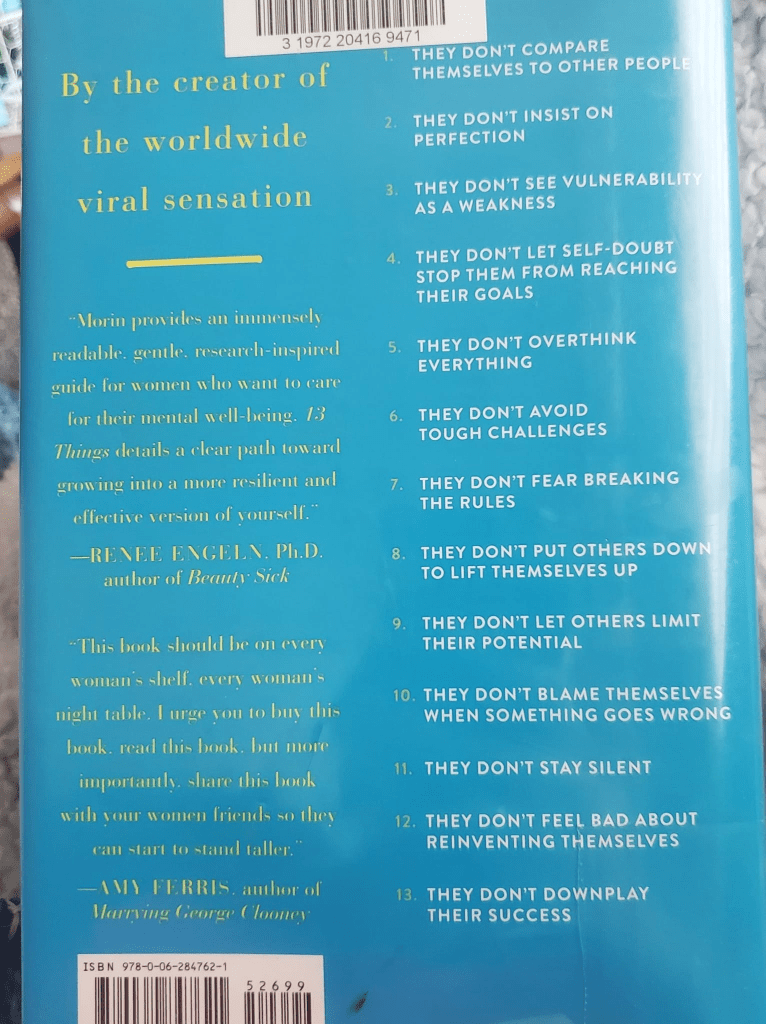

“13 Things Mentally Strong Women Don’t Do” was written by Amy Morin, a licensed clinical social worker, psychotherapist, and an instructor at Northeastern University. This book covered the 13 things mentally strong women don’t do in detail and included bullet lists of what’s helpful and not helpful with each of these traits. Here are a few takeaways:

“If you woke up tomorrow and a miracle had occurred, how would you know things were better? What would you be doing differently?” Go do those things. Change your behavior first and you’ll change how you feel.

Although I have really improved my mental strength in recent years, I often still struggle with some of the traits mentally strong people don’t do: insist on perfection (of myself and others), overthink everything (get caught up in analysis paralysis), and blame myself when something goes wrong. I loved this consideration: You can influence others, but you are not responsible for their choices. You have no way of knowing how things would have turned out if you had done them differently. You made your choices based on the information you had then, not the information you have now. Change the story you tell yourself. ![]()

I look forward to reading, learning, and sharing more with you soon!